Bitcoin Navigates $14B Open Interest Plunge As Spot Trading Hits $44B Surge: Market Reset or Bullish Setup?

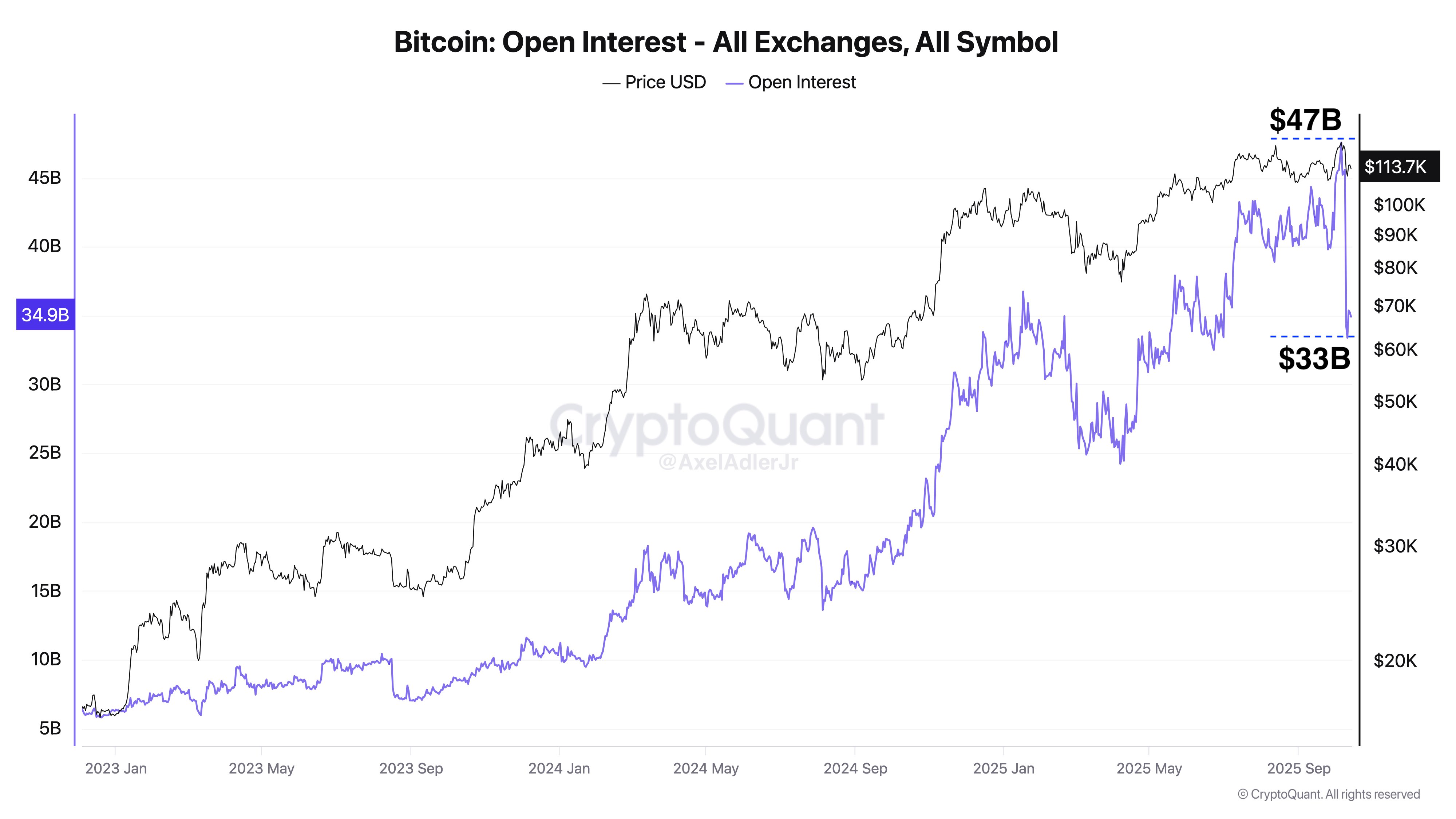

Bitcoin just weathered a massive $14 billion open interest shakeout while spot volume exploded to $44 billion - and traders are calling it the healthiest correction they've ever seen.

The Great Leverage Purge

When $14 billion in leveraged positions vanished from the board, bears expected carnage. Instead, Bitcoin barely blinked - proving once again that spot demand can swallow derivative drama whole.

Spot Markets Take the Wheel

That $44 billion surge in real coin trading? That's institutions and whales accumulating, not gamblers chasing leverage. The ratio tells the real story: for every dollar of leverage flushed, three dollars of actual Bitcoin changed hands.

Controlled Demolition or Organic Reset?

Market veterans recognize this pattern - it's the classic 'wall of worry' climb. The system purged excessive risk while maintaining underlying strength. Even Wall Street's quant funds would struggle to engineer a more perfect reset.

Because nothing says 'healthy market' like watching $14 billion evaporate while the price holds firm - unless you were one of the over-leveraged degens now learning the oldest lesson in finance: don't bet what you can't afford to lose.

A Controlled Reset Amid Growing Fear

According to Axel Adler, the recent market crash revealed an important yet underappreciated aspect of Bitcoin’s maturity. Data shows that 93% of the $14 billion decline in open interest (OI) during Friday’s sell-off wasn’t forced — meaning it wasn’t the result of automatic liquidations. Instead, traders and institutions chose to reduce leverage manually, closing positions to protect capital. Adler describes this as a “controlled deleveraging”, a stark contrast to previous cycles where similar crashes often triggered chaotic cascades of liquidations.

This behavior marks a turning point in Bitcoin’s market structure. It indicates that participants — especially institutional players — are managing risk more prudently, reinforcing a more stable and mature trading environment. In past cycles, sharp liquidations often caused extreme volatility, magnifying losses across the board. This time, however, the market handled unprecedented stress with relative discipline.

Still, despite this sign of structural maturity, the emotional landscape has shifted dramatically. As Bitcoin loses value and hovers NEAR the $110,000–$112,000 support zone, fear is spreading across the market. Many short-term traders are exiting positions, while long-term holders are reassessing exposure amid rising uncertainty. Adler notes that this phase — where fear peaks and confidence wanes — often defines the next market direction.

If demand returns at these levels, Bitcoin could confirm a healthy reset before the next rally. But failure to hold support may test investors’ conviction, potentially pushing BTC into a deeper corrective phase before broader accumulation resumes.

Bitcoin Holds Key Support, But Momentum WeakensBitcoin is currently trading around $110,300, sitting directly on a key support zone after another round of selling pressure hit the market. The 4-hour chart shows BTC struggling to maintain upward momentum after failing to break above the $116,000–$117,500 resistance range, a level that previously acted as strong demand during earlier rallies.

The rejection from this area triggered a sharp pullback, pushing BTC below both the 50 EMA (blue line) and the 200 EMA (red line) — a sign of weakening short-term structure. The price is now testing horizontal support around $110,000, which aligns with the late September consolidation range. A clean breakdown below this level could expose Bitcoin to further downside, with the next potential support around $106,000–$107,000.

Despite the bearish tone, oversold signals are beginning to appear on lower timeframes, suggesting that a temporary rebound is possible if bulls defend this zone successfully. For a sustainable recovery, Bitcoin must reclaim $114,000 and re-establish itself above the short-term moving averages. Until then, the market remains in a fragile equilibrium — with bulls defending key support and bears maintaining control of short-term momentum. The next few sessions will be decisive for BTC’s direction.

Featured image from ChatGPT, chart from TradingView.com