ETH Price Prediction 2025: Can Ethereum Reach $5,000 Amid Supply Crunch and Institutional Boom?

- Technical Analysis: Is ETH Primed for a Breakout?

- Whale Activity: The Billion-Dollar Bet on Ethereum

- The Great ETH Supply Squeeze

- Institutional Adoption: The ERC-7943 Game Changer

- Potential Roadblocks: ETF Outflows and Network Issues

- Ethereum Price Prediction: The Path to $5,000

- Ethereum Price Prediction FAQs

Ethereum (ETH) is showing all the classic signs of a major breakout as we head into Q4 2025. With whale accumulation hitting record levels, exchange supplies drying up, and institutional adoption accelerating through new tokenization standards, the stage appears set for ETH to challenge the $5,000 psychological barrier. Our analysis of technical indicators, on-chain data, and market fundamentals suggests ethereum could be preparing for its next major leg up - but not without some volatility along the way. Here's what traders need to watch as ETH navigates this critical juncture.

Technical Analysis: Is ETH Primed for a Breakout?

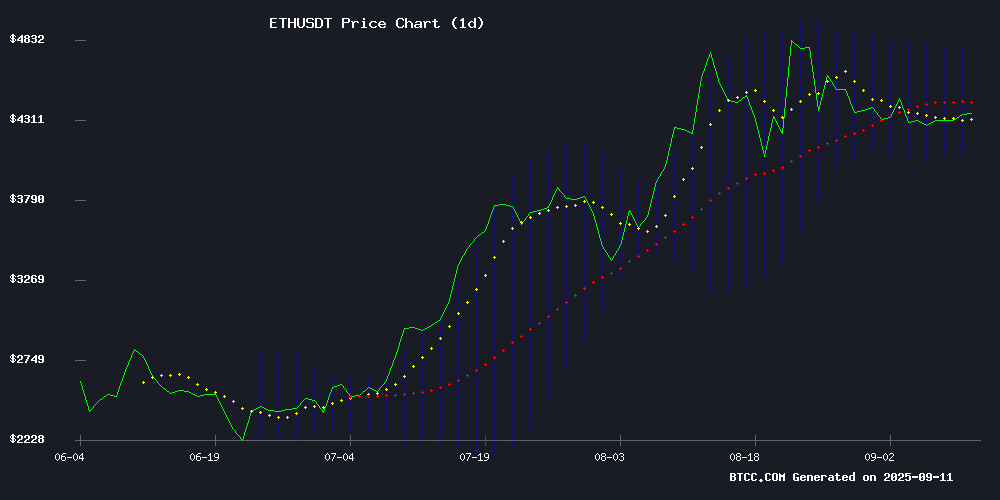

As of September 11, 2025, ETH is trading at $4,407.99, just below its 20-day moving average of $4,416.43. This slight underperformance might worry some traders, but the technical picture actually remains quite bullish. The MACD indicator shows strong momentum with a reading of 167.23 versus its signal line at 102.81, while the histogram sits at 64.42 - all pointing to continued upward pressure.

Bollinger Bands paint an interesting picture too, with the upper band at $4,708.97 and lower band at $4,123.88. This creates a clear range where $4,300 has emerged as the key support level to watch. "The technical setup favors a breakout above $4,700 if ETH holds above the $4,300 support level," notes the BTCC research team. "The MACD divergence we're seeing typically precedes significant moves."

Whale Activity: The Billion-Dollar Bet on Ethereum

Institutional players are making massive moves in the ETH market. BitMine Immersion made waves last week by scooping up 319,000 ETH (worth over $1 billion at current prices) in just seven days. That's 0.26% of Ethereum's total circulating supply gone from the market in a blink.

Analyst Paul Barron crunched the numbers: "If BitMine maintains this acquisition pace, they'd demand 4.1 million ETH by year-end - nearly 40% of all ETH currently sitting on exchanges." Combine this with other institutional players entering the space, and you've got a recipe for serious supply shock. Barron suggests $15,000 ETH by December isn't out of the question mathematically, though that WOULD require sustained demand from multiple large players.

