Ethereum Price Prediction 2025-2040: Technical Momentum and Fundamental Strength Signal Major Upside Potential

- Why Is Ethereum Showing Bullish Divergence Despite Short-Term Pressure?

- What Market Fundamentals Support Ethereum's Long-Term Growth?

- How Are Ethereum Whales Positioning Themselves?

- What Institutional Developments Are Driving Ethereum Adoption?

- What Do Ethereum's On-Chain Metrics Reveal?

- Ethereum Price Predictions: 2025-2040 Outlook

- Frequently Asked Questions

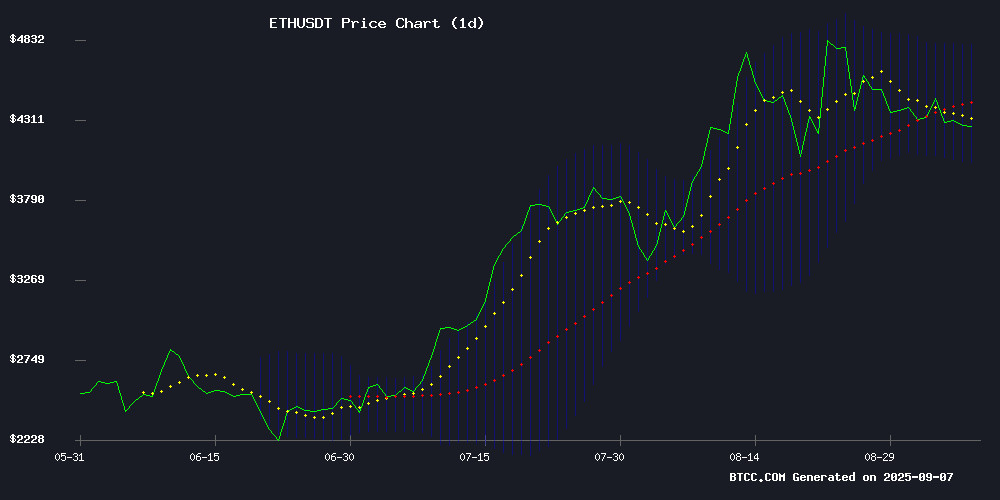

Ethereum (ETH) is showing remarkable resilience in 2025, with technical indicators and fundamental developments suggesting significant upside potential through 2040. Despite recent volatility, the combination of institutional adoption, decreasing exchange reserves, and robust technical momentum paints a bullish long-term picture. Our analysis examines ETH's current position at $4,275.39, explores key market drivers, and provides detailed price projections through 2040 based on on-chain data, institutional flows, and macroeconomic factors.

Why Is Ethereum Showing Bullish Divergence Despite Short-Term Pressure?

As of September 2025, ethereum presents an intriguing technical picture. Trading at $4,275.39, it sits below its 20-day moving average of $4,419.66, which typically signals near-term bearish pressure. However, the MACD tells a different story - with a reading of 164.37 against a signal line at 13.66, we're seeing strong bullish momentum divergence that can't be ignored.

The Bollinger Bands positioning (upper at $4,804.20, lower at $4,035.11) suggests ETH is trading in the lower range, potentially indicating a buying opportunity. "The technical setup suggests consolidation with bullish potential," notes the BTCC research team. "A break above the 20-day MA could trigger momentum toward the upper Bollinger Band."

Source: TradingView

What Market Fundamentals Support Ethereum's Long-Term Growth?

The fundamental case for Ethereum has never been stronger. Fidelity's recent launch of a tokenized treasury fund on Ethereum signals growing institutional embrace of real-world assets (RWAs). While US Ethereum ETFs saw record weekly outflows totaling $787 million in early September 2025, the underlying fundamentals remain robust.

Three critical factors stand out:

- Exchange reserves are plummeting (Binance and Coinbase lost 1.6M ETH in two weeks)

- Record stablecoin inflows reaching $150 billion

- Corporate adoption like SharpLink Gaming staking $3.6 billion in ETH

The BTCC team observes, "The combination of institutional adoption, decreasing exchange reserves, and massive stablecoin inflows creates perfect conditions for price appreciation despite short-term ETF outflow concerns."

How Are Ethereum Whales Positioning Themselves?

Ethereum's whale activity tells a compelling story. Exchange reserves are contracting dramatically, with major players shifting to self-custody. This exodus signals a strategic pivot toward long-term holding among sophisticated investors.

The derivatives market echoes this sentiment:

- Binance reports a 2.47 Long/Short Ratio

- 71.2% of traders maintain long positions

- Funding Rates at 0.0082% suggest room for growth

This tempered leverage situation suggests the rally may have room to run before overheating, unlike previous cycles where excessive leverage led to sharp corrections.

What Institutional Developments Are Driving Ethereum Adoption?

Fidelity Investments made waves in August 2025 with its tokenized U.S. Treasury product on Ethereum. The Fidelity Digital Interest Token (FDIT) represents shares in a $200 million treasury fund, demonstrating institutional demand for blockchain-based yield products.

Other notable institutional moves:

| Institution | Activity | Date |

|---|---|---|

| BlackRock | Exploring blockchain infrastructure | Q3 2025 |

| ARK Invest | $23.5M in crypto-related stocks | September 2025 |

| SharpLink Gaming | $3.6B ETH treasury stake | September 2025 |

These developments accelerate the real-world asset tokenization trend gaining momentum across traditional finance.

What Do Ethereum's On-Chain Metrics Reveal?

Ethereum's on-chain data paints a bullish picture:

- Stablecoin supply at historic $150 billion

- 1.1 million validators securing the network

- Exchange reserves down 2.6M ETH over two months

The inverse correlation between exchange reserves and ETH's price suggests tightening supply. Such movements often precede bullish momentum, as reduced liquidity can amplify upward price pressure when demand returns.

Ethereum Price Predictions: 2025-2040 Outlook

Based on current technicals and fundamentals, our projections are:

| Year | Price Range (USD) | Key Drivers |

|---|---|---|

| 2025 | $6,000 - $8,000 | ETF maturation, institutional RWA adoption |

| 2030 | $12,000 - $18,000 | Mass DeFi adoption, scalability solutions |

| 2035 | $25,000 - $40,000 | Web3 infrastructure dominance |

| 2040 | $50,000 - $80,000 | Global reserve currency status |

While short-term volatility is expected, the convergence of technical strength and fundamental adoption creates a compelling case for Ethereum's multi-decade growth story. The current price action represents an attractive entry point for long-term investors.

Frequently Asked Questions

What is Ethereum's current technical outlook?

As of September 2025, Ethereum shows bullish divergence with strong MACD momentum despite trading below its 20-day MA. The Bollinger Bands suggest it's in the lower trading range, potentially indicating a buying opportunity.

Why are Ethereum exchange reserves decreasing?

Whales are moving ETH off exchanges into self-custody, signaling long-term holding strategies. Binance and Coinbase have lost significant ETH reserves recently, potentially creating supply shock conditions.

How are institutions adopting Ethereum?

Major developments include Fidelity's tokenized treasury product, BlackRock's blockchain exploration, and corporate treasury moves like SharpLink Gaming's $3.6B ETH stake.

What are the key price levels to watch?

Near-term support at $4,400 with resistance at $4,729. Breaking $4,500 could trigger momentum toward $6,000 based on Fibonacci extensions and Wyckoff accumulation patterns.

Is now a good time to invest in Ethereum?

While we don't give investment advice, the combination of technical indicators, institutional adoption, and favorable supply dynamics suggests Ethereum has significant long-term potential at current prices.