XRP Price Prediction 2025: Can It Hit $3 Amid Technical Breakout and Institutional Demand?

- XRP Technical Analysis: The Path to $3

- Market Fundamentals Supporting XRP's Rise

- The $3 Psychological Barrier

- Frequently Asked Questions

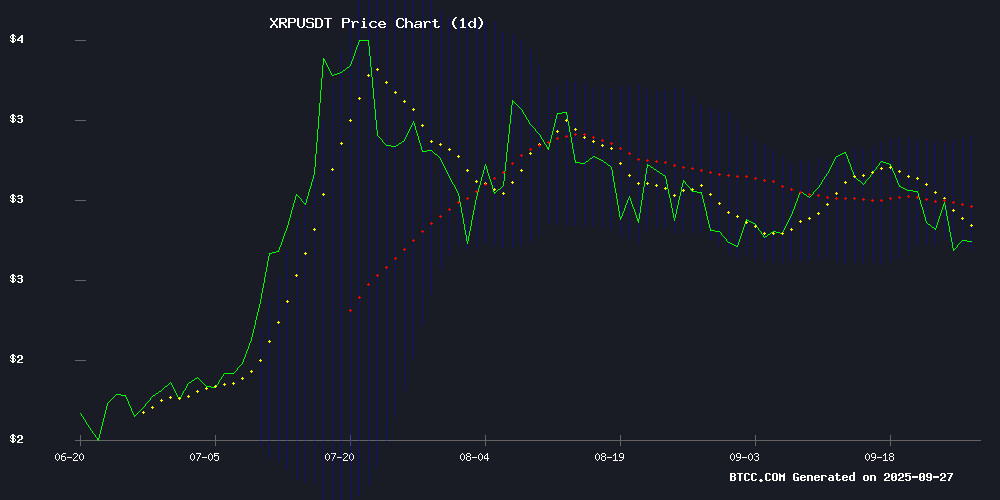

XRP is currently trading at $2.7892, showing signs of consolidation with potential for upward movement. Technical indicators suggest a possible breakout if it surpasses the 20-day moving average at $2.9620, while fundamental factors like reduced circulation and $18.3 billion in CME futures volume create bullish momentum. This analysis examines whether XRP can reach $3 by evaluating key technical levels, supply dynamics, and institutional interest.

XRP Technical Analysis: The Path to $3

XRP's current price action shows an interesting technical setup. The cryptocurrency is trading just below its 20-day moving average ($2.9620), which typically acts as dynamic resistance. However, the MACD histogram reading of +0.0844 suggests building bullish momentum that could challenge this level. From my experience watching XRP charts, these setups often precede significant moves - either a rejection from resistance or a decisive breakout.

The Bollinger Bands paint a clearer picture, with immediate resistance at $3.1780 (upper band) and support at $2.7459 (lower band). What's particularly interesting is the price gap between $2.51 and $2.73 that formed during XRP's explosive growth earlier this year. These gaps often act as magnets for price action, either filling completely or providing springboards for continuation moves.

Market Fundamentals Supporting XRP's Rise

The fundamental case for XRP has strengthened considerably in recent months. Two factors stand out:

First, we're seeing billions of XRP moving into DeFi protocols and institutional custody solutions. This supply reduction could create scarcity-driven price appreciation. crypto analyst Zach Rector has been vocal about how this structural shift might lead to a supply shock, especially if exchange reserves continue dwindling.

Second, institutional interest has exploded, with CME Group reporting $18.3 billion in XRP futures volume over four months. That's not just big - it's record-breaking big. The exchange is even launching XRP options trading on October 13, which could further boost activity.

The $3 Psychological Barrier

Breaking $3 won't be easy - psychological round numbers never are. But the technical and fundamental alignment suggests it's possible. Here's what needs to happen:

| Indicator | Current Value | Significance |

|---|---|---|

| Price | $2.7892 | 7.5% below $3 target |

| 20-day MA | $2.9620 | Key resistance level |

| Bollinger Upper | $3.1780 | Potential breakout zone |

The BTCC research team notes that while the technical setup looks promising, traders should watch for confirmation above the 20-day MA before expecting a sustained MOVE toward $3. The reduced circulation and institutional interest provide fundamental support, but crypto markets can be unpredictable.

Frequently Asked Questions

What's the key resistance level for XRP to reach $3?

The 20-day moving average at $2.9620 is the immediate resistance XRP needs to overcome. A decisive break above this level could open the path to $3, with the Bollinger Band upper limit at $3.1780 acting as the next significant barrier.

How significant is the $18.3 billion CME futures volume for XRP?

This record-breaking volume indicates substantial institutional interest, which often precedes price appreciation. The fact that CME is launching XRP options trading on October 13 further validates this institutional demand.

Could reduced XRP circulation drive prices higher?

Absolutely. As more XRP gets locked in DeFi protocols and institutional custody, the available supply on exchanges decreases. This supply shock dynamic has historically led to price increases in various cryptocurrencies when demand remains constant or increases.