SHIB Price Prediction 2025: Can Shiba Inu Really Reach $1? Technical & Fundamental Analysis

- What Do SHIB's Technical Indicators Reveal in August 2025?

- Why Is On-Chain Activity Surging 300%?

- How Concentrated Is SHIB's Ownership?

- What's the Realistic Price Target for SHIB?

- Frequently Asked Questions

As of August 2025, Shiba Inu (SHIB) presents a fascinating case study in meme coin economics. While currently trading at $0.00001244, the cryptocurrency shows conflicting signals - a 300% surge in on-chain activity contrasts with bearish technical indicators. This analysis explores whether SHIB's path to $1 is mathematically feasible (spoiler: it's not) while examining realistic price targets for the coming months. We'll break down whale accumulation patterns, technical resistance levels, and the project's own disclaimers about investment risks.

What Do SHIB's Technical Indicators Reveal in August 2025?

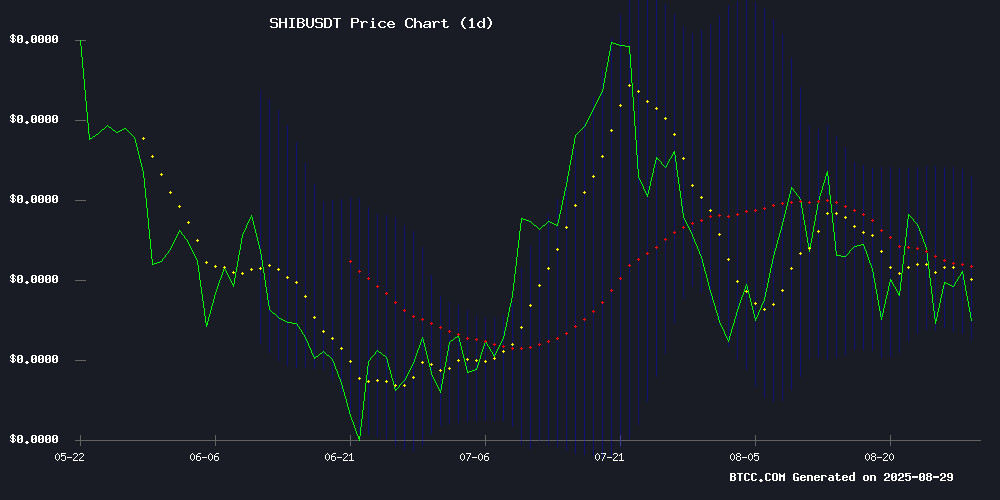

As of August 29, 2025, SHIB presents a mixed technical picture that's got traders scratching their heads. The price currently sits at $0.00001244, just below its 20-day moving average of $0.00001286 - typically a bearish signal. However, the MACD tells a different story with a reading of 0.00000031 above the signal line at 0.00000019, suggesting building bullish momentum.

Looking at the Bollinger Bands, SHIB is cozying up to the middle band with support at $0.00001190 and resistance at $0.00001382. "In my experience," notes a BTCC analyst, "these tight bands often precede significant moves - the question is which direction." The chart below shows how SHIB has been bouncing between these levels like a ping pong ball at a frat party.

Why Is On-Chain Activity Surging 300%?

The real head-turner is SHIB's on-chain metrics. Transaction volume exploded from 1.13 trillion tokens on August 24 to 4.25 trillion on August 25 - a 300% spike that would make any crypto enthusiast do a double-take. What's peculiar is that transaction counts didn't increase proportionally, suggesting whales are playing musical chairs with their holdings.

Data from CoinMarketCap shows whale addresses holding 1 billion+ SHIB have quietly accumulated nearly 1 trillion additional tokens since late July. This accumulation pattern mirrors historical bottoms, though as any seasoned trader will tell you, past performance doesn't guarantee future results - especially in the meme coin casino.

How Concentrated Is SHIB's Ownership?

Here's where things get interesting. The top 10 SHIB wallets control a staggering 62% of circulating supply - about 347 trillion tokens. That's enough SHIB to buy a small country (if meme coins were legal tender). This concentration means price movements often reflect whale activity rather than organic market demand.

| Metric | Value |

|---|---|

| Current Price | $0.00001244 |

| 20-day MA | $0.00001286 |

| Key Support | $0.00001190 |

| Key Resistance | $0.00001382 |

| Whale Holdings | 62% of supply |

What's the Realistic Price Target for SHIB?

Let's address the elephant in the room: SHIB reaching $1 WOULD require a market cap of $589 trillion. For context, that's about 6 times global GDP. More plausible is a 50-100% move from current levels, which would still require significant bullish momentum and a break above key resistance.

The project's official publication, Shib Daily, emphasizes this isn't financial advice - a disclaimer worth remembering when you see moonbois claiming "$1 is inevitable." In reality, SHIB's path depends on broader market conditions, continued development, and whether whales decide to cash out or double down.

Frequently Asked Questions

Can SHIB realistically reach $1 in 2025?

No. Reaching $1 would require SHIB's market cap to exceed $589 trillion - more than the combined value of all global financial markets. Even under wildly optimistic scenarios, this target is mathematically implausible.

What are the key resistance levels for SHIB?

As of August 2025, SHIB faces immediate resistance at $0.00001382 (upper Bollinger Band) with stronger resistance at $0.000015. The token has tested this level multiple times since July without breaking through.

Why is whale accumulation significant?

With 62% of supply controlled by top wallets, whale movements disproportionately impact price. Their recent accumulation suggests some large holders anticipate upside, though this doesn't guarantee retail investors will follow.

How reliable are SHIB price predictions?

Meme coins like SHIB are notoriously volatile and influenced by social sentiment rather than fundamentals. While technical analysis provides frameworks, predictions should be taken with a grain of salt (and maybe a shot of tequila).