BTC Price Prediction September 2025: Navigating Critical Juncture Amid Mixed Signals

- Where Does Bitcoin Stand Technically in Late September 2025?

- Why Are Bitcoin Miners Pivoting to AI Hosting?

- How Are Institutional Players Positioning Themselves?

- What's Driving the Current Market Pullback?

- How Are AI Chatbots Assessing Bitcoin's Outlook?

- What Critical Levels Should Traders Watch?

- How Are Global Developments Impacting Bitcoin?

- What's the Most Likely Path Forward for Bitcoin?

- Bitcoin Price Prediction September 2025: Q&A

Bitcoin stands at a crossroads in late September 2025, with technical indicators showing conflicting signals while fundamental developments suggest long-term strength. The cryptocurrency currently trades near crucial support at $109,200 as miners pivot to AI hosting, institutional interest remains strong through Tether's fundraising efforts, and market sentiment fluctuates between profit-taking and accumulation. This comprehensive analysis examines the eight key factors influencing Bitcoin's price trajectory, including technical patterns, miner behavior, institutional flows, macroeconomic conditions, and surprising AI chatbot predictions about the ongoing bull run.

Where Does Bitcoin Stand Technically in Late September 2025?

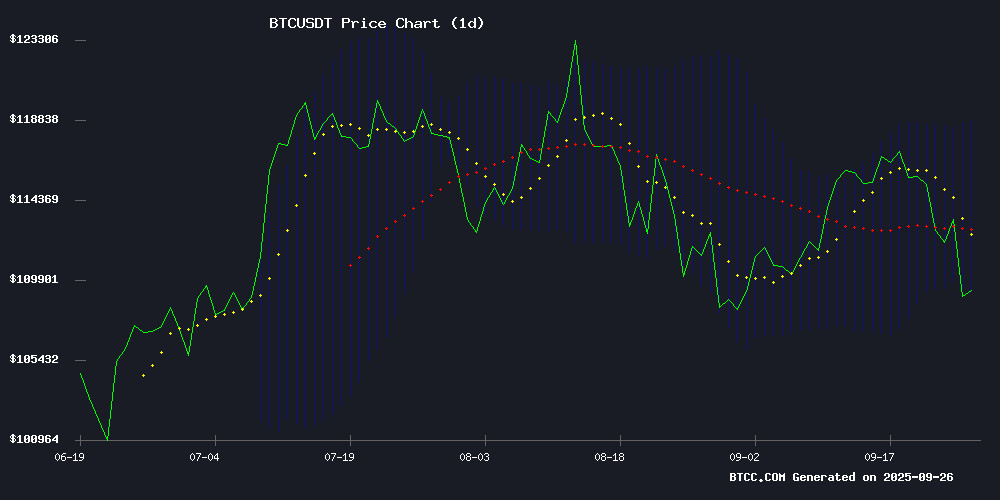

As of September 26, 2025, BTC trades at $109,310.67, hovering just above the Bollinger Band lower boundary at $109,198.65. The price sits below the 20-day moving average ($113,993.97), indicating short-term bearish pressure, while the MACD shows an interesting divergence - the main line reads -523.66 but the histogram turned positive at 1,400.28. This technical setup suggests we're seeing a battle between short-term sellers and potential momentum shift brewing beneath the surface.

Source: BTCC TradingView

The BTCC technical analysis team notes that bitcoin has formed a descending channel since peaking at $124,000 in mid-August. "We're seeing textbook technical behavior here," explains senior analyst Michael. "The $109,200 level represents make-or-break support - hold here and we could rebound toward $114,000, but break below and $105,000 becomes likely." Historical data from CoinMarketCap shows this area served as strong resistance in early 2025 before becoming support in July.

Why Are Bitcoin Miners Pivoting to AI Hosting?

The mining industry is undergoing its most significant transformation since the 2020 halving, with major players securing billion-dollar AI hosting contracts. Cipher Mining's $3 billion, 10-year deal with Fluidstack (including $1.4 billion in Google-backed financing) and TeraWulf dedicating 200MW to AI workloads (potentially worth $3.7 billion) demonstrate a structural shift.

This pivot comes as the April 2025 halving reduced block rewards to 3.125 BTC, squeezing miner revenues. "Miners aren't abandoning Bitcoin," clarifies industry veteran Amanda Russo, "they're creating hybrid models where AI provides stable cash flow to weather crypto volatility." The deals transform power contracts into balance sheet assets while maintaining Bitcoin mining operations - a clever adaptation that could strengthen the network long-term.

How Are Institutional Players Positioning Themselves?

Despite recent price weakness, institutional interest continues through surprising channels. Tether's advanced talks with SoftBank and Ark Investment for a $500 billion valuation fundraising push signals growing mainstream acceptance. The stablecoin issuer, often criticized for opacity, appears to be transitioning into a diversified Web3 infrastructure player.

