Bitcoin Price Prediction 2025: Can BTC Reach $200,000 After Fed Rate Cut and Technical Breakout?

- Technical Analysis: Is Bitcoin Primed for a Major Breakout?

- How Will Fed Policy Impact Bitcoin's Price Trajectory?

- Institutional Adoption: The Hidden Driver of BTC's Value?

- Exchange Flows: What Do Binance Outflows Tell Us?

- Can Bitcoin Really Reach $200,000? The Math Behind the Prediction

- Frequently Asked Questions

Bitcoin is showing strong bullish signals in September 2025, trading above $116,000 with technical indicators suggesting potential for further upside. The Federal Reserve's recent 25 basis point rate cut has created favorable liquidity conditions, while institutional adoption continues to accelerate with major corporations adding BTC to their treasuries. This analysis examines whether bitcoin can realistically reach $200,000 in the current market cycle.

Technical Analysis: Is Bitcoin Primed for a Major Breakout?

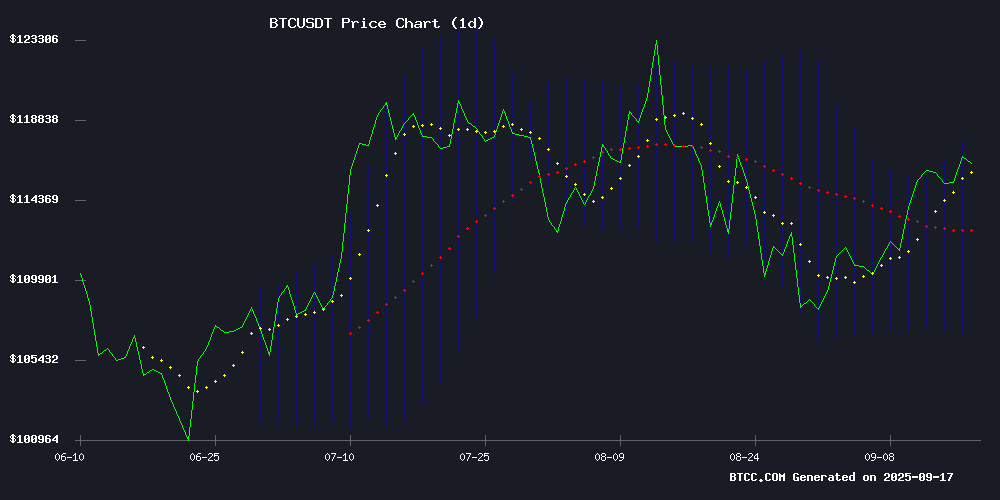

As of September 17, 2025, Bitcoin is trading at $116,148, comfortably above its 20-day moving average of $112,445. The MACD indicator, while still negative at -2,547.56, shows signs of potential bullish convergence. The Bollinger Bands present an interesting picture with upper resistance at $118,083 and lower support at $106,807.

Source: BTCC TradingView

The BTCC research team notes, "The current technical setup suggests Bitcoin is building strength for a potential breakout. Maintaining above the 20-day MA is crucial for continued upward momentum toward the $118,000 resistance level."

How Will Fed Policy Impact Bitcoin's Price Trajectory?

The Federal Reserve's recent 25 basis point rate cut marks the fourth reduction since September 2024, bringing the target range to 4.00%-4.25%. This dovish shift comes amid concerns about a weakening U.S. labor market, with August job creation plunging to just 22,000.

Interestingly, the crypto market's reaction has been relatively muted compared to previous Fed announcements. Some analysts interpret this as a sign of market maturity, while others suggest traders had already priced in the move following hints from Chair Jerome Powell at Jackson Hole.

| Fed Action | Bitcoin Price Reaction | Market Sentiment |

|---|---|---|

| 25bps Rate Cut (Sep 2025) | Minimal volatility | Neutral |

| Previous Cut (Jun 2025) | +3.2% same day | Bullish |

Institutional Adoption: The Hidden Driver of BTC's Value?

While technicals and macro factors grab headlines, institutional adoption continues to provide fundamental support for Bitcoin's price. Two notable developments in September 2025 include:

1.: The Japanese firm dramatically increased its BTC holdings through an upsized share offering, demonstrating strong institutional confidence.

2.: The gaming retailer's BTC holdings now show $28.6 million in unrealized gains, outperforming its traditional business segments.

These moves follow a growing trend of corporations treating Bitcoin as a strategic reserve asset rather than just a speculative investment.

Exchange Flows: What Do Binance Outflows Tell Us?

On-chain data reveals sustained withdrawals from Binance, with nine consecutive days of negative balances. Historically, such outflows correlate with reduced selling pressure and often precede price appreciation.

The BTCC research team explains, "When Bitcoin leaves exchanges for cold storage, it signals accumulation by investors rather than traders looking to sell. This is typically a bullish indicator for medium-term price action."

Can Bitcoin Really Reach $200,000? The Math Behind the Prediction

Reaching $200,000 from current levels WOULD require a 72.2% increase. While ambitious, several factors suggest this target is within reach:

| Metric | Current Value | Required Growth |

|---|---|---|

| Price | $116,148 | 72.2% |

| Institutional Inflows | $1.4B (Metaplanet) | Increasing |

| Fed Policy | Dovish | Supportive |

However, potential headwinds include lingering inflation concerns and the Fed's continued balance sheet reduction. The path to $200,000 likely depends on sustained institutional adoption and maintaining current technical support levels.

Frequently Asked Questions

What technical indicators suggest Bitcoin could reach $200,000?

The current technical setup shows Bitcoin trading above key moving averages with Bollinger Band expansion suggesting upward momentum. Maintaining above the 20-day MA at $112,445 is crucial for continued bullish movement toward higher resistance levels.

How does the Fed rate cut affect Bitcoin's price?

The 25 basis point rate cut creates favorable liquidity conditions for risk assets like Bitcoin. While the immediate market reaction was muted, the dovish policy shift typically benefits cryptocurrencies in the medium term by reducing opportunity costs for holding non-yielding assets.

Why are institutional Bitcoin purchases important for price appreciation?

Large-scale institutional purchases like Metaplanet's $1.4 billion BTC acquisition reduce circulating supply and demonstrate growing mainstream acceptance. When corporations treat Bitcoin as a treasury reserve asset rather than a speculative trade, it provides fundamental support for higher valuations.

What risks could prevent Bitcoin from reaching $200,000?

Potential obstacles include unexpected Fed policy reversals, regulatory crackdowns, or a breakdown of key technical support levels. The cryptocurrency market remains volatile, and past performance doesn't guarantee future results.