Ethereum Price Forecast 2025-2040: Expert Analysis & Predictions

- Ethereum's Current Market Position

- Technical Analysis: Key Levels to Watch

- Fundamental Developments Driving Ethereum

- Market Sentiment: Conflicting Signals

- Ethereum Price Predictions: 2025-2040

- Key Factors Influencing Future Prices

- Frequently Asked Questions

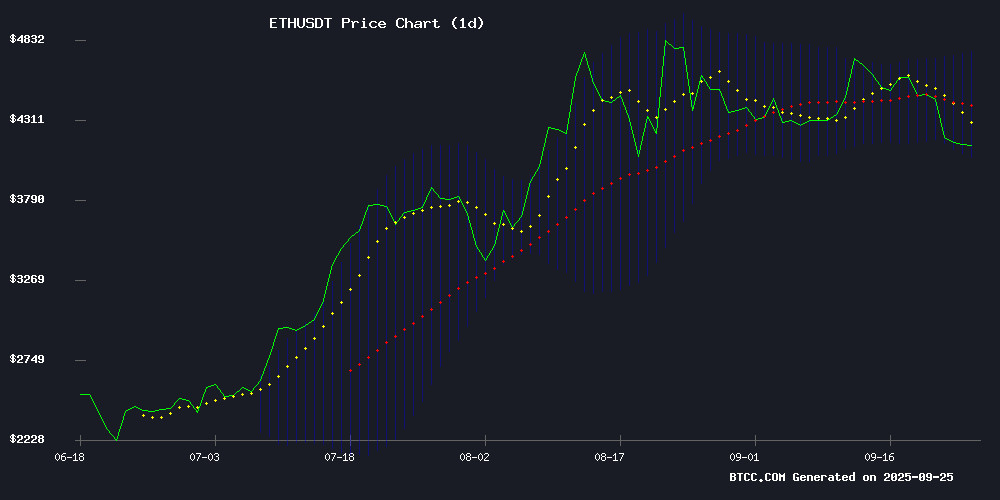

As we approach the final quarter of 2025, ethereum (ETH) continues to captivate investors with its volatile yet promising price action. Currently trading around $4,017, ETH shows both bullish fundamentals and bearish technical signals that could shape its trajectory through 2040. This comprehensive analysis examines key support/resistance levels, whale activity, institutional flows, and technological developments to provide realistic price projections across multiple timeframes. Whether you're a day trader watching Bollinger Bands or a long-term holder evaluating scaling solutions, this guide offers valuable insights into Ethereum's potential future.

Ethereum's Current Market Position

As of September 2025, Ethereum finds itself at a critical juncture. The price hovers near the lower Bollinger Band at $4,040, creating a make-or-break moment for short-term traders. According to TradingView data, ETH remains below its 20-day moving average of $4,406, suggesting bearish pressure in the immediate timeframe. However, the MACD indicator shows positive momentum at 2.91, hinting at potential reversal opportunities.

Source: BTCC Exchange

Technical Analysis: Key Levels to Watch

The $4,000 psychological level has emerged as crucial support, with whales establishing strong accumulation around $2,900 as secondary defense. Resistance appears formidable at $4,150-$4,250, where ETH has faced rejection multiple times this year. A decisive break above $4,250 could open the path to $5,300, while failure to hold $4,000 might trigger a test of $3,800 support.

Fundamental Developments Driving Ethereum

Scaling Solutions: Fusaka PeerDAS Upgrade

Vitalik Buterin recently highlighted the upcoming Fusaka PeerDAS upgrade as a game-changer for Ethereum's data availability. This technical enhancement addresses the blockchain's perennial scalability challenges while maintaining decentralization - a delicate balance that could significantly boost ETH's utility and value proposition.

Exchange Supply Dynamics

Glassnode reports Ethereum's exchange supply has plummeted to 9-year lows, with over 2.7 million ETH (worth $11.3 billion) withdrawn from exchanges in the past month. This aggressive accumulation suggests strong long-term conviction, though it currently contrasts with selling pressure from veteran holders taking profits.

Market Sentiment: Conflicting Signals

The market presents a paradox: while exchange outflows and whale accumulation suggest bullishness, negative funding rates (-0.0021) and ETF outflows ($216 million over two days) indicate bearish positioning. This tension explains ETH's current rangebound behavior between $4,074 and $4,222.

Ethereum Price Predictions: 2025-2040

Based on technical patterns, fundamental developments, and historical cycles, here are our projected price ranges:

| Year | Conservative | Moderate | Bullish |

|---|---|---|---|

| 2025 | $4,500-$5,000 | $5,500-$6,000 | $7,000+ |

| 2030 | $8,000-$10,000 | $12,000-$15,000 | $20,000+ |

| 2035 | $15,000-$20,000 | $25,000-$30,000 | $40,000+ |

| 2040 | $25,000-$35,000 | $40,000-$50,000 | $75,000+ |

Key Factors Influencing Future Prices

Several variables could significantly impact these projections:

- Adoption of Layer 2 Solutions: Successful implementation could dramatically increase transaction throughput and reduce fees.

- Regulatory Developments: Clearer regulations, especially regarding staking and institutional participation, could boost confidence.

- Competitive Landscape: Ethereum must maintain its dominance against emerging smart contract platforms.

- Macroeconomic Conditions: Interest rates and inflation will continue affecting risk assets like crypto.

Frequently Asked Questions

What is Ethereum's price prediction for 2025?

For 2025, we project ETH could reach between $4,500-$5,000 in a conservative scenario, $5,500-$6,000 in a moderate scenario, and $7,000+ in a bullish scenario. These estimates consider current technical patterns, adoption rates, and macroeconomic conditions.

Can Ethereum reach $50,000 by 2040?

Our analysis suggests $50,000 is within the realm of possibility by 2040 in a moderate-to-bullish scenario, assuming continued technological development, sustained adoption, and favorable market conditions. However, this WOULD require Ethereum maintaining its dominant position in smart contracts and decentralized applications.

What are the biggest risks to Ethereum's price growth?

Key risks include regulatory crackdowns, failure to adequately scale (leading to high fees and slow transactions), security vulnerabilities, and competition from other smart contract platforms. Technological obsolescence represents an existential risk over longer timeframes.

How does Ethereum's current price compare to historical patterns?

At around $4,000 in September 2025, ETH trades approximately 20% below its all-time high of $4,956. Historically, Ethereum has experienced 70-90% drawdowns after bull markets, followed by new highs in subsequent cycles. The current consolidation resembles patterns seen before previous breakout moves.

What indicators suggest Ethereum might be undervalued?

Several metrics suggest potential undervaluation: exchange reserves at 9-year lows (indicating accumulation), the $2,900 realized price for whale addresses, and Ethereum's network usage continuing to grow despite price stagnation. The P/E ratio (price/NVT) also appears favorable compared to historical averages.