TT Joins Forces with SIGMA AI: A Game-Changing Alliance in Blockchain Tech

Breaking: Two tech titans collide as TT announces strategic partnership with SIGMA AI—expect seismic shifts in decentralized intelligence.

Why This Matters

When blockchain meets cutting-edge AI, traditional finance's legacy systems start sweating. This isn't just integration—it's an infrastructure overhaul.

The Nuts and Bolts

No details were spared (because none were given), but insiders whisper about AI-powered smart contracts that actually understand sarcasm. Finally.

Wall Street's Worst Nightmare

Another nail in the coffin for overpaid hedge fund managers as algorithms get smarter than their Harvard MBAs. Bonus point: SIGMA's tech probably costs less than a banker's lunch.

In July Trading Technologies International (TT), the capital markets technology provider, made a minority investment in SIGMA AI, a fintech specializing in real-time data and AI-driven insights. SIGMA AI is also developing a proprietary AI and innovation hub for TT.

![]()

Justin Llewellyn-Jones, TT

Justin Llewellyn-Jones, chief executive of TT, said in a statement: “This partnership with SIGMA AI will deliver ground-breaking AI-driven solutions to our clients through products that are faster, smarter, and easier to use, with robust governance frameworks that put security and safety at the forefront to guard against the nefarious use of this technology.”

Andy Simpson, founder and chief executive of SIGMA AI, told Markets Media that the investment is an extension of the fintech’s existing partnership with TT, which began in 2024.

TT said the investment will also enhance internal productivity by giving global teams access to innovative new tools and processes in a SAFE and secure manner. Simpson is expanding his leadership responsibilities taking on the additional role of Head of AI and Innovation at TT.

“TT is a global institution right in the sweet spot of what we do,” Simpson added. “Their global position is a brilliant springboard for us to expand.”

TT brings robustness, resilience, and adherence to standards and best practices that have been adopted by the firm’s blue chip clients according to Simpson. This will allow SIGMA AI to jointly develop products with TT for that customer base, which WOULD have been harder for a small fintech to access

“The capital injection is fantastic for us, but also TT’s influence in terms of pragmatic innovation,” he added.

Simpson argued that SIGMA AI differentiates itself by bringing “cutting edge” innovation and the ability to deliver personalized analytics at scale in real time, which will become the standard in the future.

![]()

Andy Simpson, SIGMA AI

“We’ve been looking at AI for a long time now,” he added. “We predicate all of our engineering on real time, so we can bring customers immediacy and personalization.”

There have been criticisms of AI models hallucinating and providing incorrect answers. Simpson said SIGMA AI has used a RAG (retrieval-augmented generation) system that enhances generative AI models. RAG improves reliability by providing source citations and evidence for generated content to allow users to verify the origin and accuracy of information. The firm also built fault checking and fact checking agents to look for common errors.

In addition to being able to take any type of structured data, SIGMA AI has built its own feed handlers for unstructured data, such as news.

“The agents go back through the data that we are ingesting to check whether the answers that we are producing in the analytics are correct,” Simpson added. “I think TT liked the business when they dug under the hood.”

In addition, he believes it is still critical that humans are kept in the loop and check content or analytics produced by a model before it is used.

“There is certainly room for automation but regulators would take a dim view if we didn’t put checks and balances in place to meet the required standards,” he said.

Simpson predicts that AI will become a key feature of trading and investment and lead to a massive increase in productivity. For example, predictive analytics will be able provide a probability for filling a trade across the day.

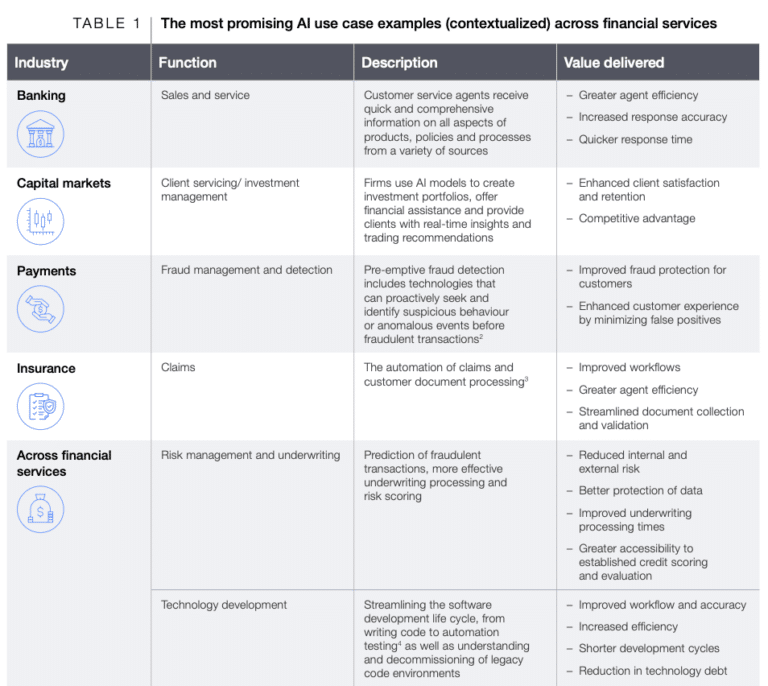

Artificial intelligence, and particularly generative AI (genAI), soared to the top of the agenda for businesses, policy-makers and other stakeholders in 2024 according to a report from the World Economic Forum and Accenture.

The report said financial services businesses with their data-rich and language-heavy operations are uniquely positioned to capitalize on the developments of AI and have been doing so for years. In addition, financial services firms spent $35bn on AI in 2023 and McKinsey estimated this could reach $97bn by 2027.

“Research indicates that 32-39% of the work performed across capital markets, insurance and banking businesses has high potential to be fully automated and 34-37% holds high augmentation potential,” added the report.

Source: WEF

In asset management, the AI revolution is a timely opportunity to break out of entrenched cost structures by increasing efficiency across business functions according to a report from consultancy McKinsey.

“More recently, with the advent of agentic AI, there is a once-in-a-generation opportunity for asset managers to recover and leapfrog profitability levels,” said McKinsey.

The consultancy gave the example that a mid-sized asset manager with $500bn in assets under management could capture 25% to 40% of total cost base in efficiencies through AI opportunities.

“To realize the value at stake, taking a role-based approach to automation by embedding VIRTUAL agents and traditional automation in seamless ways, alongside human roles, while focusing on change management and adoption, will be crucial,“ added the report.

In addition, McKinsey said that in client-facing roles, gen AI is enabling more seamless and personalized interactions, and can have a 9% efficiency impact. In investment management, gen AI is transforming the way insights are generated and decisions are made, and can have an 8% efficiency impact.

“Analysts are using gen AI-powered research assistants to synthesize data from earnings calls, financial reports, and conferences, accelerating the insight generation process,” said McKinsey. “Portfolio managers are leveraging gen AI tools to refine strategies, narrow investment options, and optimize portfolio construction. Enhanced risk models and automated reporting are further supporting a more data-driven investment approach.”