BTC Price Prediction 2025: Can Bitcoin Really Hit $200,000? Expert Analysis

- Current Bitcoin Market Overview

- Institutional Money Flooding Into Bitcoin

- Macroeconomic Winds Favoring Bitcoin

- The $200,000 Question: Realistic or Fantasy?

- Global Adoption Stories Adding Fuel

- Frequently Asked Questions

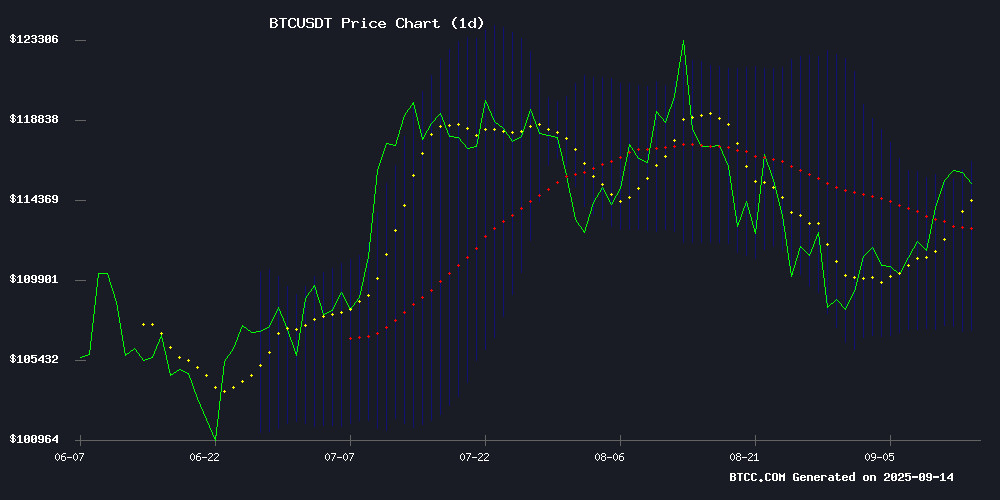

As bitcoin hovers around $115,720 on September 14, 2025, the crypto world is buzzing with one question: can BTC really reach $200,000 this cycle? Our deep dive into technical indicators, institutional flows, and macroeconomic factors reveals a fascinating roadmap. With spot Bitcoin ETFs seeing $2 billion weekly inflows, mining stocks attracting institutional money, and key technical levels being tested, we break down the bullish case - and the potential roadblocks ahead.

Current Bitcoin Market Overview

Bitcoin's price action on September 14, 2025 presents a fascinating technical picture. The cryptocurrency currently trades at $115,720, comfortably above its 20-day moving average of $111,832 - a key short-term trend indicator that suggests bullish momentum remains intact. According to TradingView data, the MACD indicator shows some near-term consolidation with readings of -1705.1279 | 679.9931 | -2385.1210, but the position above the middle Bollinger Band at $111,832 indicates underlying strength.

Source: BTCC Trading Platform

The $107,035 level has emerged as critical support - a floor that's been tested multiple times in recent weeks. Historical data from CoinMarketCap shows that each time Bitcoin has approached this level in Q3 2025, buying pressure has emerged, creating what technical analysts call a "demand zone." Maintaining above this level could pave the way for further upside, while a breakdown might signal deeper correction territory.

Institutional Money Flooding Into Bitcoin

The institutional story in September 2025 is perhaps even more compelling than the technical setup. US Bitcoin ETFs recorded a staggering $642 million single-day inflow on September 12 alone, continuing a trend of robust buying activity. Weekly inflows reached $2.3 billion, with Fidelity's FBTC and BlackRock's IBIT leading the charge - Fidelity attracted $315 million in daily inflows, while BlackRock saw $264 million.

