8 Years In Hiding—Now $3 Billion In Ether Awakens: Crypto’s Sleeping Giant Stirs

After nearly a decade of digital dormancy, a cryptocurrency fortune worth billions suddenly springs to life.

The Lazarus Wallet

Eight years of complete inactivity shattered by sudden movement—$3 billion in Ether just broke its silence. This isn't just another whale transaction; it's a time capsule from crypto's primordial era suddenly cracking open.

Market Tremors

The blockchain doesn't forget. Every satoshi accounted for, every transaction permanently etched. When dormant assets of this magnitude awaken, they don't just ripple—they send shockwaves through trading floors and portfolio strategies alike.

Timing Is Everything

Why now? After surviving multiple market cycles, regulatory battles, and technological revolutions, this fortune chooses today to stretch its legs. Coincidence? Or calculated move by someone who's watched this space evolve from the shadows?

Legacy Meets Liquidity

Early adopters understood what most Wall Street suits still don't—digital scarcity creates value that traditional finance can't comprehend. Though they'll probably try to package it into another questionable ETF anyway.

The awakening of sleeping giants reminds us that in crypto, patience isn't just a virtue—it's a billion-dollar strategy.

Whale Moves Into Staking

According to blockchain observers, the transferred coins were not sent to trading venues. Instead, the funds were directed into new addresses tied to staking services, including Ethereum’s Plasma infrastructure, where assets can earn yield while remaining locked.

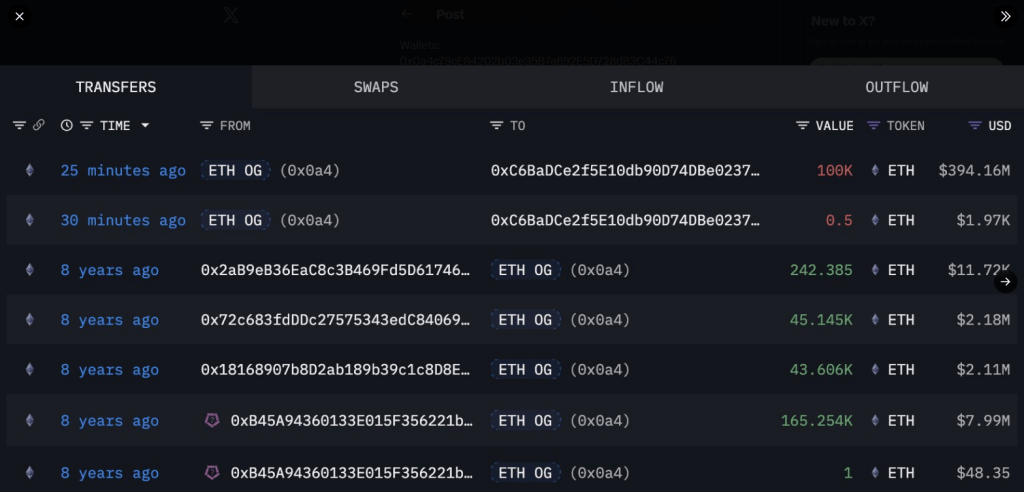

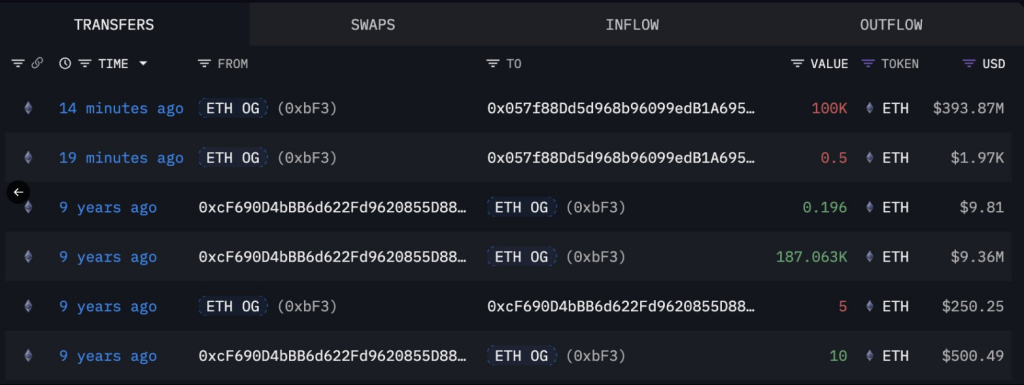

Two wallets that have been dormant for over 8 years just woke up and moved 200K $ETH($785M) to 2 new addresses.

This Ethereum OG originally sourced their $ETH primarily from #Bitfinex, currently holds a total of 736,316 $ETH($2.89B) across 8 wallets.

Wallets:… pic.twitter.com/wVFzXZcL0o

— Lookonchain (@lookonchain) September 26, 2025

Emmett Gallic, an analyst who flagged the movement, described the action as “bullish.” The choice to stake rather than sell has been noted by market watchers as a possible signal of long-term confidence in Ethereum’s prospects.

On-Chain Records Point To Early Holders

Reports have disclosed that much of the ETH came from Bitfinex and mining pools active around 2017. Some of the wallets had last moved funds about four years ago; others had been dormant for over eight years.

At the time those coins were last active, their combined worth was about $30 million. That figure contrasts sharply with today’s value, which approaches $3 billion, highlighting how much the asset has changed hands in value even for those who stayed put.

Price Pressure And ETF OutflowsEthereum’s price was under stress when the whale reappeared. Based on market data, ETH dipped to $3,829 today, a low not seen since August.

Reports show institutional vehicles have been selling recently: ETFs recorded roughly $547 million in outflows over four consecutive days earlier this week.

On Thursday, all ETFs logged net outflows except BlackRock, which posted neither inflows nor outflows that day. That said, BlackRock had sold close to $27 million worth of ETH the previous day. These moves appear to have helped push the price lower ahead of the whale’s action.

Market Reaction And What It May MeanAnalysts have pointed out that a large transfer like this WOULD normally stoke fears of a liquidation. In this case, the absence of exchange deposits seemed to calm some traders.

Staking shifts coins off liquid markets and can reduce immediate sell pressure. Still, the broader sell-off from ETF products has been sizable and may keep acting as a drag on price until flows stabilize.

Featured image from Unsplash, chart from TradingView