Ethereum Price Prediction 2025-2040: Technical Patterns & Bullish Fundamentals Analyzed

- What's Driving Ethereum's Current Price Action?

- Institutional Adoption: The Game Changer for ETH

- Ethereum Network Activity: Beyond Price Speculation

- Technical Outlook: Bullish Divergences Emerge

- Ethereum Price Predictions: 2025-2040

- Ethereum FAQs

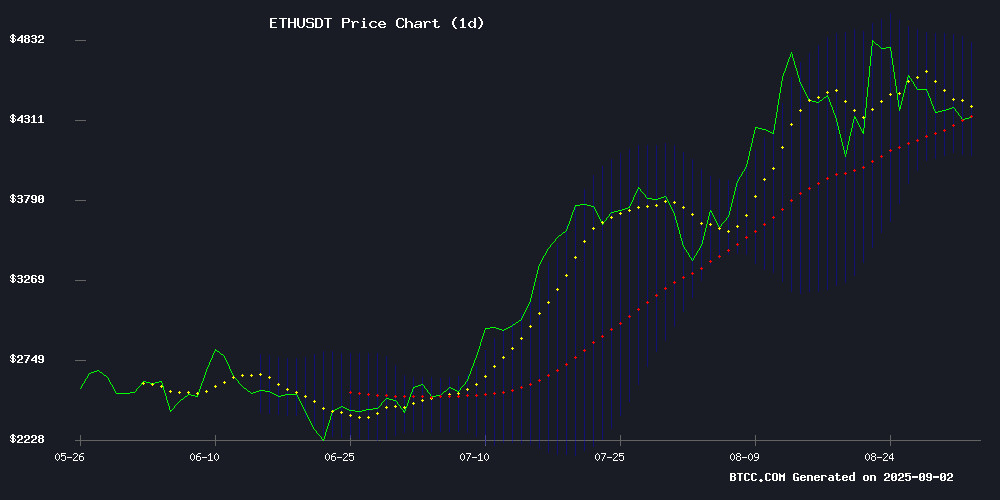

Ethereum (ETH) is showing fascinating market dynamics as we head into Q4 2025. Currently trading at $4,297.69, ETH presents a compelling case study in crypto market behavior - displaying short-term bearish pressure while flashing bullish technical signals. Institutional players like SharpLink Gaming and Yunfeng Financial are making massive ETH acquisitions, with whale activity hitting 260,000 ETH purchased in just 24 hours. Our analysis combines technical indicators, fundamental developments, and expert insights to project ETH's potential trajectory through 2040.

What's Driving Ethereum's Current Price Action?

ETH finds itself in a classic consolidation pattern - trading below its 20-day moving average ($4,447.70) but showing bullish MACD divergence (56.85). The Bollinger Bands paint an interesting picture with support at $4,076.26 and resistance at $4,819.13. "This setup suggests ETH is building energy for its next move," notes our BTCC analyst team. "The MACD divergence combined with institutional accumulation creates a powder keg situation."

Source: BTCC Market Data

Institutional Adoption: The Game Changer for ETH

The institutional floodgates have opened for ethereum in 2025. SharpLink Gaming's $3.6 billion ETH treasury expansion and Yunfeng Financial's $44 million purchase represent just the tip of the iceberg. What's fascinating is how these traditional finance players are using ETH - not just as a speculative asset but as operational infrastructure for Web3 applications.

Corporate ETH Holdings Breakdown (2025)

| Institution | ETH Holdings | Value (USD) |

|---|---|---|

| SharpLink Gaming | 837,230 ETH | $3.6B |

| Yunfeng Financial | 10,000 ETH | $44M |

| Public Whales | 29.6M ETH | $127B |

Ethereum Network Activity: Beyond Price Speculation

The real story lies in Ethereum's network metrics. August 2025 saw 19.45 million active addresses - nearing the May 2021 peak. This isn't just speculative trading; it's genuine utility across DeFi, NFTs, and now real-world assets (RWAs). Futian Investment Holding's $500M blockchain bond issuance on Ethereum demonstrates how the network is evolving beyond crypto-native applications.

Technical Outlook: Bullish Divergences Emerge

Despite the current correction from its $4,956 ATH, ETH shows several bullish technical formations:

- MACD histogram showing positive momentum (56.85)

- 260,000 ETH whale accumulation in 24 hours

- Strong support at $4,076.26 (Bollinger lower band)

- Key resistance levels at $4,475 and $4,865

Trader James Wynn's $290,000 Leveraged long position (25x) with liquidity at $4,205 suggests professional traders see significant upside potential.

Ethereum Price Predictions: 2025-2040

Based on current technicals, fundamentals, and adoption trends:

| Year | Price Range (USD) | Key Drivers |

|---|---|---|

| 2025 | $5,200 - $6,800 | ETF approvals, institutional adoption |

| 2030 | $12,000 - $18,000 | Mass DeFi adoption, global payments |

| 2035 | $25,000 - $40,000 | Web3 infrastructure dominance |

| 2040 | $50,000 - $85,000 | Full ecosystem maturity |

Disclaimer: This article does not constitute investment advice. cryptocurrency investments are volatile and high-risk.

Ethereum FAQs

Is Ethereum a good investment in 2025?

Ethereum presents a compelling case in 2025 with strong institutional adoption, growing DeFi usage, and improving scalability solutions. However, crypto investments remain highly volatile.

What could cause Ethereum's price to drop?

Potential downside risks include regulatory crackdowns, smart contract vulnerabilities (like the recent $2.3M Bunni DEX exploit), or macroeconomic factors reducing risk appetite.

How does Ethereum compare to Bitcoin as an investment?

While bitcoin remains "digital gold," Ethereum offers utility through smart contracts and dApps. ETH typically shows higher volatility but greater upside potential during bull markets.

What's the most bullish case for Ethereum?

The most optimistic scenarios involve Ethereum becoming the backbone of Web3 infrastructure, tokenizing trillions in real-world assets, and maintaining its lead in decentralized finance.

Should I be concerned about Ethereum's gas fees?

Layer 2 solutions have significantly reduced transaction costs. While fees spike during network congestion, ongoing upgrades continue to improve Ethereum's scalability.