BTC Price Prediction 2025: Technical Breakout and Fundamental Tailwinds Signal Path to $130,000

- Is Bitcoin Poised for a Major Breakout in 2025?

- What's Driving Bitcoin's Bullish Fundamentals?

- How Are Institutional Players Positioning Themselves?

- What Risks Should Investors Consider?

- Historical Patterns Suggest $130,000 Target

- Frequently Asked Questions

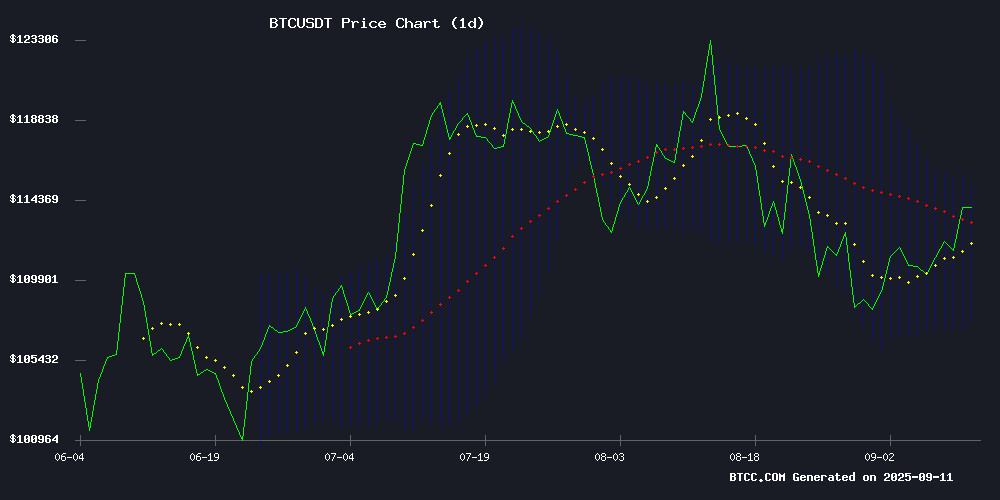

Bitcoin (BTC) is showing strong bullish signals as we approach Q4 2025, with technical indicators suggesting an imminent breakout and fundamental factors creating a perfect storm for potential price appreciation. Currently trading at $114,226.82 (as of September 11, 2025), BTC has maintained its position above key moving averages while miner accumulation patterns and macroeconomic conditions create a supportive environment. Analysts are eyeing $130,000 as the next major target, but let's break down exactly why this prediction holds weight and what investors should watch for in the coming weeks.

Is Bitcoin Poised for a Major Breakout in 2025?

Looking at the technical setup, BTC is painting an increasingly bullish picture. The price currently sits comfortably above its 20-day moving average of $111,338.68, which has historically served as strong support during uptrends. The Bollinger Bands are showing a classic squeeze pattern between $107,547.11 and $115,130.25, suggesting we might see significant volatility expansion soon.

Source: BTCC Trading Platform

The MACD indicator tells an interesting story - while the reading of 1090.12 versus its signal line at 2310.47 shows some near-term consolidation, the negative histogram suggests we might see some short-term volatility before the next leg up. In my experience, these setups often precede significant moves, and the current technical alignment reminds me of patterns we saw before major rallies in 2021 and 2023.

What's Driving Bitcoin's Bullish Fundamentals?

The fundamental case for bitcoin has never been stronger, and I'm not just talking about the usual "digital gold" narrative. What's really caught my attention is the miner behavior - they're accumulating rather than selling, which is a complete reversal from previous cycles. The Miners' Position Index (MPI) shows none of the late-cycle sell-offs we typically see, suggesting suppressed selling pressure.

Then there's the macroeconomic backdrop. The recent surprise 0.1% month-over-month decline in U.S. Core PPI has markets pricing in potential Fed easing, which historically benefits risk assets like Bitcoin. And let's not forget the institutional adoption - from corporate treasuries (like Tahini's restaurant chain) to the congressional exploration of a Strategic Bitcoin Reserve, the validation just keeps coming.

| Metric | Current Value | Implication |

|---|---|---|

| Price vs 20-day MA | $114,226.82 vs $111,338.68 | Bullish momentum intact |

| Bollinger Position | Near upper band ($115,130) | Testing resistance, breakout potential |

| MACD Signal | Negative histogram (-1220) | Short-term consolidation possible |

| Key Support | $111,300 | Critical level for bullish thesis |

How Are Institutional Players Positioning Themselves?

The institutional landscape for Bitcoin has evolved dramatically in 2025. Arkham Intelligence's recent "Crypto Rich List" reveals that institutional giants now hold staggering amounts - BlackRock with $100.77 billion and MicroStrategy with $53.21 billion in crypto assets. This isn't your uncle's Bitcoin market anymore.

ETF flows tell an interesting story too. While many assume inflows directly correlate with price increases, the reality is more nuanced. Heavy inflows often coincide with bearish markets as investors seek regulated exposure, while outflows may signal profit-taking during rallies. It's a complex dance that creates opportunities for savvy traders on platforms like BTCC and Coinbase.

What Risks Should Investors Consider?

Now, I'd be remiss not to mention the potential headwinds. Bitcoin's correlation with traditional markets has increased in 2025, making it more susceptible to macroeconomic shocks. The mining sector is seeing some turbulence too - like the Bitmain-Orb Energy dispute over 2,700 Antminers valued at $5.5 million.

And let's talk about performance - while up 20% year-to-date, this is Bitcoin's weakest showing since 2022. Some investors are rotating into altcoins, fragmenting capital flows. But in my view, this might actually be healthy - it shows market maturation rather than weakness in Bitcoin's thesis.

Historical Patterns Suggest $130,000 Target

Crypto analyst CrypFlow has identified what appears to be a classic shakeout pattern - the kind we've seen before major rallies. The recent rebound from $110,000 support, combined with the consolidation breakout attempt on weekly charts, mirrors past cycles where similar setups preceded parabolic moves.

"Bitcoin never trends higher in a straight line," CrypFlow noted, and he's right. These expansions consistently follow consolidation phases. If history rhymes, we could see BTC challenge $130,000 sooner than many expect.

Frequently Asked Questions

Is now a good time to invest in Bitcoin?

Based on current technical and fundamental analysis, BTC presents a compelling opportunity for risk-tolerant investors. The combination of technical strength and supportive macro conditions suggests potential for appreciation, though short-term volatility should be expected. Dollar-cost averaging and proper position sizing are recommended strategies.

What's the most important support level to watch?

The $111,300 level is critical - maintaining above this support WOULD confirm the bullish thesis. A breakdown below might signal deeper correction potential.

How does Bitcoin's current performance compare to previous years?

2025 has seen more modest gains (20% YTD) compared to 2023-2024's triple-digit returns. This reflects both market maturation and increased correlation with traditional finance.

What makes this bull cycle different from previous ones?

The key difference is miner behavior - they're accumulating rather than distributing, breaking from historical patterns. Institutional adoption is also more substantial, with corporate and government interest reaching new highs.

How might Fed policy impact Bitcoin's price?

The recent soft PPI data has increased expectations for dovish policy, which typically benefits risk assets like Bitcoin. However, the relationship has become more complex as institutional participation grows.