Ethereum Price Forecast 2025-2040: Expert Analysis on Short-Term Targets & Long-Term Projections

- What's Driving Ethereum's Current Price Action?

- How Significant is Institutional Demand for Ethereum?

- Can Ethereum Maintain Its Dominance Amid Layer 2 Growth?

- What Do Technical Patterns Suggest About ETH's Near-Term Price?

- Ethereum Price Projections: 2025 Through 2040

- Frequently Asked Questions

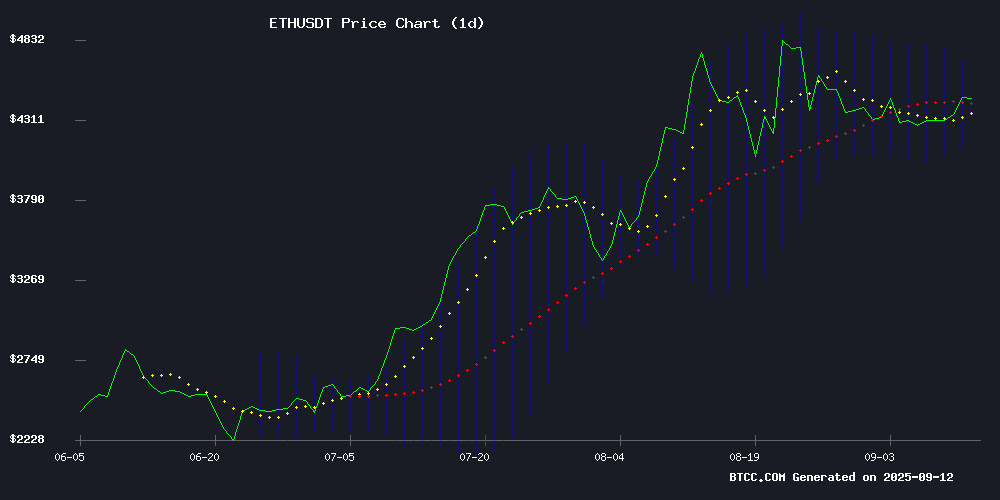

Ethereum (ETH) is currently showing strong bullish momentum, trading at $4,633.56 as of September 2025, with technical indicators suggesting potential upside to $5,100-$6,000 in the near term. This comprehensive analysis examines ETH's price trajectory through 2040, incorporating technical patterns, institutional demand signals, and ecosystem developments. From whale accumulation patterns to LAYER 2 scaling solutions, we break down the key factors driving Ethereum's valuation across multiple time horizons.

What's Driving Ethereum's Current Price Action?

ETH is currently trading comfortably above its 20-day moving average of $4,411.73, with the MACD showing strong bullish momentum at 120.76 versus its signal line at 105.80. The price is testing the upper Bollinger Band at $4,674.53, which could act as temporary resistance before the next leg up. According to TradingView data, ethereum has maintained this technical strength despite recent market volatility.

How Significant is Institutional Demand for Ethereum?

The institutional picture for Ethereum has never been stronger. Just last week, three whale wallets acquired $205 million worth of ETH through institutional gateway FalconX. Publicly-listed BitMine expanded its holdings to over 2.1 million ETH with a $200 million purchase. U.S. spot ETH ETFs have seen $171 million in net inflows this week alone, with BlackRock's product recording a $74.5 million single-day inflow on September 11.

Can Ethereum Maintain Its Dominance Amid Layer 2 Growth?

While Ethereum remains the undisputed leader in smart contract platforms, the rise of Layer 2 solutions like Arbitrum and Optimism presents both challenges and opportunities. These scaling solutions now handle over 60% of Ethereum's transaction volume, according to L2Beat data. The key question is whether Ethereum can maintain its value capture as activity migrates to these faster, cheaper networks.

What Do Technical Patterns Suggest About ETH's Near-Term Price?

Elliott Wave analysis indicates Ethereum may be entering an extended fifth wave that could propel prices beyond initial $6,000 targets. The September 1 low of $4,212 likely marked Wave-2 of this final push, with Wave-3 currently targeting $5,655. This technical setup suggests we could see accelerated upside in coming weeks.

Ethereum Price Projections: 2025 Through 2040

| Year | Conservative | Moderate | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $5,200-$5,800 | $6,000-$6,500 | $7,000+ | ETF adoption, institutional inflows |

| 2030 | $8,000-$12,000 | $15,000-$20,000 | $25,000+ | Layer 2 scaling, DeFi maturation |

| 2035 | $18,000-$25,000 | $30,000-$40,000 | $50,000+ | Enterprise adoption, Web3 infrastructure |

| 2040 | $35,000-$50,000 | $60,000-$80,000 | $100,000+ | Global digital economy integration |

Frequently Asked Questions

What is Ethereum's price prediction for 2025?

Based on current technical indicators and institutional demand, Ethereum could reach between $5,200-$7,000 by the end of 2025, with the moderate forecast around $6,000-$6,500. Key drivers include ETF adoption and continued institutional inflows.

How high can Ethereum go by 2030?

Long-term projections suggest Ethereum could reach $8,000-$25,000 by 2030, depending on Layer 2 adoption rates and DeFi ecosystem growth. The moderate forecast centers around $15,000-$20,000.

What are the biggest risks to Ethereum's price growth?

Potential risks include regulatory challenges, failure to scale effectively, competition from alternative Layer 1 networks, and macroeconomic factors that could reduce institutional crypto appetite.

Is now a good time to buy Ethereum?

While technical indicators currently suggest bullish momentum, investors should always conduct their own research and consider dollar-cost averaging to mitigate timing risks. This article does not constitute investment advice.

How does Ethereum's growth compare to Bitcoin?

Ethereum typically shows higher volatility but greater upside potential during bull markets due to its utility in DeFi and smart contracts, while bitcoin remains the more stable store of value.