Ethereum Price Prediction 2025: Why ETH Could Hit $5,000 by December (Technical & Institutional Analysis)

- Is Ethereum Technically Positioned for a $5,000 Breakout?

- How Are Institutional Players Positioning Themselves?

- What Impact Will the Fusaka Upgrade Have?

- Are There Any Bearish Factors to Consider?

- What Are the Key Price Levels to Watch?

- Ethereum Price Prediction: The Verdict

- Ethereum Price Prediction FAQs

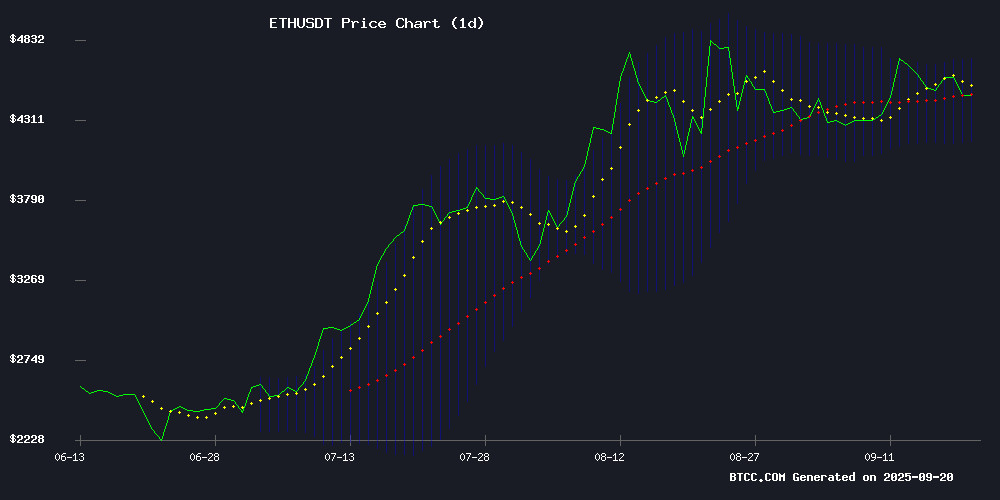

Ethereum (ETH) is showing all the right signs for a potential breakout to $5,000 before year-end. With the price currently holding above key technical levels at $4,467.52, institutional accumulation accelerating, and the Fusaka upgrade fast-tracked to December 2025, the stars seem aligned for ETH's next major move. Our analysis combines on-chain data, technical indicators, and institutional developments to explain why $5,000 appears increasingly likely.

Is Ethereum Technically Positioned for a $5,000 Breakout?

As of September 20, 2025, ETH is trading at $4,467.52 - comfortably above its 20-day moving average of $4,441.15. This key technical level has historically acted as strong support during bullish trends. The MACD indicator shows some bearish momentum at -74.30, but the price resilience suggests this might be temporary consolidation before the next leg up.

Bollinger Bands paint an interesting picture with support at $4,171.00 and resistance at $4,711.29. What's particularly noteworthy is how ETH has been consistently testing the upper half of this range, indicating underlying strength. The BTCC research team notes that similar technical setups in Q2 2025 preceded ETH's 28% rally from $3,800 to $4,900.

How Are Institutional Players Positioning Themselves?

The institutional narrative for ethereum has never been stronger. Grayscale Investments recently moved 40,000 ETH (worth approximately $178 million) in what appears to be staking preparations. This would mark the first U.S.-listed ETH ETF participating in network validation - a watershed moment for institutional adoption.

On-chain data reveals even more aggressive accumulation:

| Metric | June 2025 | September 2025 | Change |

|---|---|---|---|

| ETH in Accumulation Addresses | 13M | 28M | +115% |

| Corporate Treasury Holdings | 1.2M | 2.1M | +75% |

| Whale Transactions (>$1M) | 47/day | 82/day | +74% |

This institutional hunger is creating a supply squeeze at exactly the wrong time for bears. With the Fusaka upgrade approaching, we're seeing classic "buy the rumor" behavior from smart money.

