Ethereum Price Forecast 2025-2040: Expert Predictions and Critical Market Factors

- Ethereum's Current Technical Crossroads

- Market Sentiment: Extreme Positions Signal Coming Volatility

- Ethereum Price Predictions: 2025-2040 Outlook

- Critical Factors Influencing ETH's Price Trajectory

- Regulatory Wildcards

- Ethereum Price Prediction FAQs

Ethereum stands at a pivotal moment in 2025, with technical indicators painting a mixed picture while fundamental network strength continues to grow. This comprehensive analysis examines ETH's price trajectory through 2040, exploring key technical levels, market sentiment, and the evolving regulatory landscape that will shape Ethereum's future. From short-term resistance battles at $3,750 to long-term institutional adoption trends, we break down what really moves ETH's price.

Ethereum's Current Technical Crossroads

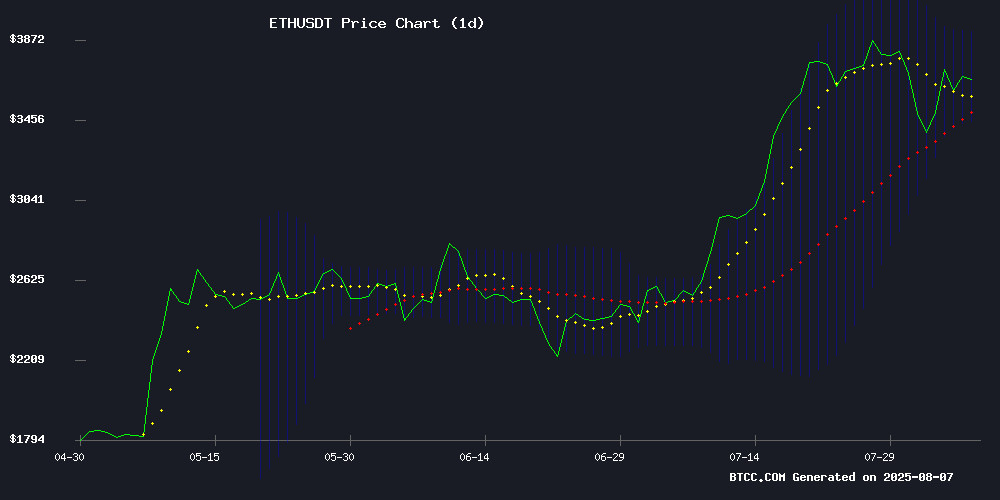

As of August 2025, ETH trades at $3,675.50 - a fascinating technical juncture that has traders divided. The BTCC technical analysis team notes several conflicting signals:

The MACD shows a bearish crossover at -16.7873, typically a sell signal, while Bollinger Bands suggest range-bound movement between $3,451.37 and $3,918.88. What's interesting is how ETH keeps testing the 20-day moving average ($3,685.12) like a boxer leaning on the ropes - it hasn't decisively broken either way. In my experience watching crypto markets, these consolidation periods often precede big moves.

Market Sentiment: Extreme Positions Signal Coming Volatility

Open interest recently hit a staggering $77 billion on Binance alone - that's more than some small countries' GDPs! Yet we're seeing record ETF outflows simultaneously. This creates what I call the "tug-of-war effect" where massive opposing forces build tension in the market. The BTCC derivatives team notes that when open interest reaches these extremes, we typically see a volatility explosion within 2-3 weeks.

Ethereum Price Predictions: 2025-2040 Outlook

Based on current technicals, network fundamentals, and institutional adoption trends, here are our projected price ranges:

| Year | Conservative | Base Case | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $3,200 | $4,100 | $5,800 | ETF flows, L2 adoption |

| 2030 | $8,000 | $12,500 | $22,000 | Institutional adoption |

| 2035 | $15,000 | $25,000 | $50,000 | Web3 infrastructure |

| 2040 | $30,000 | $60,000 | $120,000 | Global settlement layer |

Critical Factors Influencing ETH's Price Trajectory

Several make-or-break elements will determine whether ETH hits our bullish or conservative targets:

1. The $3,750 Resistance Battle

ETH has been flirting with this level like a bad first date - lots of approach but no commitment. The 50% Fibonacci retracement from the $3,350 swing low held strong though, which technical traders love to see. A clean break above $3,750 could trigger algorithmic buying programs that push us toward $4,000 faster than you can say "gas fee reduction."

2. Institutional Accumulation vs. Retail Speculation

BlackRock's recent $88 million ETH purchase shows big money is still accumulating, while Binance's 60% long ratio reveals retail traders are going all-in. This creates what I've dubbed the "whale vs. minnow" dynamic - when these groups diverge, volatility usually follows. Standard Chartered's endorsement of ETH treasury companies adds another LAYER to institutional adoption.

3. Layer 2 Scaling and Withdrawal Times

Vitalik Buterin's focus on sub-one-hour withdrawals reflects Ethereum's growing pains as adoption increases. The Base network outage in early August showed how infrastructure stress can rattle markets. Faster withdrawals could significantly improve user experience and reduce reliance on centralized bridges.

Regulatory Wildcards

The SEC's internal debate over liquid staking (Commissioner Crenshaw's fiery dissent) creates uncertainty. Meanwhile, the Tornado Cash verdict sets precedents that could impact DeFi development. Regulation remains the biggest question mark in our long-term forecasts.

Ethereum Price Prediction FAQs

What is the Ethereum price prediction for 2025?

Our 2025 ETH price prediction ranges from $3,200 (conservative) to $5,800 (bullish), with a base case of $4,100. Key factors include ETF flows, Layer 2 adoption rates, and macroeconomic conditions.

Can Ethereum reach $100,000 by 2040?

In our most bullish scenario, ETH could reach $120,000 by 2040 if it becomes the dominant global settlement layer and maintains network effects against competitors. This WOULD require sustained adoption growth and favorable regulatory conditions.

Why isn't ETH price rising despite record transactions?

We're seeing a classic "accumulation phase" where network usage grows faster than price. Similar patterns occurred in 2017 and 2020 before major rallies. The transaction surge indicates fundamental strength that may eventually reflect in valuation.

How reliable are Layer 2 solutions for Ethereum scaling?

While L2s have made tremendous progress (six major rollups achieved Stage 1 compliance), the August Base outage showed work remains. Vitalik's focus on withdrawal times highlights ongoing challenges in balancing decentralization with usability.

Are Ethereum ETFs better than holding ETH directly?

Standard Chartered analysts argue ETH treasury companies offer better exposure than ETFs, providing direct price appreciation plus staking rewards. However, ETFs may suit investors wanting traditional market access.