ETH Price Prediction 2025: Navigating Short-Term Volatility with Long-Term Conviction

- What's the Current Technical Picture for Ethereum?

- How Are Institutional Players Moving in the ETH Market?

- What's Driving the Recent ETH Price Volatility?

- Is Ethereum Still a Good Long-Term Investment?

- What Are the Key ETH Price Levels to Watch?

- How Are Corporations Using ETH in Their Treasury Strategies?

- What's the Outlook for ETH After Recent Pullback?

- ETH Price Prediction: Frequently Asked Questions

Ethereum (ETH) finds itself at a critical juncture in August 2025, trading at $4,116.80 amid significant institutional activity and technical signals. While short-term indicators show bearish pressure with $422 million in institutional outflows, long-term fundamentals remain robust with companies like BitMine accumulating $6.6 billion in ETH holdings. This comprehensive analysis examines the competing forces shaping ETH's price trajectory, from technical support levels to growing corporate treasury adoption.

What's the Current Technical Picture for Ethereum?

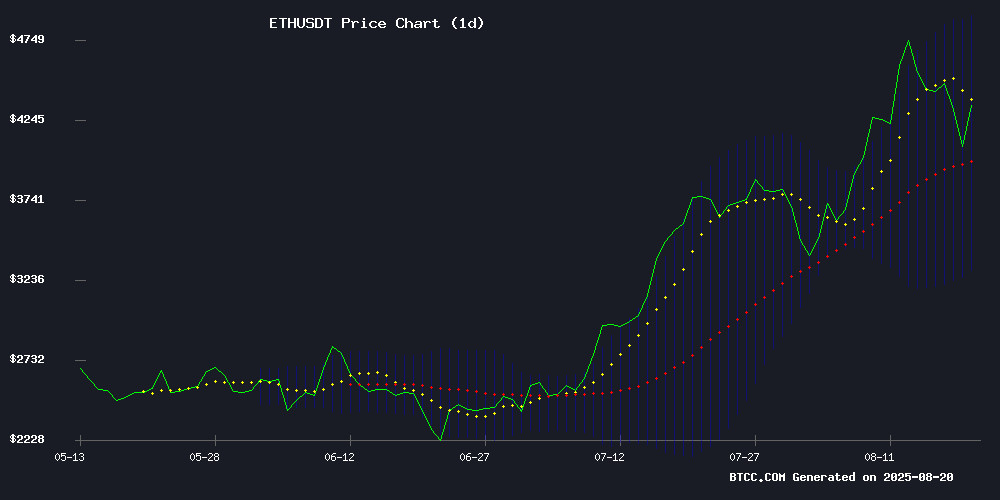

As of August 20, 2025, ETH is dancing around key technical levels that could determine its near-term direction. The cryptocurrency currently trades just above its 20-day moving average at $4,088.76 - a level that's served as both support and resistance multiple times this month. The MACD indicator, while still in negative territory at -86.34, shows signs of potential bullish convergence as the gap between MACD and its signal line narrows.

Bollinger Bands paint an interesting picture with price action hovering NEAR the middle band. The upper resistance sits at $4,884.14 while lower support waits at $3,293.38 - that's a massive $1,500+ range that could come into play if volatility spikes. The BTCC team notes that ETH has tested the 20-day MA support three times this week alone, suggesting traders are closely watching this level.

How Are Institutional Players Moving in the ETH Market?

The institutional landscape presents a fascinating tug-of-war. On one side, we've seen massive outflows from ETF products - BlackRock and Fidelity alone dumped $422 million worth of ETH in a single day this week. This marks the third consecutive session of institutional selling, totaling $678 million in outflows according to TradingView data.

But here's where it gets interesting. While some big names are taking profits, others are doubling down. SharpLink Gaming just added 143,593 ETH ($537 million) to its treasury reserves, bringing its total holdings to 740,760 ETH worth over $3 billion. BitMine Immersion Technologies now holds a staggering 1.52 million ETH ($6.6 billion), representing about 1.26% of Ethereum's total supply.

| Institution | ETH Holdings | USD Value |

|---|---|---|

| BitMine | 1.52M ETH | $6.6B |

| SharpLink Gaming | 740,760 ETH | $3B |

| BTCS Inc. | 70,000 ETH | $301M |

What's Driving the Recent ETH Price Volatility?

