SOL Price Prediction 2025: Will Solana Break $200 as Technicals and ETF Hype Align?

- What Do the Technical Indicators Say About SOL's Price Movement?

- How Is Institutional Activity Impacting Solana's Price?

- Could ETF Speculation Push SOL to $500?

- What Are the Key Price Levels to Watch?

- How Does Solana's Current Rally Compare to 2021?

- Is Now a Good Time to Buy SOL?

- SOL Price Prediction: Frequently Asked Questions

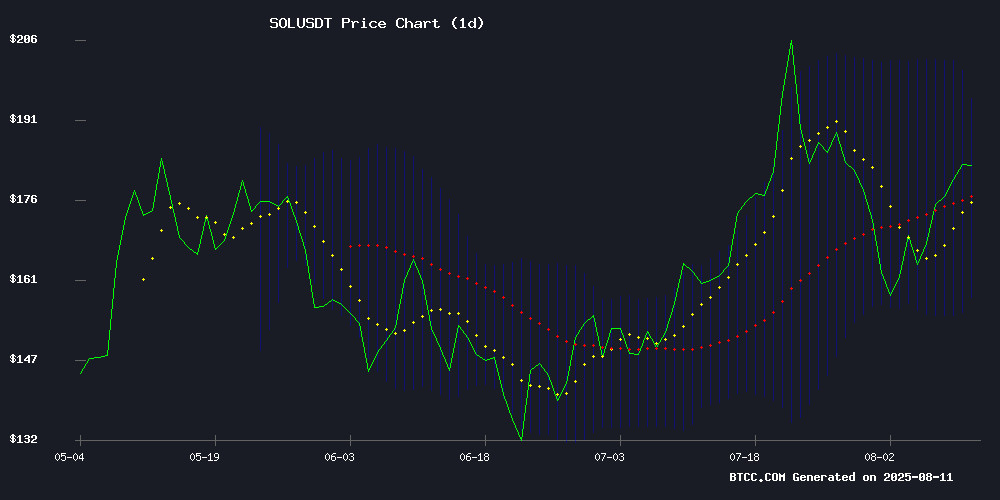

Solana (SOL) is showing strong bullish signals as we approach the second half of 2025, with technical indicators and growing institutional interest converging around the $200 resistance level. The cryptocurrency has gained 18% in the past week alone, currently trading at $183.78, while corporate holdings now exceed $591 million across just four public companies. This analysis examines the key factors driving SOL's price action, including technical patterns, institutional accumulation, and the growing ETF speculation that could propel Solana to new highs.

What Do the Technical Indicators Say About SOL's Price Movement?

SOL's technical setup paints an increasingly bullish picture as of August 2025. The price has maintained a firm position above the 20-day moving average at $176.53, while the MACD histogram shows positive divergence at 3.4510 - a classic bullish signal. The Bollinger Bands are expanding with price action hugging the upper band at $195.08, suggesting potential for continued upward movement.

"The $190-$200 zone represents critical resistance," notes the BTCC research team. "A weekly close above $195 could accelerate momentum toward $250, though we expect significant profit-taking NEAR the psychological $200 level." The $176 support level now serves as the bull/bear demarcation line, with stronger support waiting at $157 should a correction occur.

How Is Institutional Activity Impacting Solana's Price?

Institutional demand for SOL has reached notable levels in 2025, with four publicly traded companies collectively holding over 3.5 million tokens worth $591.1 million. Upexi, Inc. leads the pack with 1.9 million SOL acquired in just four months, followed by DeFi Developments Corp's 1.18 million SOL position showing $36.8 million in unrealized gains.

| Company | SOL Holdings | Value (USD) |

|---|---|---|

| Upexi, Inc. | 1.9M | $320M |

| DeFi Developments Corp | 1.18M | $199M |

| SOL Strategies | 0.3M | $50.6M |

| Torrent Capital | 0.12M | $20.2M |

These corporate holdings represent about 0.65% of Solana's circulating supply - not massive, but significant enough to reduce sell pressure in the market. What's particularly interesting is that most of these companies are employing dollar-cost averaging strategies rather than making large lump-sum purchases.

Could ETF Speculation Push SOL to $500?

The crypto community is abuzz with speculation about potential Solana ETF approvals following Blackrock and Fidelity's growing involvement in the ecosystem. While Bitcoin and ethereum ETFs have dominated discussions until now, SOL's strong institutional backing and technological advantages are making it a serious contender for the next wave of crypto ETF products.

"The $500 narrative for SOL is gaining traction," says a BTCC market analyst, "but it's important to understand this WOULD require ETF approvals - realistically a 2026 scenario at the earliest." The analyst notes that while SOL could potentially double from current levels based on technicals alone, reaching $500 would need fundamental catalysts like ETF approvals or massive adoption of Solana's blockchain for enterprise applications.

What Are the Key Price Levels to Watch?

Traders should monitor these critical SOL price levels in the coming weeks:

- $190-$200: Make-or-break resistance (23.6% Fibonacci retracement from all-time high)

- $176: 20-day moving average serving as bull/bear demarcation line

- $157: Strong support at Bollinger Band base if correction occurs

Liquidation clusters identify $174 as immediate support and $184-$185 as the current make-or-break zone. A decisive breakout could propel SOL toward $256, though traders should note that cumulative long liquidations totaling $436.74 million suggest Leveraged positions remain cautious.

How Does Solana's Current Rally Compare to 2021?

The current SOL price action shows some parallels to its 2021 breakout, but with important differences. The 2021 rally was driven primarily by retail frenzy and DeFi mania, while the 2025 movement appears more institutionally driven. Exchange inflows spiked to $15.18 million on August 9, typically a precursor to profit-taking, while trading volume actually dipped 10% - suggesting this rally might have more staying power than previous ones.

That said, Solana's trajectory appears bifurcated: strong technical momentum clashes with on-chain indicators of distribution. Market participants are now weighing whether solana can emulate its 2021 performance or succumb to resistance pressure. The involvement of traditional finance players like Blackrock adds a new dimension to this cycle that wasn't present in 2021.

Is Now a Good Time to Buy SOL?

This depends entirely on your investment horizon and risk tolerance. Short-term traders might wait for a confirmed breakout above $195 before entering positions, while long-term investors could view any dips toward $176 as accumulation opportunities. The growing institutional interest suggests SOL is being taken seriously as a blockchain platform, not just as a speculative asset.

However, with great potential comes great volatility. The same technicals showing bullish signals now could quickly turn if bitcoin experiences a significant correction or if macroeconomic conditions worsen. As always in crypto, position sizing and risk management remain crucial.

This article does not constitute investment advice.

SOL Price Prediction: Frequently Asked Questions

What is the short-term price prediction for Solana?

In the near term, analysts project SOL could reach $200-250 if it breaks through the $195 resistance level. However, profit-taking near $200 is likely to create some selling pressure.

Can Solana reach $500 in 2025?

While some analysts mention $500 as a possibility, this would likely require fundamental catalysts like ETF approvals, which most experts see as a 2026 scenario at the earliest.

What are the main factors driving SOL's price?

Three key factors are influencing SOL's price: technical breakout patterns, growing institutional accumulation, and speculation about potential ETF products tracking Solana's performance.

How much SOL do institutions hold?

Four publicly traded companies currently hold over 3.5 million SOL worth approximately $591 million, representing about 0.65% of the circulating supply.

What are the key support and resistance levels?

Key levels to watch include resistance at $190-$200, support at the 20MA ($176), and stronger support at $157 if a correction occurs.