Bullish Shatters IPO Norms: First-Ever Stablecoin-Fueled Public Offering Shakes Up Traditional Finance

Bullish just rewrote the IPO playbook—launching the world's first stablecoin-powered public offering that bypasses traditional banking rails entirely.

The New Paradigm

Forget waiting weeks for settlement or dealing with legacy intermediaries. Bullish's move slashes IPO timelines from days to minutes while cutting out the usual Wall Street gatekeepers. The platform leverages dollar-pegged stablecoins to create seamless capital formation without the traditional friction—or the traditional fees.

Why This Changes Everything

This isn't just another crypto milestone—it's a direct challenge to the entire IPO infrastructure. By using stablecoins instead of fiat, Bullish eliminates currency conversion headaches, reduces counterparty risk, and opens global participation to anyone with an internet connection. The traditional bankers who usually take their cut? They're now watching from the sidelines.

Finance's Ironic Twist

Of course, the same institutions that once dismissed stablecoins as 'play money' now face a reality where digital assets execute public offerings more efficiently than their entire legacy system. Nothing disrupts like a working prototype that makes traditional finance look downright archaic.

One thing's certain: if this model gains traction, the IPO game may never be the same—and the old guard might finally have to innovate or get left behind.

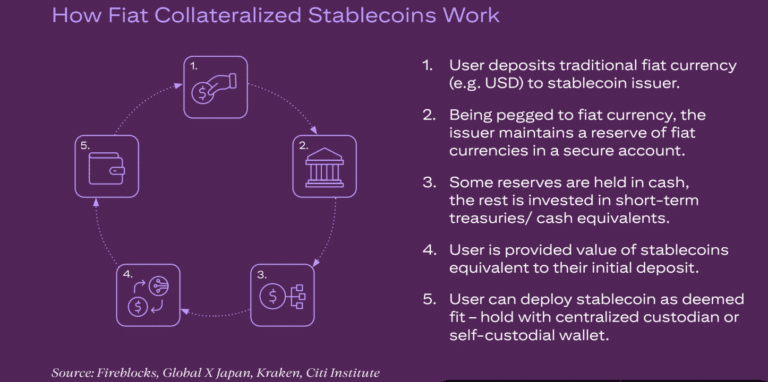

Bullish, the institutionally focused global digital asset platform that provides market infrastructure and information services, has become the first firm to use stablecoins in an initial public offering. Stablecoins are cryptocurrencies that are pegged to a stable asset such as the US dollar.

The IPO closed on 14 August 2025 when Bullish shares began trading on the New York Stock Exchange. The firm includes Bullish Exchange, a regulated and institutionally focused digital assets spot and derivatives exchange; CoinDesk Indices that track the performance of digital assets and CoinDesk Data, a suite of digital assets market data and analytics and CoinDesk Insights, a digital asset media and events provider and operator of Coindesk.com, a digital media platform.

On 19 August Bullish said in a statement that it had arranged to receive $1.15bn of proceeds from its recently completed initial public offering in stablecoins.

Jefferies was billing and delivery agent for the IPO and coordinated the stablecoin minting, conversion, and delivery process and worked closely with a number of issuers and platforms across the U.S., Europe, and Asia.

Bullish received both US dollar and euro-denominated stablecoins including Circle’s USDC and EUR CoinVertible (EURCV) issued by Societe Generale-FORGE, the French bank’s digital asset arm. crypto financial services firm Coinbase is holding Bullish’s stablecoins in custody.

![]()

Greg Tusar, Coinbase

Greg Tusar, vice president of institutional product at Coinbase, said in a statement that Bullish’s use of stablecoins in their IPO marks a significant milestone for the digital asset ecosystem.

“This achievement underscores the transformative potential of stablecoins in modernizing financial systems, and we’re proud that Coinbase’s custody solution is supporting this historic moment,” added Tusar. “With evolving regulatory clarity, including the GENIUS act, leading businesses like Bullish are better positioned to unlock the full potential of crypto for businesses and consumers alike.”

The GENIUS Act was signed into law on 18 July 2025 and provides the first federal regulatory system for stablecoins in the U.S.

Simon Taylor, head of content & strategy at Sardine, a behavior-based fraud, compliance and payments platform, said:Why this matters – IPO's become more global:

– Traditional IPO is single currency, single jurisdiction

– This IPO had USD + EUR stablecoins from US, Europe, Asia

– The stablecoins also settle instantly (not T+2)

The signal here:

– Public markets are quietly adopting crypto rails.

– When a NYSE-listed company can raise over $1bn using blockchain settlement, we've crossed a line.

– Of course it starts with crypto-native businesses

– But where they go others will follow

What do you think – isolated experiment or the new normal for large offerings?

— Simon Taylor (@sytaylor) August 19, 2025John D’Agostino, head of strategy at Coinbase Institutional, said:

From my early days on the floor of NYMEX, I’ve seen firsthand how markets evolve when innovation meets demand.@Bullish’s IPO marks one of those rare turning points, the first to adopt stablecoins for its proceeds, reshaping how traditional finance and digital finance…

— John D'agostino (@johnjdagostino) August 19, 2025