What's particularly interesting is how this institutional activity extends beyond just ETF flows. On-chain data reveals large holders (wallets holding 10-10K BTC) have accumulated over 202,000 BTC in the past six months. This whale activity often precedes major price movements, as these sophisticated investors tend to front-run retail momentum.

| Metric | Value | Significance |

|---|---|---|

| Current Price | $115,720 | Testing key resistance |

| 20-day MA | $111,832 | Short-term trend support |

| Weekly ETF Inflows | $2.3B | Institutional demand |

| Whale Accumulation | 202K BTC | Smart money positioning |

Macroeconomic Winds Favoring Bitcoin

The Federal Reserve's monetary policy remains a critical driver for Bitcoin in September 2025. With traders anticipating a 25-basis-point rate cut (and even pricing in a slim chance of a 50-point cut), financial conditions appear poised to ease. Historically, Bitcoin has thrived in dovish monetary environments - the 2020-2021 bull run coincided with near-zero rates and quantitative easing.

Political interference adds another LAYER of complexity. The recent attempted firing of Fed Governor Lisa Cook over mortgage fraud allegations - temporarily blocked by a federal judge but now under appeal - represents unprecedented political pressure on central bank independence. As one hedge fund manager quipped on CNBC last week: "When the rules of the game keep changing, people start looking for games with clearer rules - that's where Bitcoin comes in."

The $200,000 Question: Realistic or Fantasy?

Reaching $200,000 would require Bitcoin to nearly double from current levels - an ambitious but not unprecedented move in crypto markets. The BTCC research team identifies several key factors that could catalyze such a move:

- Breaking $116,000 resistance: This level represents a massive supply wall where approximately 534,000 BTC (2.68% of circulating supply) sits. A clean breakout could trigger algorithmic buying and FOMO momentum.

- Sustained ETF inflows: At current rates, monthly inflows could approach $10 billion - equivalent to about 86,000 BTC at current prices, creating significant buy-side pressure.

- Macro instability: Further deterioration in traditional markets or Fed credibility could accelerate Bitcoin's adoption as a hedge asset.

However, risks remain. The same on-chain data showing whale accumulation also reveals that 93.6% of Bitcoin's circulating supply is currently in profit - historically, such levels have sometimes preceded profit-taking events. And let's not forget - crypto markets have a habit of humbling even the most confident predictions.

Global Adoption Stories Adding Fuel

El Salvador continues making waves in the crypto space, announcing specialized bitcoin banks as part of its Investment Bank Law enacted in August 2023. This MOVE solidifies the country's position as a hemispheric leader in digital asset adoption. Market observers anticipate these developments could catalyze further institutional adoption across Latin America - a region where currency instability makes Bitcoin particularly attractive.

Meanwhile, the recent Yala stablecoin (YU) depegging incident serves as a reminder of crypto's growing pains. The Bitcoin-native over-collateralized asset plunged to $0.20 following a protocol exploit before partially recovering to $0.91. While the team assured user assets remained secure, the event highlights the importance of robust security in decentralized finance systems.

Frequently Asked Questions

What is Bitcoin's current price and key technical levels?

As of September 14, 2025, Bitcoin trades at $115,720. Key technical levels include support at $107,035 (critical floor), $111,832 (20-day moving average), and resistance at $116,963 (major supply wall).

How much institutional money is flowing into Bitcoin?

US Bitcoin ETFs saw $2.3 billion in weekly inflows as of September 12, 2025, with single-day inflows reaching $642 million on September 12 alone. Large holders have accumulated over 202,000 BTC in the past six months.

What macroeconomic factors affect Bitcoin's price?

Federal Reserve policy (anticipated rate cuts), political interference in central bank operations, and broader financial market stability all significantly impact Bitcoin's price action and adoption narrative.

Is $200,000 realistic for Bitcoin in 2025?

While ambitious, the $200,000 target becomes plausible if Bitcoin breaks through $116,000 resistance with conviction, maintains strong institutional inflows, and benefits from continued macroeconomic uncertainty. However, crypto markets remain volatile and unpredictable.

What are the risks to Bitcoin's price growth?

Key risks include profit-taking at current levels (93.6% of supply in profit), potential regulatory developments, macroeconomic stabilization reducing Bitcoin's hedge appeal, and technical breakdowns below critical support levels.