Bitcoin Funding Frenzy: Binance Premium Reveals Aggressive Long Positioning as Market Dynamics Shift

Traders are piling into Bitcoin longs with unprecedented aggression—and the Binance funding premium tells the whole story.

The Funding Game Changer

Binance's premium metric just flashed its most bullish signal in months. Not some subtle nudge—this is capital marching into long positions with conviction that would make traditional finance veterans uncomfortable. The shift happened fast, catching many sidelined investors flat-footed.

Market Mechanics Under Pressure

When funding rates diverge this dramatically, it creates ripple effects across perpetual swaps and spot markets. The imbalance suggests traders are betting big on upside momentum—potentially setting up a squeeze that could vaporize short positions. Meanwhile, traditional financial institutions keep scratching their heads about 'digital gold' while missing the most obvious alpha signal in years.

Wall Street's favorite pastime? Watching crypto markets make moves they should've seen coming—then writing research reports explaining why they didn't. The real action happens where the leverage is, and right now, that's screaming one direction only.

Binance Traders Expecting Bitcoin Price Surge

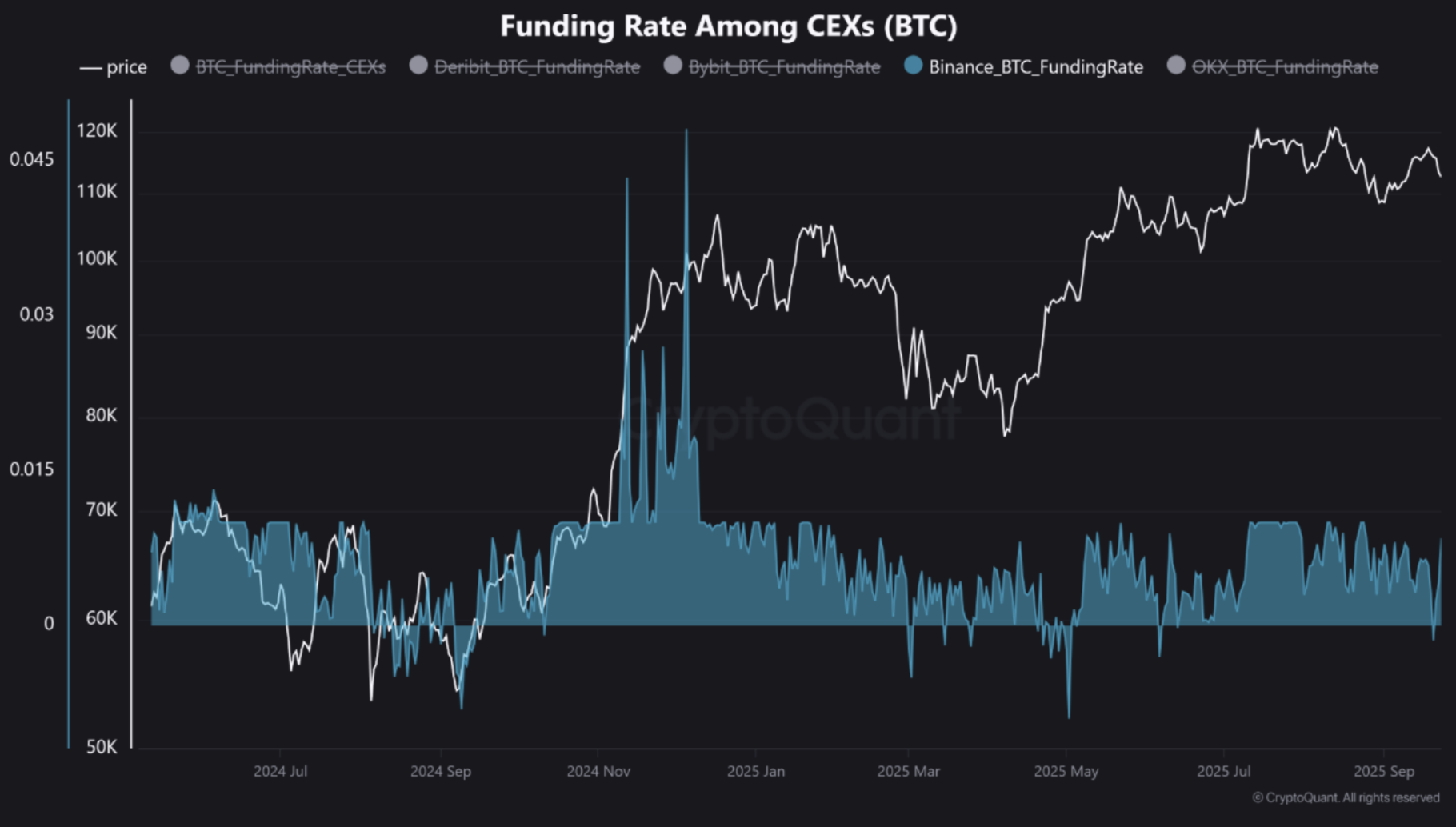

According to a CryptoQuant Quicktake post by contributor Crazzyblockk, fresh derivatives data from Binance is signaling shifting market dynamics – specifically, the recent BTC funding rate on Binance points toward traders taking a bullish stance.

On the contrary, the BTC funding rate from other exchanges, such as OKX, Bybit, and Deribit, suggests that traders on these platforms are still uncertain about taking any directional bet.

As of September 23, the BTC perpetual funding rate on Binance climbed to +0.0084%, suggesting that the long positions are dominant and traders are willing to pay a premium to maintain their bullish bets.

