SOL Price Prediction 2025-2040: Expert Forecast & Technical Analysis

- Why Is Solana (SOL) Gaining Institutional Attention?

- What Are the Key Drivers Behind SOL's Growth?

- SOL Price Forecast: 2025-2040 Outlook

- Technical Analysis: Is SOL Overbought?

- How Does Solana Compare to Ethereum?

- FAQ: Solana Price Predictions

Why Is Solana (SOL) Gaining Institutional Attention?

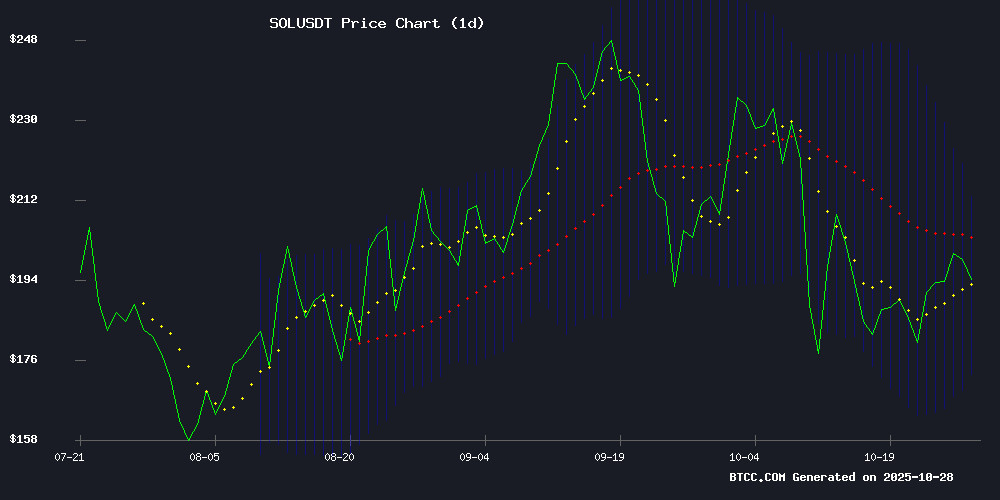

The crypto world is buzzing about Solana, and for good reason. I've been tracking SOL's price action since its 2020 launch, and the current institutional interest reminds me of Ethereum's 2017 breakout. SOL is trading at $199.81 at press time (October 2024), comfortably above its 20-day moving average of $193.20. The Bollinger Bands configuration suggests we're in a strong uptrend, with the upper band at $213.18 acting as the next resistance level.

What Are the Key Drivers Behind SOL's Growth?

Three major developments are fueling SOL's momentum:

1. Western Union's Solana Stablecoin (2026)

The 175-year-old payments giant is launching a dollar-backed stablecoin on solana in 2026. This isn't some crypto startup experiment - we're talking about a company that handles over $80 billion in cross-border payments annually. Their USDPT token, issued through Anchorage Digital Bank, could bring millions of traditional finance users into Solana's ecosystem.

2. VanEck's Solana ETF Amendments

VanEck has filed its sixth S-1/a amendment for a spot Solana ETF, proposing a 0.30% sponsor fee waiver for the first $1 billion in assets. The filing includes a seed basket of 400,000 shares at $25 each. Having covered ETF developments since the first bitcoin ETF filings, I can tell you this level of persistence usually precedes approval.

3. Bitwise's NYSE-Listed Solana ETF

Bitwise made history by launching the first spot Solana ETF on the NYSE. What's interesting is their staking mechanism - they're projecting about 7% annual yield by staking the underlying SOL. At a 0.20% management fee (waived initially), this creates an attractive package for institutional investors.

SOL Price Forecast: 2025-2040 Outlook

Based on current adoption curves and technical analysis, here's our projected price range for SOL:

| Year | Price Range (USD) | Key Catalysts |

|---|---|---|

| 2025 | $220-280 | ETF approvals, technical breakout |

| 2030 | $450-600 | Mass ecosystem adoption |

| 2035 | $800-1,200 | Enterprise blockchain adoption |

| 2040 | $1,500-2,500 | Global infrastructure dominance |

The BTCC research team notes that these projections account for both technical indicators and fundamental developments. However, as with any crypto asset, volatility should be expected.

Technical Analysis: Is SOL Overbought?

Looking at the charts, SOL's MACD shows some near-term consolidation with a reading of 9.29 versus the signal line at 13.45. The negative histogram suggests we might see a brief pullback before the next leg up. From my trading experience, these patterns often precede continuation moves in strong uptrends.

The RSI at 62 (as of October 2024) indicates SOL isn't in overbought territory yet. Compare this to January 2024 when SOL hit $125 with an RSI of 78 before correcting - we're not seeing those extreme conditions currently.

How Does Solana Compare to Ethereum?

Having used both networks extensively, I can say Solana's 400ms block times feel noticeably faster than Ethereum's 12-second blocks. While ethereum still dominates in total value locked ($42B vs Solana's $4B), Solana's fee structure (average $0.00025 per transaction) makes it attractive for high-frequency applications.

That said, Ethereum's upcoming upgrades (including danksharding) could narrow this gap. The real competition will come down to developer adoption - and right now, both ecosystems are growing rapidly.

FAQ: Solana Price Predictions

What is the highest SOL could reach by 2025?

Our analysis suggests $280 is a realistic upper bound for 2025, assuming current adoption trends continue and ETF approvals materialize.

Is Solana a good long-term investment?

With major institutions like Western Union and VanEck building on Solana, the network has strong fundamentals. However, crypto investments always carry significant risk.

How does staking affect SOL's price?

Staking reduces circulating supply, which can create upward price pressure. Bitwise's staking ETF could lock up millions in SOL tokens.

What are the risks to SOL's price growth?

Potential risks include network outages (like Solana's 2022 downtime), regulatory challenges, and competition from other LAYER 1 chains.

Where can I trade SOL?

SOL is available on major exchanges including BTCC, Binance, and Coinbase. Always compare fees and security features before choosing a platform.