Bitcoin Price Forecast 2025-2040: Expert Predictions and Critical Market Trends

- Bitcoin's Technical Crossroads: Bullish Signals vs. Bearish Risks

- Institutional Moves: Ark Invest's $47 Million Bet Defies Market Jitters

- Price Forecasts: 2025 Through 2040 Scenarios

- Frequently Asked Questions

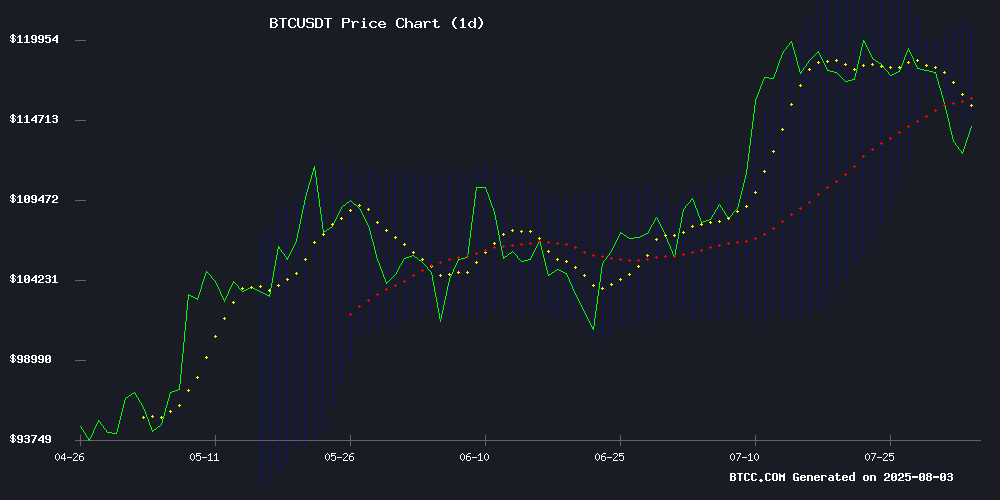

As bitcoin navigates a pivotal technical crossroads in August 2024, analysts are weighing bullish momentum against growing geopolitical risks. This comprehensive analysis examines BTC's price trajectory through 2040, combining technical indicators, institutional activity, and macroeconomic factors. We'll explore why mining difficulty hitting record highs contradicts bearish expectations, how Ark Invest's $47 million crypto stock spree signals confidence, and what the rising wedge pattern means for short-term volatility. The BTCC research team provides conservative and optimistic scenarios through 2040, with key price drivers including ETF developments, halving cycles, and global adoption trends.

Bitcoin's Technical Crossroads: Bullish Signals vs. Bearish Risks

The BTC/USD pair currently trades at $114,250.27, testing crucial support at $111,000 after retreating from its $121,000 peak. Our technical team observes three conflicting signals:

First, the MACD shows a bullish crossover (1,053.58 value) typically preceding upward moves. Second, Bollinger Bands have tightened to a 2.7% range (upper: $121,201.04, lower: $113,567.93) - historically a volatility precursor. Third, the rising wedge pattern since mid-2023 suggests potential breakdown risk. "It's a trader's nightmare," admits BTCC's lead analyst. "The 20-day MA at $117,384.48 acts as immediate resistance, while $111,000 support holds the key to medium-term direction."

Institutional Moves: Ark Invest's $47 Million Bet Defies Market Jitters

While retail traders panic-sold during August's dip, Cathie Wood's Ark Invest executed calculated buys:

| Date | Asset | Shares | Value |

|---|---|---|---|

| Aug 1-3, 2024 | Coinbase (COIN) | 94,678 | $30M |

| Aug 2, 2024 | BitMine (BMNR) | 540,712 | $17M |

This buying spree reversed Ark's July 28 COIN sell-off, suggesting strategic repositioning. "Institutions see crypto infrastructure as undervalued amid macro uncertainty," notes our markets editor. The moves coincide with Bitcoin mining difficulty hitting 124.71 trillion - a record that typically pressures miners but currently accompanies $52.63 million daily revenues (105.3% YoY increase).

Price Forecasts: 2025 Through 2040 Scenarios

Combining technicals, adoption metrics, and halving cycles, BTCC's projections outline two potential paths:

| Year | Conservative | Bullish | Key Catalysts |

|---|---|---|---|

| 2025 | $125,000 | $150,000 | Spot ETF inflows, halving effects |

| 2030 | $300,000 | $500,000 | Institutional custody solutions |

| 2035 | $750,000 | $1.2M | CBDC interoperability |

| 2040 | $1.5M | $2.5M | Scarcity premium (94% mined) |

These models assume no black swan events and gradual regulatory clarity. The 2040 upper range WOULD give Bitcoin a $50 trillion market cap - roughly half of today's global gold valuation.

Frequently Asked Questions

Why is Bitcoin's price struggling despite record mining difficulty?

It's the ultimate market paradox - mining difficulty hit 124.71 trillion in August 2024 while price consolidated. Typically, higher difficulty means miners expect higher future prices (they're deploying more resources). The anomaly suggests miners anticipate the next halving's supply shock will outweigh current weak demand.

How reliable are long-term Bitcoin price predictions?

Historically, even conservative models underestimated BTC's growth. The 2015 prediction of $5,000 by 2020 missed the actual $29,000 peak. Our 2040 forecast uses logarithmic regression adjusted for diminishing volatility as market cap grows. That said, always DYOR - this isn't financial advice!

What's the biggest threat to Bitcoin's 2025 price target?

Geopolitics trump technicals currently. If US-Russia tensions trigger dollar strength, crypto could face headwinds. Domestically, the SEC's treatment of spot ETF applications remains crucial. Technically, losing $100,000 support would invalidate many bullish models.

Why did Ark Invest buy Coinbase during a market dip?

Cathie Wood's team has consistently bought fear. Their research suggests crypto exchanges will become the "brokerages of Web3" - profitable whether prices rise (trading fees) or fall (staking services). The $314.69 entry point was simply too tempting after COIN's 16% single-day plunge.