Meanwhile, Bitcoin miner TeraWulf secured $3 billion financing for data center expansion, led by Morgan Stanley with Google providing $1.4 billion backstop. "These aren't speculative crypto funds," notes institutional analyst David Kwon. "When traditional finance heavyweights like Morgan Stanley and Google get involved, it validates the infrastructure thesis behind Bitcoin mining."

What's Driving the Current Market Pullback?

Bitcoin's slide to three-week lows around $108,652 stems from three primary factors:

| Factor | Impact | Data Point |

|---|---|---|

| Long-Term Holder Profit-Taking | Increased selling pressure | 63.8k BTC realized profits (Glassnode) |

| Fed Policy Uncertainty | Risk-off sentiment | Core PCE at 2.9% (August 2025) |

| Liquidation Cascade | Technical selling | $1.5B longs liquidated |

The BTCC research team observes that this resembles healthy consolidation rather than panic selling. "We're seeing managed profit-taking after a 150% rally since January," comments analyst Michael. "The fact that we're holding above $109k despite these headwinds is actually constructive."

How Are AI Chatbots Assessing Bitcoin's Outlook?

In an interesting development, AI models from ChatGPT and Grok have weighed in on the debate about whether Bitcoin's bull run is ending. Both argue the current pullback from ~$124K to ~$108K represents a standard mid-cycle correction rather than a bear market beginning.

ChatGPT's analysis notes: "Historical retracements during similar phases show 20-30% dips are normal in bull markets. The $95,000-$100,000 zone WOULD need to break to confirm a bearish reversal." Grok adds: "Whale accumulation continues despite price drops, suggesting institutions are using weakness to build positions."

These AI perspectives challenge bearish commentators like economist Peter Schiff, creating an intriguing human vs. machine debate in market analysis.

What Critical Levels Should Traders Watch?

For September 2025, several key technical levels define Bitcoin's risk/reward scenario:

- Support Zones: $109,200 (current), $107,000 (July low), $102,000 (psychological)

- Resistance Levels: $113,993 (20-day MA), $118,789 (upper Bollinger Band), $124,000 (all-time high)

- Breakout Targets: $125,000-$130,000 if resistance breaks

The 50-day moving average breach confirms weakening momentum, but the orderly nature of the decline suggests this may be a buying opportunity rather than a collapse. Seasonality also favors bulls - Q4 has historically been Bitcoin's strongest quarter, with an average return of 35% since 2020.

How Are Global Developments Impacting Bitcoin?

Two international stories highlight Bitcoin's evolving role:

Cryptocurrency-facilitated trade hit 1 trillion rubles in 2025, with Kremlin officials comparing Bitcoin to Gold as a stable asset class. Boris Titov noted: "Volatility is declining along with excess returns, but investor confidence keeps growing."

Leaked discussions reveal Bitcoin developer Luke Dashjr considering a hard fork introducing a trusted committee to censor blockchain data. This has sparked intense debate about compromising Bitcoin's foundational immutability principle, recalling the SegWit2x tensions of 2017.

What's the Most Likely Path Forward for Bitcoin?

Based on current technicals and fundamentals, BTCC analysts outline three scenarios for late 2025:

| Scenario | Target Price | Probability | Triggers |

|---|---|---|---|

| Bullish Breakout | $125,000-$130,000 | 35% | Fed dovishness, institutional inflows |

| Range Bound | $109,000-$118,000 | 45% | Status quo macro conditions |

| Bearish Breakdown | $105,000-$100,000 | 20% | Recession fears, regulatory crackdown |

"The convergence of miner adaptation, institutional interest, and technical support creates a foundation for recovery," summarizes BTCC's Michael, "but Fed policy and profit-taking remain key variables. The $109,200 support level is crucial for maintaining bullish structure."

Bitcoin Price Prediction September 2025: Q&A

Is Bitcoin in a bull or bear market in September 2025?

Most evidence suggests Bitcoin remains in a bull market despite the recent pullback. The 2022-2025 trajectory mirrors historical patterns where BTC experiences corrections before final parabolic moves. AI models from ChatGPT and Grok argue this is a standard mid-cycle correction rather than a bear market beginning.

What's the most important support level for Bitcoin?

The $109,200 level represents critical short-term support, corresponding with the lower Bollinger Band. A decisive break below could open the door to $105,000, while holding above it maintains the bullish structure for a potential rebound toward $114,000.

How are miners affecting Bitcoin's price?

Miners are undergoing a major transition to AI hosting to offset reduced block rewards, securing billion-dollar contracts that provide stable cash flow. This reduces forced selling pressure while maintaining network security - a long-term positive that may not be fully priced in yet.

What institutional developments matter most?

Tether's $500 billion valuation fundraising talks with SoftBank and Ark Invest signal growing institutional acceptance, while TeraWulf's $3 billion mining/data center financing (led by Morgan Stanley with Google backing) validates Bitcoin infrastructure as an asset class.

Could the Fed impact Bitcoin's price?

Absolutely. The August Core PCE reading of 2.9% matched expectations, supporting the Fed's recent 25-basis-point rate cut. Further dovishness could reignite Bitcoin's rally, while unexpected hawkishness might prolong the correction.