The Great ETH Supply Squeeze

Exchange reserves tell a startling story - 260,000 ETH have fled trading platforms since September began. This holder mentality is creating what traders call a "supply squeeze," where decreasing availability meets steady or increasing demand. The exchange supply ratio has dropped to just 0.145 from 0.156 in late August.

What's particularly interesting is how whales absorbed supply during ETH's consolidation phase between September 5-10. Large holders (10K-100K ETH) added 450,000 coins to their balances this week alone. Meanwhile, retail traders have been doing what they often do - selling too soon. Short-term holders offloaded 500,000 ETH during the same period. It's the classic bull market dynamic: weak hands funding strong hands through premature exits.

Institutional Adoption: The ERC-7943 Game Changer

The launch of the ERC-7943 Standard by top real-world asset (RWA) firms including Bit2Me, Brickken, and Compellio SA could be a watershed moment for Ethereum's institutional adoption. This new framework enhances transparency and interoperability in institutional tokenization - crucial factors for traditional finance players dipping their toes into crypto.

The timing couldn't be better. On-chain RWA valuations recently surpassed $27 billion, with U.S. Treasuries accounting for $7.45 billion of that total. As Luxembourg-based Compellio's team put it: "ERC-7943 offers institutions the compliance they need without sacrificing the composability that makes Ethereum so powerful."

Potential Roadblocks: ETF Outflows and Network Issues

Not all signs are bullish though. Ethereum ETFs have seen surprising outflows recently, with a single-day withdrawal of 104,100 ETH (worth $447 million) standing out. August's final week saw daily net flows collapse to 16,600 ETH from 85,000 ETH previously.

Network issues have also emerged. Linea, a prominent Ethereum LAYER 2 chain, suffered an outage on September 10 when block production halted for over an hour. While operations resumed quickly, the incident highlighted the growing pains of Ethereum's scaling solutions.

Ethereum Price Prediction: The Path to $5,000

Given the confluence of factors - technical setup, whale accumulation, supply dynamics, and institutional adoption - ETH appears well-positioned for a run at $5,000 in the medium term. The key levels to watch are:

| Key Level | Price | Significance |

|---|---|---|

| Current Price | $4,407.99 | Testing 20-day MA support |

| Immediate Resistance | $4,700 | Bollinger Upper Band |

| Critical Support | $4,300 | Bull/bear battle line |

| Target Price | $5,000 | Psychological & technical target |

Maintaining above $4,300 support remains crucial for the bullish scenario to play out. If that level holds, the path to $5,000 looks increasingly plausible given the supply and demand dynamics at play.

Ethereum Price Prediction FAQs

What is the current ETH price prediction for 2025?

As of September 2025, analysts project ETH could reach $5,000 by year-end based on current technical indicators, whale accumulation patterns, and institutional adoption trends. However, maintaining support above $4,300 is crucial for this bullish scenario.

Why are whales accumulating so much ETH?

Large holders appear to be positioning ahead of expected supply shocks from staking lockups, institutional adoption, and new tokenization standards like ERC-7943. The decreasing availability of ETH on exchanges (exchange supply ratio down to 0.145) suggests whales anticipate higher prices ahead.

What are the key support and resistance levels for ETH?

The immediate critical support is $4,300, with resistance at $4,700 (Bollinger upper band). A breakout above $4,700 could open the path to $5,000, while a breakdown below $4,300 might test lower support levels.

How does institutional adoption affect ETH's price?

Institutional adoption through ETFs and RWA tokenization creates sustained demand while reducing circulating supply. The recent ERC-7943 Standard launch and billion-dollar ETH purchases by firms like BitMine demonstrate growing institutional interest that could support higher prices.

What risks could prevent ETH from reaching $5,000?

Potential roadblocks include continued ETF outflows, macroeconomic uncertainty, network issues like the recent Linea outage, and if whale accumulation slows significantly. Technical breakdown below $4,300 could also delay the $5,000 target.