It is worth highlighting that the increase in funding rate is not an isolated event, as it suggests a positive seven-day change, indicating strengthening conviction among Binance traders.

For comparison, the BTC funding rate on OKX is currently hovering at -0.0001%, while on Bybit it sits at 0.0015%. Finally, Deribit shows a funding rate of 0.0019%. The analyst added:

This isn’t just a difference in numbers; it’s a difference in narrative. While funding rates on OKX and Bybit have actually decreased over the last seven days, Binance’s rate has climbed.

For the uninitiated, funding rates can be viewed as a real-time gauge of trader sentiment in the perpetual swaps market. A strong positive rate like that of Binance, which diverges from the rest of the market, points toward aggressive bullish speculation.

Is BTC About To Make A Move?

In a separate CryptoQuant post, contributor XWIN Research Japan noted that Bitcoin’s implied volatility has dropped to its lowest level since 2023. Back then, the lull in the market was followed by an explosive rally of 325%, which propelled BTC from $29,000 to $124,000.

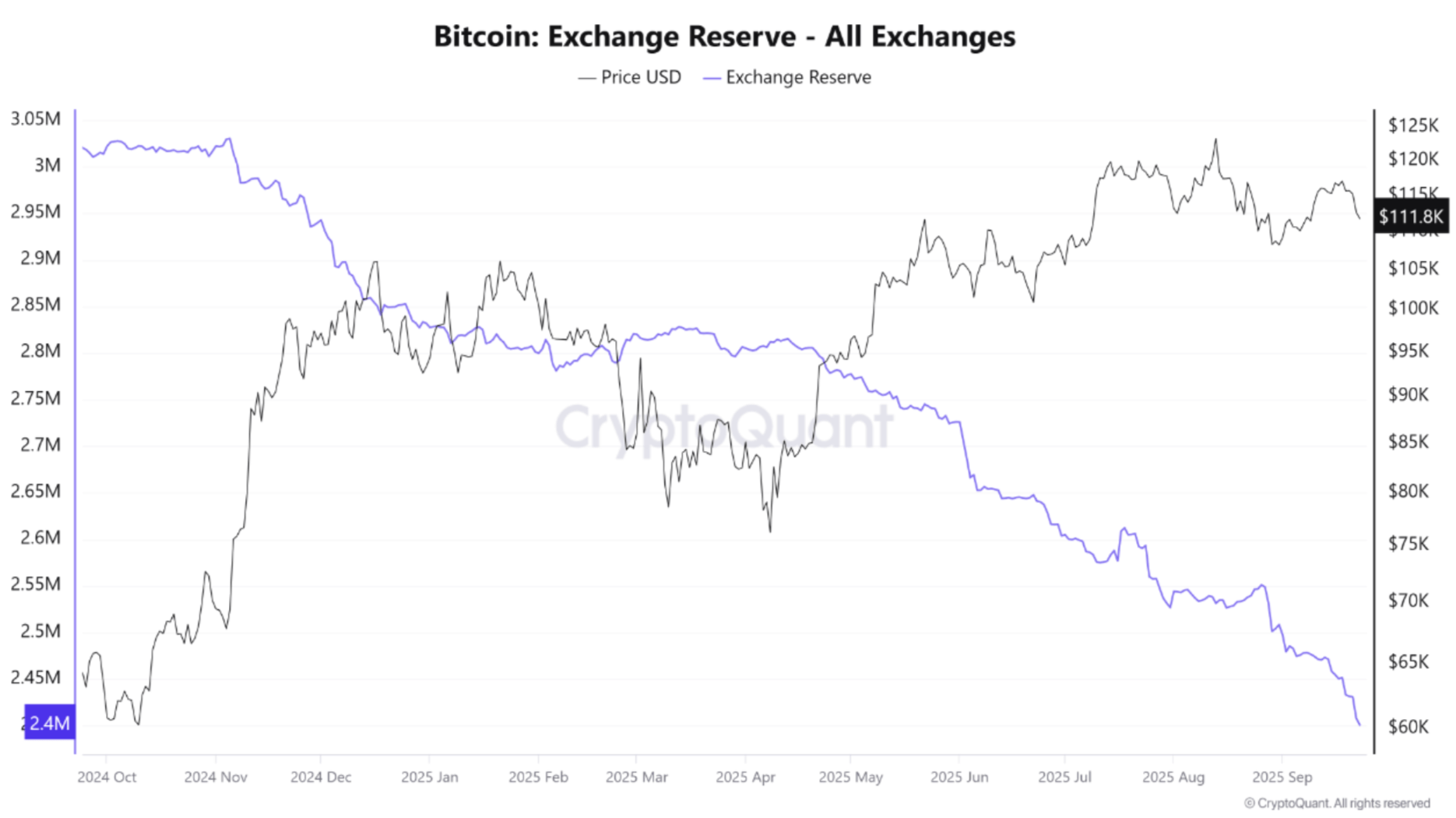

The analyst added that the total bitcoin exchange reserves continue to deplete at a rapid pace, hitting new multi-year lows. Historically, such a fall in BTC exchange reserves has preceded supply squeezes, leading to a dramatic rise in demand.

That said, the overall sentiment toward BTC appears to be cold at present. The bitcoin Fear & Greed Index suggests that investors are fearful of entering the market, which may offer a good opportunity to accumulate BTC at current market prices.

However, fresh data from BTC wallets confirms that new wallets – those that are less than a month old – are starting to buy the top digital asset. At press time, BTC trades at $113,796, up 1% in the past 24 hours.