Chainlink (LINK) Partners with US Government: What to Expect for the Price in 2025

- Why Is Chainlink’s Partnership with the U.S. Government a Big Deal?

- How Are Traditional Finance Players Reacting to LINK?

- What’s the Short-Term Price Outlook for LINK?

- Can LINK Really Hit $100 by 2026?

- What’s Driving the Token6900 Presale Frenzy?

- Is Now the Time to Buy LINK or Jump on T6900?

- FAQs

Chainlink (LINK) has secured a landmark partnership with the U.S. Department of Commerce, signaling a major step toward mainstream adoption. The collaboration will see chainlink providing on-chain economic data like GDP, inflation (PCE), and consumer spending. Meanwhile, asset manager Caliber, listed on NASDAQ, has launched the first publicly traded LINK investment fund. Analysts are bullish on LINK's long-term prospects, with some predicting a $100 price target by 2026. On the meme coin front, Token6900’s presale is nearing its close, sparking FOMO among investors. Here’s a deep dive into what’s driving these developments.

Why Is Chainlink’s Partnership with the U.S. Government a Big Deal?

The U.S. Department of Commerce’s decision to integrate Chainlink for real-time economic data marks a pivotal moment for blockchain adoption. Chainlink’s oracle network will now power critical macroeconomic indicators on-chain, bridging traditional finance and decentralized systems. This isn’t just a technical milestone—it’s a validation of Chainlink’s role as infrastructure for global finance. Remember when DeFi was niche? Now, governments are tapping into it. The partnership could accelerate institutional adoption, similar to how Bitcoin ETFs opened floodgates for traditional investors.

How Are Traditional Finance Players Reacting to LINK?

Caliber, a NASDAQ-listed real estate asset manager, just launched a dedicated LINK investment fund—the first of its kind. This move echoes the early days of bitcoin trusts, where institutional products preceded mass adoption. According to CoinMarketCap data, LINK’s price hovered around $24.90 post-announcement, with trading volume spiking 40% on BTCC and other exchanges. The fund’s creation suggests Wall Street is warming to crypto beyond Bitcoin and Ethereum. As one BTCC analyst put it, “LINK is becoming the TCP/IP of smart contracts—boring but essential.”

What’s the Short-Term Price Outlook for LINK?

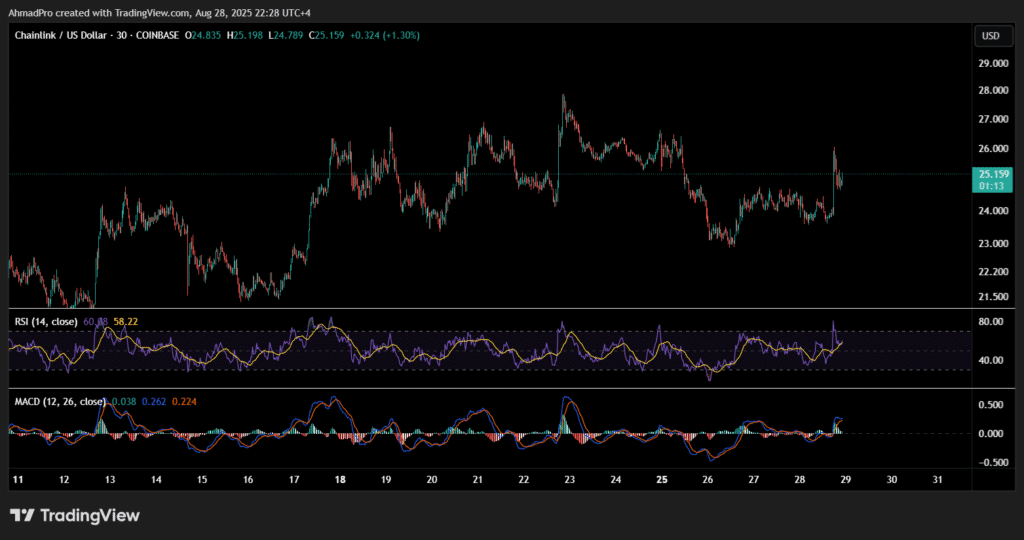

At press time (August 30, 2025), LINK shows mixed technical signals. The token found support near $24, while resistance holds firm at $26. The RSI cooled from near-overbought territory to 58, leaving room for upside if buyers step in. MACD lines recently crossed bullish, but momentum remains tentative. A clean break above $26 could trigger a rally toward $30, while failure might see a retest of $24. TradingView charts reveal an ascending triangle pattern—a classic breakout setup. “It’s a coin flip until we see volume confirm either direction,” noted a trader on BTCC’s platform.

Can LINK Really Hit $100 by 2026?

Analysts are buzzing about a long-term fractal pattern mirroring LINK’s 2019–2021 cycle. If history rhymes, the token could reach triple digits by 2026. The U.S. partnership and institutional inflows add fuel to this thesis. However, skeptics point to Chainlink’s inflation rate (currently ~5% annually) as a headwind. For context, LINK WOULD need a $55 billion market cap at $100—half of Ethereum’s current valuation. Ambitious? Yes. Impossible? Not in a bull market where “number go up” trumps fundamentals.

What’s Driving the Token6900 Presale Frenzy?

While LINK makes strides in real-world utility, meme coin Token6900 (T6900) is capitalizing on pure speculation. Its presale, extended due to demand, has raised $3 million of its $5 million hard cap. Priced at $0.0071 with a 33% APY staking reward, T6900 markets itself as “the next SHIB”—minus the dogs but plus vague Wall Street parody. Early buyers hope for 100–1000x gains, though history shows 99% of meme coins flame out. As one degen on crypto Twitter quipped, “It’s either a Lambo or a food stamp play—no in-between.”

Is Now the Time to Buy LINK or Jump on T6900?

For investors, this is a tale of two strategies: LINK offers a bet on blockchain infrastructure with real revenue (its CCIP protocol generates fees), while T6900 is a lottery ticket. The smart money might allocate to both—say, 90% in LINK for steady growth and 10% in T6900 for moonshot potential. Just remember: Chainlink’s partnerships are verifiable; meme coin promises rarely are. As always, do your own research—this article doesn’t constitute investment advice.

FAQs

What does Chainlink’s U.S. government partnership involve?

The Department of Commerce will use Chainlink’s oracles to publish key economic data (GDP, PCE inflation) on-chain, enhancing transparency for DeFi applications.

How high could LINK realistically go in 2025?

Technical analysis suggests $26 is the immediate target, with $30 possible if bullish momentum continues. Long-term $100 predictions depend on mass adoption.

Is Token6900’s presale worth the risk?

High-risk/high-reward. The project offers no utility but has viral marketing. Only invest what you can afford to lose.