Bitcoin Price Prediction 2025: Can BTC Hit $170K? Key Factors to Watch

- Where Is Bitcoin's Price Heading in 2025?

- Technical Indicators: Bullish Signals Need Confirmation

- Institutional Winds: ETF Outflows vs. JP Morgan's Bold Prediction

- Miner Meltdown: Hashprice Crisis Reshapes Industry

- Power Law Model: $142K Fair Value in Sight?

- Altcoin Season Looming as BTC Dominance Weakens

- Frequently Asked Questions

Bitcoin stands at a critical juncture in November 2025, with technical indicators flashing bullish signals while facing headwinds from ETF outflows and miner struggles. The BTCC research team analyzes the complex landscape where JP Morgan's $170K prediction battles against short-term volatility. From power law models to institutional flows, we break down the 8 key factors that could determine Bitcoin's next major move.

Where Is Bitcoin's Price Heading in 2025?

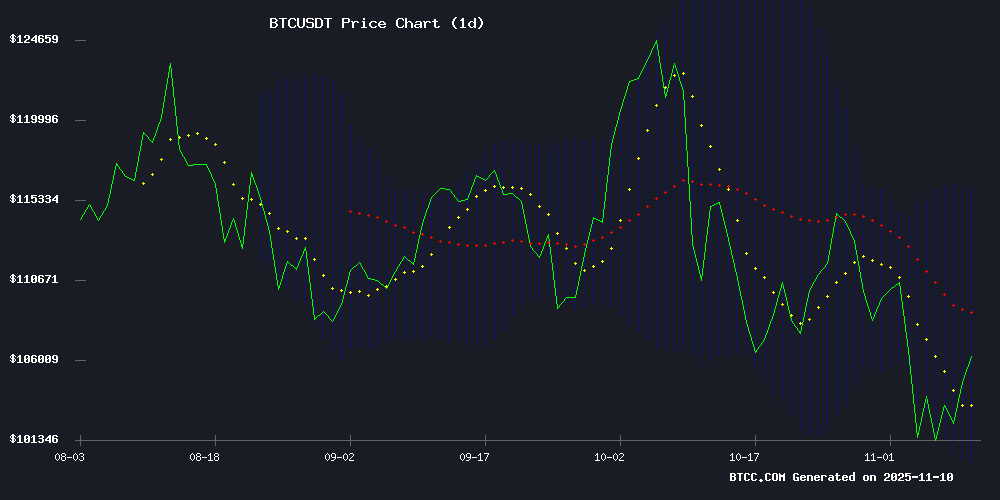

As of November 10, 2025, Bitcoin trades at $106,144.25 - a fascinating crossroads where technicals, fundamentals, and market psychology collide. The cryptocurrency has shown remarkable resilience after testing the $100K support level last week, but the real question is whether this is the calm before another storm or the launchpad for new highs.

Source: BTCC Trading Platform

Technical Indicators: Bullish Signals Need Confirmation

The MACD indicator currently shows a bullish crossover with the MACD line at 3,643.65 above the signal line at 2,152.03 - traditionally a buy signal. However, price action remains slightly below the 20-day moving average ($108,014.20), creating what technical analysts call a "make or break" situation.

Bollinger Bands tell an interesting story - with the price hovering near the middle band while the upper band sits at $116,045.81. In my experience watching bitcoin cycles, we typically see explosive moves when price breaks decisively above the middle band during periods of volatility contraction like we're seeing now.

| Key Levels | Price |

|---|---|

| Support | $100,000 (psychological) |

| Resistance | $116,045 (Bollinger Upper) |

| 50-week SMA | $102,980 |

Institutional Winds: ETF Outflows vs. JP Morgan's Bold Prediction

The past week saw $1.28 billion net outflows from US spot Bitcoin ETFs, with BlackRock's IBIT leading the exodus at $580.98 million withdrawn. This comes as somewhat of a surprise given JP Morgan's recent $170K price prediction based on institutional adoption trends.

Digging deeper into the data from CoinMarketCap, we see an interesting dichotomy - while short-term traders are pulling back, corporate treasury adoption continues growing steadily. It's the classic "weak hands vs strong hands" scenario playing out in real-time.

Miner Meltdown: Hashprice Crisis Reshapes Industry

Bitcoin miners face their toughest challenge since the 2024 halving, with hashprice plunging to $42/PH/s - dangerously close to the $40 breakeven point for many operations. We're seeing fascinating adaptations though - companies like Bitdeer shifting to self-mining while others like Cipher Mining strike $15.2 billion AI infrastructure deals with tech giants.

The mining shakeout could actually benefit Bitcoin long-term by weeding out inefficient operators. As one veteran miner told me last week: "The weak hands get flushed out, the strong survive, and the network emerges healthier."

Power Law Model: $142K Fair Value in Sight?

Adam Livingston's power law analysis suggests Bitcoin is "hugging" its $142,000 fair value threshold - a historical precursor to major rallies. The model's upper band projection of $512,000 by December 2025 might sound outrageous, but its decade-long accuracy demands attention.

What fascinates me most is how current price action mirrors March 2024 patterns where Bitcoin either surged immediately after reaching this valuation band or dipped briefly before stronger recoveries. History doesn't repeat but it often rhymes.

Altcoin Season Looming as BTC Dominance Weakens

Bitcoin's market dominance has declined 5.13% since May 2025 to 59.90%, fueling speculation about an impending altcoin season. Analyst Matthew Hyland notes the BTC Dominance chart "looks bearish," potentially signaling capital rotation into altcoins.

However, before you dump your Bitcoin for the latest meme coin, remember we're still technically in "Bitcoin Season" by market indices. The smart money seems to be maintaining Core BTC positions while cautiously testing altcoin waters.

Frequently Asked Questions

What is Bitcoin's price prediction for 2025?

Analysts project a wide range from $142,000 (Power Law model) to $170,000 (JP Morgan), with short-term support at $100K and resistance at $116K. The BTCC research team emphasizes that these are probabilistic scenarios, not guarantees.

Why are Bitcoin ETFs seeing outflows?

The $1.28 billion weekly outflow likely reflects short-term trader caution amid market volatility, though long-term institutional adoption trends remain positive according to TradingView data.

Is now a good time to buy Bitcoin?

This article does not constitute investment advice. That said, the current consolidation NEAR key support levels combined with bullish technical indicators makes this an interesting juncture for investors with appropriate risk tolerance.

What's happening with Bitcoin miners?

Miners face profitability challenges with hashprice at $42/PH/s, leading to operational changes including AI pivots and self-mining strategies. The industry shakeout could ultimately strengthen Bitcoin's network fundamentals.

Could altcoins outperform Bitcoin soon?

While BTC dominance has weakened to 59.90%, market indices still show Bitcoin Season conditions. Any altcoin rally WOULD likely require Bitcoin stability first, creating a potential "rising tide lifts all boats" scenario.