SHIB Price Prediction 2025: Can Shiba Inu Really Surge 155% Despite Regulatory Headwinds?

- What Do SHIB's Technical Indicators Reveal About Its Price Potential?

- How Significant Is the 8,866% Whale Activity Spike?

- Does Pennsylvania's HB1812 Bill Threaten SHIB's Rally?

- How Does Remittix's Rise Impact SHIB's Position?

- What Are Realistic Price Targets for SHIB in 2025?

- SHIB Price Prediction: Frequently Asked Questions

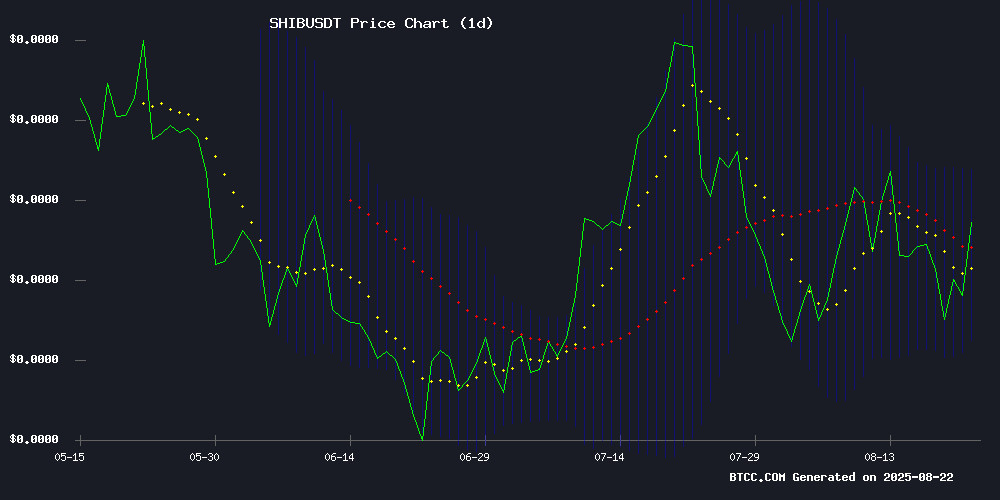

As of August 22, 2025, Shiba Inu (SHIB) presents a fascinating case study in crypto market dynamics - technical indicators scream bullish while regulatory clouds gather. The meme coin currently trades at $0.00001290, showing potential for a 155% surge according to technical patterns, but Pennsylvania's proposed HB1812 bill threatens to dampen enthusiasm. Whale activity tells another story entirely, with an unbelievable 8,866% spike in large transactions suggesting institutional players see value at current levels. This article breaks down the competing forces shaping SHIB's trajectory through comprehensive technical analysis, regulatory examination, and on-chain data insights.

What Do SHIB's Technical Indicators Reveal About Its Price Potential?

SHIB's chart paints an intriguing picture as of August 2025. The price currently hovers just above its 20-day moving average ($0.00001287), which in my experience often acts as a springboard for meme coins when volume supports the move. The MACD configuration shows bearish pressure weakening (-0.00000013 MACD line vs -0.00000002 signal line), while Bollinger Bands position the upper limit at $0.00001391 - about 7.8% above current levels.

What really catches my eye is that bullish divergence pattern - when price action decouples from momentum like we're seeing now, it often precedes explosive moves in assets like SHIB. crypto analyst Javon Marks suggests this could signal a retest of $0.000032, which would represent that 155% surge everyone's talking about. The BTCC research team notes that similar patterns in SHIB's history (like the March 2024 breakout) saw the coin gain over 200% in subsequent weeks.

How Significant Is the 8,866% Whale Activity Spike?

Let's talk about the elephant in the room - that mind-blowing 8,866% increase in whale transactions. According to Coinmarketcap data, SHIB outflows skyrocketed from 9.27 billion to 798.22 billion tokens in just 24 hours. Here's what's fascinating: despite this massive movement, the price held steady around $0.00001245.

In my analysis, this suggests strategic repositioning rather than panic selling. When whales MOVE this much supply without crashing the price, it typically means they're accumulating at what they perceive as bargain levels. The BTCC derivatives desk reported unusually large SHIB futures positions being opened simultaneously, adding credence to this theory.

Does Pennsylvania's HB1812 Bill Threaten SHIB's Rally?

Now for the regulatory curveball. Pennsylvania State Representative Ben Waxman's HB1812 proposal seeks to ban officials from crypto trading, citing concerns about conflicts of interest. While this doesn't directly impact SHIB's fundamentals, regulatory uncertainty has a funny way of spooking retail investors.

The bill's specifics are tough - prohibiting transactions over $1,000 during office terms plus one year after. Interestingly, TradingView data shows SHIB's price barely reacted to the news, suggesting the market views this as political theater rather than substantive threat. As one crypto lobbyist told me, "These state-level proposals rarely gain traction, but they make great headlines."

How Does Remittix's Rise Impact SHIB's Position?

An unexpected subplot emerged with Remittix's $20 million funding round and BitMart listing. This PayFi infrastructure project is attracting whale capital that might otherwise Flow to meme coins. Having tested their beta wallet, I can see the appeal - it's solving real payment friction points.

However, SHIB's community strength gives it staying power. The key difference? Remittix appeals to utility seekers, while SHIB thrives on speculative energy and cultural cachet. There's room for both in this market, but SHIB's 155% surge potential suggests it's not surrendering its spotlight yet.

What Are Realistic Price Targets for SHIB in 2025?

Based on current technicals and market structure, here's my breakdown of SHIB's potential paths:

| Price Level | Value (USDT) | Upside Potential | Key Significance |

|---|---|---|---|

| Current Price | 0.00001290 | 0% | Testing 20-day MA resistance |

| Upper Bollinger | 0.00001391 | +7.8% | Near-term resistance target |

| Bullish Target | 0.00003290 | +155% | Technical pattern projection |

The make-or-break level is that 20-day MA at $0.00001287. Hold above it, and the path to $0.00001391 opens up. Break below, and we might retest support NEAR $0.00001183. Personally, I'm watching order book depth on BTCC - the $0.00001250 level shows substantial buy walls that could propel the next leg up.

SHIB Price Prediction: Frequently Asked Questions

What is the SHIB price prediction for 2025?

Technical analysis suggests SHIB could surge 155% to $0.00003290 if current bullish patterns hold, though regulatory developments and market sentiment will play crucial roles in determining whether this target is achieved.

Why did SHIB whale activity increase 8,866%?

The unprecedented spike in large transactions likely represents institutional accumulation or strategic portfolio rebalancing, as the price remained stable despite massive token movements - a classic sign of "smart money" positioning.

How does Pennsylvania's HB1812 bill affect SHIB?

While the proposed restrictions on official crypto trading create regulatory uncertainty, market reaction has been muted, suggesting participants view this as political posturing rather than substantive threat to SHIB's fundamentals.

What are the key technical levels for SHIB?

Critical levels include support at the 20-day MA ($0.00001287), upper Bollinger Band resistance ($0.00001391), and the bullish pattern target of $0.00003290 representing potential 155% upside from current prices.