ADA Price Prediction 2025: Technical Strength and Fundamental Catalysts Signal Imminent Breakout

- What Does ADA's Technical Setup Reveal About Future Price Action?

- How Are Market Sentiment and Whale Activity Influencing ADA?

- What Key Price Levels Should Traders Watch?

- Is Now a Good Time to Invest in ADA?

- ADA Price Prediction: Frequently Asked Questions

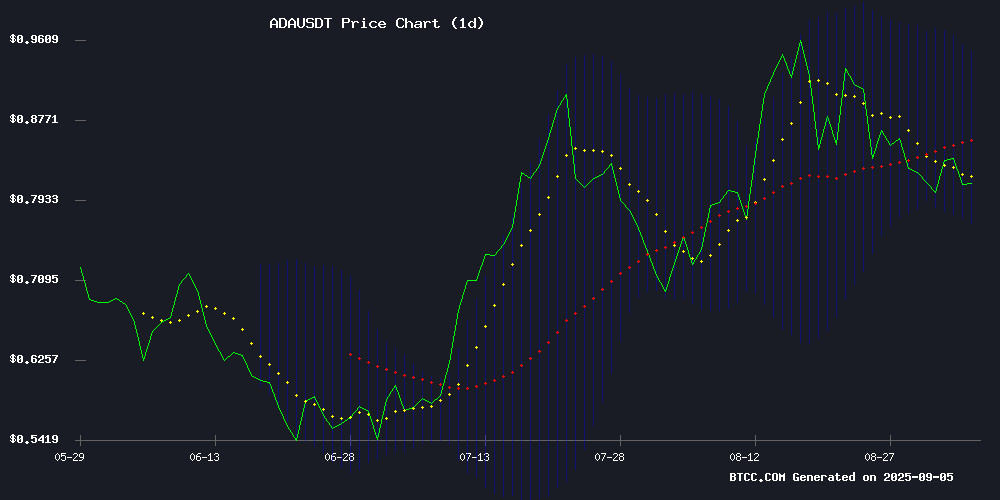

Cardano (ADA) is showing intriguing signals as we enter September 2025, with technical indicators and fundamental developments aligning to suggest potential upside. The cryptocurrency currently trades at $0.8319, displaying resilience above crucial support levels while MACD readings hint at building bullish momentum. What makes this particularly interesting is the apparent disconnect between retail sentiment (which remains bearish) and price action (which has gained 5% recently). Charles Hoskinson's regulatory clearance adds fundamental fuel to the technical picture, creating what our analysis suggests could be a favorable risk-reward scenario for medium-term investors. The key question isn't whether ADA will move, but rather when and how sharply that movement might occur.

What Does ADA's Technical Setup Reveal About Future Price Action?

As of September 6, 2025, ADA presents a fascinating technical picture. The price sits just below the 20-day moving average ($0.8602), which typically signals short-term bearish pressure. However, digging deeper reveals more nuanced signals:

| Indicator | Value | Interpretation |

|---|---|---|

| Current Price | $0.8319 | Testing support levels |

| MACD | 0.026054 | Bullish momentum building |

| Bollinger Lower | $0.7720 | Strong historical support |

| Bollinger Upper | $0.9484 | Potential breakout target |

The Bollinger Bands tell an important story - with price hovering comfortably above the lower band ($0.7720), there's substantial breathing room before support becomes threatened. Meanwhile, the MACD's positive reading suggests underlying strength that might not be immediately apparent from price alone. A decisive break above the middle Bollinger Band at $0.8602 could serve as confirmation that upward momentum is accelerating, with the upper band NEAR $0.95 representing a logical initial target.

How Are Market Sentiment and Whale Activity Influencing ADA?

Sentiment analysis reveals a curious dichotomy in ADA markets. Retail traders have grown increasingly bearish, with bullish-to-bearish commentary ratios hitting 1.5:1 according to Santiment data - typically a contrarian indicator. Meanwhile, blockchain data suggests whales are accumulating during this period of retail pessimism, creating what often becomes a recipe for upward price surprises.

Charles Hoskinson's recent regulatory clearance has added fundamental support to this technical setup. The cardano founder's influence continues to shape the project's trajectory, with developments in the ecosystem providing tangible reasons for optimism. This creates an environment where negative sentiment among smaller traders might actually be creating buying opportunities for those with longer time horizons.

What Key Price Levels Should Traders Watch?

ADA currently consolidates near $0.82 after repeatedly defending the $0.78-$0.80 zone - an area that's emerged as significant support. The 200-day EMA poses resistance at $0.85, but the real breakout level to watch is $0.92, which represents a Fibonacci pivot point. A clean break above this level could open the door to moves toward $1.00-$1.15.

On the flip side, failure to hold $0.78 would suggest weakening structure and could lead to a test of $0.70. The TD Sequential indicator currently hints at an impending rebound, though as always in crypto markets, confirmation is key. What's particularly interesting is how this mirrors ADA's behavior in August 2025, when the asset rallied during fear periods and corrected when Optimism spiked.

Is Now a Good Time to Invest in ADA?

From a risk-reward perspective, current levels offer an interesting proposition for medium-term investors. The combination of:

- Technical support at $0.78-$0.80

- Bullish MACD divergence

- Whale accumulation during retail pessimism

- Positive ecosystem developments

creates a scenario where downside appears somewhat contained while upside potential remains meaningful. That said, crypto markets are inherently volatile, and positions should always be sized appropriately. The BTCC research team notes that ADA's current setup resembles previous periods that preceded meaningful rallies, though past performance never guarantees future results.

This article does not constitute investment advice.

ADA Price Prediction: Frequently Asked Questions

What is the current ADA price as of September 2025?

As of September 6, 2025, ADA trades at $0.8319, according to CoinMarketCap data.

What are the key support and resistance levels for ADA?

Key support sits at $0.78-$0.80, with resistance at $0.85 (200-day EMA) and $0.92 (Fibonacci pivot). A break above $0.92 could target $1.00-$1.15.

Why is there a disconnect between ADA's price and retail sentiment?

While retail traders have turned bearish (1.5:1 bearish-to-bullish ratio), blockchain data shows whales accumulating, creating potential for upward price movement against prevailing sentiment.

How do fundamental developments affect ADA's price outlook?

Charles Hoskinson's regulatory clearance and ongoing Cardano ecosystem growth provide fundamental support that complements the current technical setup.