The current market turbulence stems from several converging factors. First, we've got macroeconomic uncertainty ahead of Fed Chair Powell's Jackson Hole speech - crypto markets hate uncertainty, and ETH has historically been more sensitive to macro shifts than Bitcoin. Second, there's been record short interest building in ETH derivatives markets, creating a powder keg situation where any significant price move could trigger liquidations in either direction.

Then there's the on-chain dynamics. ethereum has seen unusual validator exits recently, which some interpret as stakers taking profits or rotating positions. The network's staking yield currently sits at around 4.2% annually - not bad compared to traditional finance, but perhaps not enough to keep everyone committed during volatile periods.

Is Ethereum Still a Good Long-Term Investment?

Despite the short-term headwinds, the long-term case for ETH remains compelling. The cryptocurrency serves as the backbone for the entire smart contract ecosystem, and its network effects continue growing. Companies like BitMine aren't accumulating billions in ETH because they think it's going to zero - they clearly see long-term value in holding Ethereum as both a financial asset and infrastructure play.

From a technical standpoint, ETH holding above $4,000 is psychologically important. The $3,293 lower Bollinger Band WOULD represent a 20% decline from current levels - painful for recent buyers but potentially an attractive entry point for long-term holders. The BTCC team suggests dollar-cost averaging as a strategy to navigate the current volatility.

What Are the Key ETH Price Levels to Watch?

Traders should keep an eye on several critical levels:

- Immediate support: $4,088 (20-day MA)

- Strong support: $4,000 (psychological level), then $3,293 (lower Bollinger Band)

- Resistance: $4,350 (recent high), then $4,884 (upper Bollinger Band)

- Breakout level: A sustained move above $4,500 could signal renewed bullish momentum

The 23.6% Fibonacci retracement level of the recent swing high to low currently acts as immediate resistance around $4,185. Beyond that, the 50% retracement near $4,320 could prove tougher to crack if selling pressure persists.

How Are Corporations Using ETH in Their Treasury Strategies?

The corporate ETH accumulation trend continues gaining steam. BTCS Inc. made headlines by announcing it will become the first company to issue dividends in Ethereum - shareholders will receive $0.05 per share in ETH, with an additional $0.35 for those who hold through January 2026. This innovative approach aims to reward long-term investors while discouraging short-selling.

SharpLink Gaming has been particularly aggressive, adding 11,956 ETH in just four days during this recent dip. Their treasury strategy has already generated 1,388 ETH in staking rewards since June - that's about $5.7 million at current prices just from putting their holdings to work.

What's the Outlook for ETH After Recent Pullback?

The current correction, while painful for some traders, appears relatively healthy in the context of ETH's 200% rally earlier this year. Market cycles typically see periods of consolidation after big moves, and this could simply be that process playing out.

Analyst Michaël van de Poppe suggests the pullback may present accumulation opportunities, noting that Ethereum's fundamentals continue strengthening despite price volatility. The growing institutional adoption, expanding LAYER 2 ecosystem, and increasing use cases for ETH as collateral all support the long-term bullish thesis.

This article does not constitute investment advice. Always conduct your own research before making investment decisions.

ETH Price Prediction: Frequently Asked Questions

What is Ethereum's current price?

As of August 20, 2025, Ethereum (ETH) is trading at $4,116.80 on major exchanges like BTCC.

What are the key support levels for ETH?

The immediate support is the 20-day moving average at $4,088.76, followed by psychological support at $4,000. The lower Bollinger Band provides stronger support at $3,293.38.

Why are institutions selling ETH?

Some institutions appear to be taking profits after ETH's strong rally earlier this year. BlackRock and Fidelity ETFs have seen $678 million in outflows over three days.

Which companies are accumulating ETH?

BitMine holds 1.52M ETH ($6.6B), SharpLink Gaming has 740,760 ETH ($3B), and BTCS Inc. holds 70,000 ETH ($301M) as part of corporate treasury strategies.

Is now a good time to buy ETH?

While short-term volatility persists, many analysts view current prices as attractive for long-term investors. Dollar-cost averaging can help navigate the uncertainty.

What's the long-term outlook for Ethereum?

The long-term outlook remains positive due to Ethereum's dominant position in smart contracts, growing institutional adoption, and expanding ecosystem of Layer 2 solutions.