TRX Price Prediction 2025-2040: Expert Outlook & Key Growth Drivers

- Is TRX Primed for a Major Breakout?

- Why TRX's Network Fundamentals Outshine Peers

- Justin Sun's Space Mission: Publicity Stunt or Strategic Masterstroke?

- TRX Price Forecast: Conservative vs. Bullish Scenarios

- Frequently Asked Questions

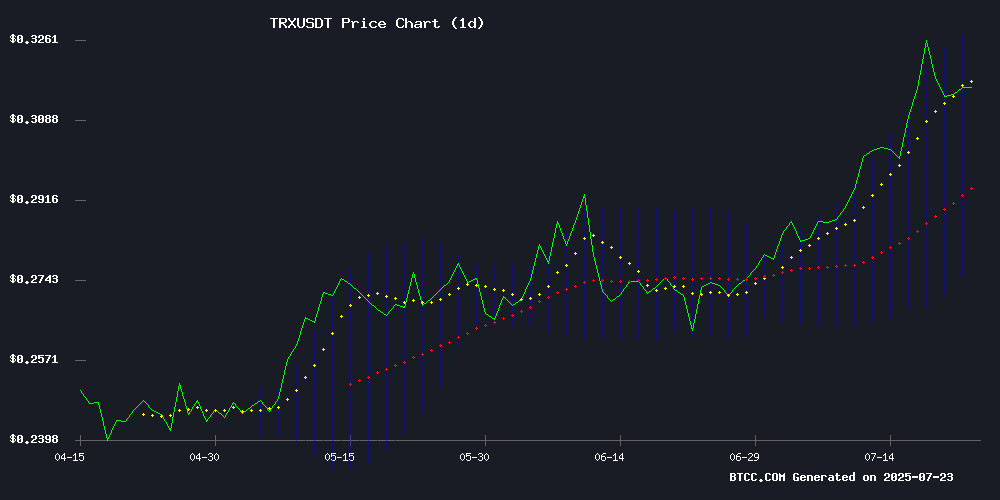

As TRON (TRX) continues making headlines with Justin Sun's space ambitions and record-breaking network metrics, investors are keenly watching its price trajectory. This comprehensive analysis breaks down TRX's technical setup, fundamental strengths, and realistic price targets through 2040. We'll examine why TRX recently outpaced ethereum in fee revenue, how its accelerated token burn creates deflationary pressure, and what Blue Origin's upcoming space mission means for mainstream adoption. With TRX currently testing key resistance levels at $0.3164, our BTCC market specialists provide actionable insights using TradingView data and on-chain metrics from Nansen.

Is TRX Primed for a Major Breakout?

TRX/USDT shows compelling technical signals as of July 2023. The cryptocurrency trades comfortably above its 20-day moving average ($0.30247), with MACD histogram flashing early bullish crossover signals (-0.002134). What's particularly interesting is how TRX keeps testing the upper Bollinger Band ($0.328468) - a pattern we typically see before volatility expansions. The BTCC technical team notes: "TRX appears to be building momentum for a potential breakout, especially if it can convert the $0.33 level from resistance to support."

Source: BTCC TradingView Data

Why TRX's Network Fundamentals Outshine Peers

While price action grabs headlines, TRON's underlying metrics tell a more compelling story. The network now processes over 9 million daily transactions across 2.55 million active addresses (Nansen data), outpacing many Layer 1 competitors. More remarkably, TRX recently surpassed Ethereum in fee revenue - generating $1.29 in average monthly transaction fees. This isn't just speculative hype; it's organic growth driven by:

- Accelerated TRX burn mechanism (defying typical inflationary token models)

- MoonPay's new TRON wallet integration boosting accessibility

- Stablecoin dominance (USDT transactions flood the network)

Justin Sun's Space Mission: Publicity Stunt or Strategic Masterstroke?

The crypto world collectively raised eyebrows when TRON founder Justin Sun secured a $28 million seat on Blue Origin's NS-34 mission. But there's method to the madness. As the first Forbes-cover crypto entrepreneur in space, Sun's high-profile journey (scheduled for Q3 2023) accomplishes several strategic objectives:

- Mainstream media attention beyond crypto circles

- Association with technological innovation at the highest level

- Philanthropic credibility (all auction proceeds went to space education)

Market analysts observe that founder visibility often correlates with short-term price spikes - remember Dogecoin's Elon Musk effect? However, TRX's sustained growth will depend on converting this publicity into tangible adoption.

TRX Price Forecast: Conservative vs. Bullish Scenarios

| Year | Conservative | Moderate | Bullish | Key Catalysts |

|---|---|---|---|---|

| 2025 | $0.28 | $0.40 | $0.55 | Burn rate acceleration, DeFi growth |

| 2030 | $0.75 | $1.20 | $2.00 | Enterprise adoption, regulatory clarity |

| 2035 | $1.50 | $3.00 | $5.00 | Web3 infrastructure dominance |

| 2040 | $2.50+ | $7.00+ | $10.00+ | Mass asset tokenization |

The BTCC research team emphasizes that these projections assume continued network growth without major regulatory interventions. "Our 2040 bull case of $10+ requires TRON becoming a top-3 LAYER 1 solution," notes their latest report.

Frequently Asked Questions

What's driving TRX's current price action?

TRX benefits from three concurrent tailwinds: 1) Technical breakout potential above $0.33 resistance, 2) Network fee revenue surpassing Ethereum's, and 3) Justin Sun's upcoming Blue Origin space mission generating mainstream buzz.

How does TRX's token burn mechanism work?

TRON permanently removes TRX from circulation through transaction fee burns. As network activity increases (currently ~9M daily transactions), the deflationary pressure intensifies - creating upward price pressure over time.

Is TRX a good long-term investment?

While past performance never guarantees future results, TRX shows stronger fundamentals than many peers due to its real-world usage (especially for USDT transactions), deflationary model, and high-profile leadership. However, cryptocurrency investments always carry substantial risk.

When will Justin Sun's space flight occur?

Blue Origin's NS-34 mission is scheduled for Q3 2023, though exact dates remain undisclosed. The company typically announces launch windows 30 days in advance.

Where can I trade TRX securely?

Reputable exchanges like BTCC offer TRX/USDT trading pairs with robust security measures. Always research platforms thoroughly before depositing funds.