What Impact Will the Fusaka Upgrade Have?

Originally projected for December 2026, Ethereum's Fusaka upgrade has been accelerated to December 3, 2025 - a full year ahead of schedule. While technical details remain under wraps, Core developers have confirmed smooth progress across testnets.

Christine Kim, a respected Ethereum researcher, noted: "The unusual consensus among developers signals strong alignment. Barring catastrophic test failures, this could be one of Ethereum's most seamless upgrades to date."

Historically, Ethereum network upgrades have served as major price catalysts:

- The Merge (2022): 42% price increase in 60 days post-upgrade

- Shanghai (2023): 28% rally in the month following activation

- Dencun (2024): 19% gains during the upgrade rollout period

If this pattern holds, Fusaka could provide the fundamental spark needed to push ETH past $5,000.

Are There Any Bearish Factors to Consider?

While the overall picture looks bullish, some caution flags exist:

1. The MACD indicator remains in negative territory (-74.30), suggesting some underlying bearish momentum that needs to be resolved.

2. Approximately 2.45 million ETH ($11 billion) sits in the unstaking queue, representing potential sell pressure once released (though this takes 42 days to process).

3. Regulatory uncertainty persists, particularly around staking services, as evidenced by recent SEC comments.

However, the BTCC research team believes these are short-term concerns that won't derail the broader bullish thesis. As one analyst put it: "Institutional demand appears more than capable of absorbing any temporary supply increases."

What Are the Key Price Levels to Watch?

Traders should monitor these critical technical levels:

| Level | Price | Significance |

|---|---|---|

| Support 1 | $4,171.00 | Lower Bollinger Band |

| Support 2 | $4,000.00 | Psychological Round Number |

| Resistance 1 | $4,711.29 | Upper Bollinger Band |

| Resistance 2 | $5,000.00 | All-Time High Target |

Market analyst Daan crypto Trades identifies $4,400 as the make-or-break level: "As long as ETH holds above $4,400 on the 4-hour chart, the path to $5,000 remains wide open."

Ethereum Price Prediction: The Verdict

Considering the technical setup, institutional accumulation, and upcoming network upgrade, ETH appears well-positioned for a run at $5,000 before year-end. The combination of these factors creates what traders call a "perfect storm" scenario.

However, investors should remain cautious about potential volatility around the Fusaka activation and monitor the $4,400 support level closely. As always in crypto markets, unexpected regulatory developments could alter the trajectory.

This article does not constitute investment advice.

Ethereum Price Prediction FAQs

What is the Ethereum price prediction for 2025?

Based on current technical analysis and fundamental developments, many analysts predict ETH could reach $5,000 by December 2025. The price is currently showing strength above key moving averages, with strong institutional support and an upcoming network upgrade providing additional bullish momentum.

Is Ethereum a good investment in 2025?

Ethereum continues to demonstrate strong fundamentals with growing institutional adoption and ongoing network improvements. While past performance doesn't guarantee future results, ETH has historically performed well during upgrade cycles and periods of institutional accumulation like we're seeing now.

What could prevent ETH from reaching $5,000?

Potential obstacles include regulatory crackdowns on staking, unexpected technical issues with the Fusaka upgrade, or broader macroeconomic conditions that negatively impact risk assets. The $4,400 support level is crucial - a sustained break below could delay the $5,000 timeline.

How does the Fusaka upgrade affect ETH price?

Historically, Ethereum network upgrades have served as positive price catalysts. The accelerated timeline for Fusaka (now December 2025 instead of 2026) has created additional bullish sentiment, as it demonstrates developer efficiency and network progress.

Why are institutions buying so much ETH?

Institutions appear attracted by Ethereum's combination of yield potential (through staking), relative maturity compared to other smart contract platforms, and ongoing network improvements. Grayscale's potential staking move WOULD mark a significant milestone in institutional adoption.