LTC Price Prediction 2025: Can Litecoin Break Through $200 Despite Market Volatility?

- Current Technical Landscape: Where Does LTC Stand?

- Institutional Adoption: The Fundamental Game Changer

- The $200 Question: Realistic Target or Pipe Dream?

- Regulatory Wildcards: The X-Factor in LTC's Equation

- Historical Context: Learning From LTC's Past Cycles

- FAQ: Your Litecoin Questions Answered

Litecoin (LTC) finds itself at a critical juncture in August 2025, trading at $109.49 while facing both technical resistance and fundamental crosscurrents. This analysis examines whether LTC can overcome its current challenges to reach the $200 milestone, exploring key technical indicators, institutional adoption trends, and regulatory developments shaping its price trajectory. With the cryptocurrency balancing between bullish institutional interest and bearish technical signals, we break down the complex factors influencing its potential path forward.

Current Technical Landscape: Where Does LTC Stand?

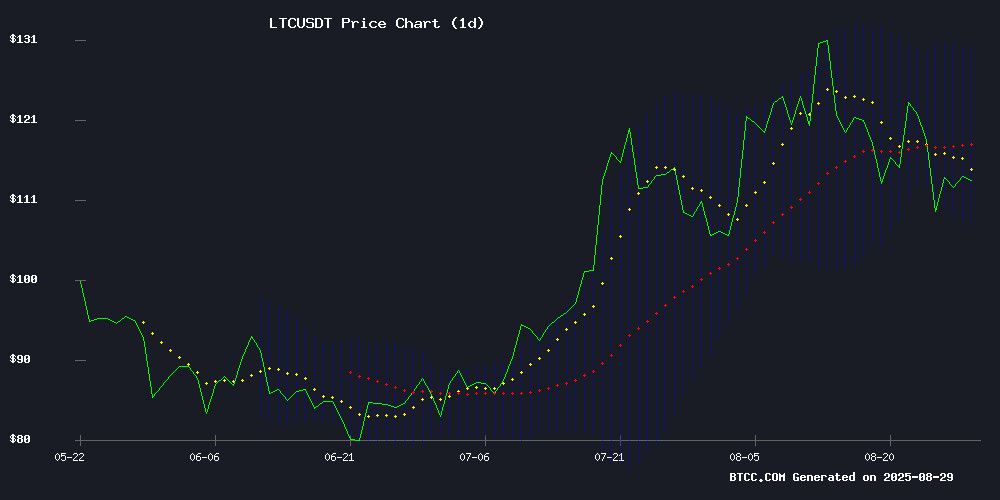

As of August 29, 2025, Litecoin presents a mixed technical picture that's got traders scratching their heads. The digital silver is currently trading below its 20-day moving average ($118.46), which typically signals bearish pressure in the short term. However, the MACD indicator tells a different story with a positive reading of 5.85 (signal line at 2.55), suggesting there's still some bullish momentum lurking beneath the surface.

The Bollinger Bands paint an interesting scenario - LTC is hovering NEAR the lower band at $106.73, with the middle band at $118.46 and upper band at $130.18. This positioning indicates potential support levels that could prevent further downside. "LTC's position below the 20-day MA shows short-term weakness," notes a BTCC market analyst, "but that positive MACD can't be ignored. If we see a clean break above $118.50, that could be the green light for bulls to take control."

Source: BTCC Market Data

Institutional Adoption: The Fundamental Game Changer

The institutional landscape for Litecoin has seen some fascinating developments recently. Canadian crypto infrastructure firm Luxxfolio made waves in July when it pivoted to become the first publicly traded company to anchor its treasury in Litecoin. Now they're doubling down with plans to raise CAD$100 million ($73 million) to expand their LTC strategy, including an ambitious goal to accumulate 1 million LTC by 2026.

Meanwhile across the pond, SolMining launched a UK-regulated cloud mining platform supporting LTC alongside bitcoin and Dogecoin. Their "compliance first" approach with AI-driven risk monitoring and multi-signature cold wallets adds a layer of legitimacy to Litecoin mining that was previously lacking.

However, it's not all smooth sailing. The rapid growth of crypto treasuries has drawn regulatory scrutiny, with Fortune reporting unusual stock movements ahead of cryptocurrency announcements at several small-cap companies. MEI Pharma's shares nearly doubled before disclosing a $100 million Litecoin acquisition - the kind of pattern that makes regulators reach for their rulebooks.

The $200 Question: Realistic Target or Pipe Dream?

Let's crunch the numbers on that $200 target. At the current price of $109.49, LTC WOULD need to appreciate approximately 82.6% to hit $200. That's no small feat, especially considering it would require breaking through multiple resistance levels:

| Resistance Level | Price | % Above Current |

|---|---|---|

| 20-day MA | $118.46 | 8.2% |

| Upper Bollinger Band | $130.18 | 18.9% |

| Psychological Resistance | $150.00 | 37.0% |

| Target Price | $200.00 | 82.6% |

"While the institutional adoption story is compelling," explains our BTCC analyst, "$200 seems like a stretch in the immediate term unless we see either a major market catalyst or a full-blown crypto bull run. The technicals suggest we might consolidate between $100-$130 before making any significant moves."

Regulatory Wildcards: The X-Factor in LTC's Equation

The regulatory environment has become increasingly complex for cryptocurrencies in 2025. The insider trading concerns highlighted by Fortune represent just one facet of growing scrutiny. Binance's recent suspension of an employee over alleged insider trading tied to a token launch shows exchanges are feeling the heat too.

For Litecoin specifically, the challenge lies in balancing its growing institutional appeal with regulatory compliance. The involvement of Charlie Lee (Litecoin's creator) on Luxxfolio's advisory board adds credibility but also raises the stakes for proper governance.

Historical Context: Learning From LTC's Past Cycles

Looking back at Litecoin's historical performance provides valuable context. The cryptocurrency has shown remarkable resilience since its 2011 launch, weathering multiple market cycles. Its previous all-time high near $400 during the 2021 bull run demonstrates its potential for significant upside when market conditions align.

However, the current macroeconomic environment differs substantially from previous bull markets. With interest rates still elevated compared to the zero-rate era of 2020-2021, and regulatory uncertainty persisting, the path to $200 may require more than just following historical patterns.

FAQ: Your Litecoin Questions Answered

What are the key resistance levels for LTC in August 2025?

Litecoin faces immediate resistance at its 20-day moving average ($118.46) and upper Bollinger Band ($130.18). Breaking through these levels decisively would be the first step toward higher price targets.

How significant is institutional adoption for Litecoin's price?

Institutional interest, exemplified by Luxxfolio's treasury strategy and SolMining's regulated platform, provides fundamental support. However, regulatory concerns could create short-term volatility despite these positive developments.

What percentage gain does LTC need to reach $200?

From its current price of $109.49, Litecoin would need to appreciate approximately 82.6% to reach the $200 target.

Does Litecoin creator Charlie Lee's involvement with Luxxfolio matter?

Lee's advisory role adds credibility to Luxxfolio's Litecoin-focused strategy, potentially increasing institutional confidence in LTC as a treasury asset.

What are the main risks to Litecoin's price growth?

Key risks include regulatory scrutiny, broader crypto market sentiment, and the challenge of maintaining momentum if institutional adoption slows.