Bitcoin’s Youth Movement: 73,000 BTC Floods Into New Wallets - Rally Imminent?

Bitcoin's network just witnessed a massive injection of fresh capital as over 73,000 BTC pours into wallets created within the past month.

The Whale Watch

New money's flooding the Bitcoin ecosystem at a pace that's turning heads across crypto circles. These aren't your grandfather's Bitcoin addresses - we're talking digital wallets younger than 30 days swallowing 73,000 coins like they're going out of style.

Market Mechanics Unleashed

When this much BTC moves into fresh wallets simultaneously, it screams institutional accumulation. Retail investors don't move with this kind of coordinated precision. Somebody's building a war chest.

The Timing Game

Historical patterns show similar wallet inflows often precede major price breakouts. While traditional finance types are still debating whether Bitcoin's a real asset class, smart money's quietly positioning for the next leg up.

Because nothing says 'market confidence' like billion-dollar positions moving while Wall Street analysts are still trying to figure out their Zoom backgrounds.

Bitcoin NPC Back In Positive Territory

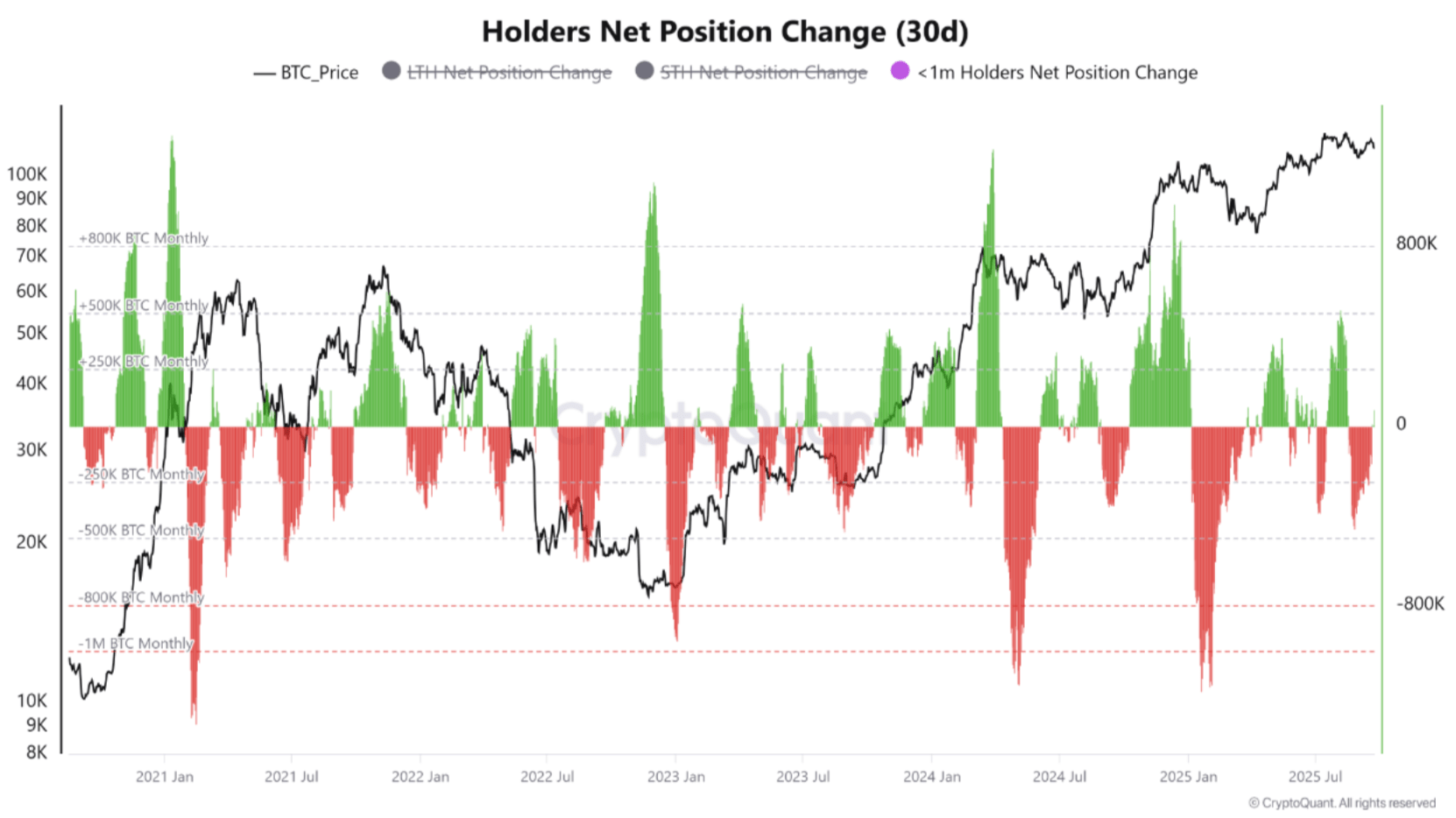

According to a CryptoQuant Quicktake post by contributor Crazzyblockk, the NPC of Bitcoin holders who have held the digital asset for less than one month has decisively flipped into positive territory. This change shows that new demand is flowing into the market at an accelerated rate.

Crazzyblockk highlighted that the 30-day change in supply held by wallets younger than one month has surged, hitting as high as +73,702 BTC on September 23. The following chart confirms the uptick following a period of negative action.

It is worth emphasizing that the influx of fresh capital into the bitcoin market is beneficial in helping to absorb the supply being sold by long-term holders (LTH). Typically, LTH refers to holders who have held BTC for more than six months.

Currently, these LTH are selling their BTC at a rate of approximately -145,000 BTC, indicative of a typical bull market where early investors realize profits. The analyst added that the fact that selling pressure is being met with strong demand from new entrants is a sign of the rally’s sustainability.

The CryptoQuant contributor added that the accumulation is not limited to the newest cohort. Besides the less than one-month cohort, short-term holders (STH) – investors who have held BTC for less than six months – are also accumulating.

The STH NPC has changed to +159,098 BTC, cementing the robust demand for the top cryptocurrency by market cap across a spectrum of investors based on their time in the market. Crazzyblockk added:

The current dynamic – where profit-taking from long-term investors is being absorbed by a new and enthusiastic wave of buyers – is a classic characteristic of a strengthening bull market. The positive flip in the youngest holder cohort is a leading indicator of broadening market participation and suggests a strong conviction among new investors. This robust demand structure is highly supportive of continued price appreciation in the NEAR to medium term.

Some Areas Of Concern For BTC

While the demand for BTC from young cohorts is encouraging, some concerns still linger about the digital asset’s near-term price action. For instance, BTC exchange inflows remain elevated, raising fears of greater selling pressure.

Similarly, recent on-chain data shows that BTC’s current rally is primarily being led by retail investors. Bitcoin whales – wallets with significant BTC holdings – are noticeably absent from the current rally.

That said, the digital asset’s fundamentals continue to strengthen as the Bitcoin network activity recently reached a new 2025 peak. At press time, BTC trades at $112,804, down 0.2% in the past 24 hours.