Bitcoin’s CME Gap Fuels Market Frenzy: Why Hyper-Bullish Sentiment Is Surging in 2025

Bitcoin’s latest CME gap has traders buzzing—and the market’s moving fast. Here’s why hyper-bullish momentum is stealing the spotlight.

The CME Gap Effect

When Bitcoin futures leave a gap on the CME chart, price tends to chase it. Right now, that gap’s a neon sign flashing 'volatility ahead.'

Market Mechanics in Overdrive

Liquidity’s thin, leverage is stacked, and every whale move sends ripples. Classic Bitcoin—cutting through noise like a chainsaw through red tape.

Hyper-Bullish? Or Just Hyper-Hype?

Sure, the crowd’s frothing. But let’s be real—Wall Street’s still trying to short it with one hand and buy ETFs with the other. Stay sharp.

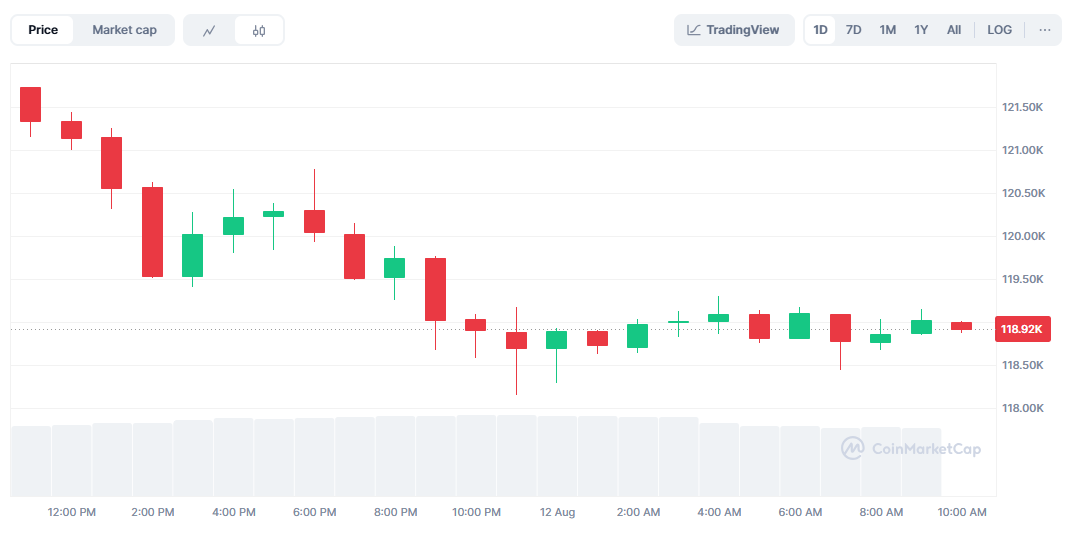

He added that if BTC retraces, it may close the gap toward $120,000 before resuming upward momentum. Others believe BTC could skip the close entirely if momentum pushes it past $123,000 into new all-time highs.

Institutional and Macro Drivers Are Lifting BTC

Beyond chart patterns, Bitcoin’s strength is being underpinned by fresh macroeconomic and institutional tailwinds.

Former President Trump’s recent 401(k) directive could see U.S. retirement funds allocate a fraction of their $12.2 trillion pool into Bitcoin, representing a potential $1.2 trillion inflow at just 10% allocation.

On top of this, spot Bitcoin ETFs continue to see record inflows, while corporate treasuries – like Rumble – are adding Bitcoin to their balance sheets.

Rumble now holds over 210 BTC worth $25 million, alongside plans to expand AI cloud capacity through acquisitions.

These moves highlight growing confidence in Bitcoin as both a treasury asset and a hedge against fiat instability.

Bitcoin Price Outlook: Key Levels to Watch

Technical analysts point to $120,000 as a near-term resistance level, with a break above it potentially triggering a run toward $123,000 and fresh all-time highs.

Should momentum wane, support is expected around $117,500 – the lower end of the CME gap.

Market participants are also eyeing the potential impact of U.S. economic data releases this week, which could influence risk sentiment and either strengthen or weaken Bitcoin’s current uptrend.

In previous bull cycles, breakouts from similar consolidation patterns have often led to double-digit percentage gains within weeks.

Bitcoin Hyper: The Bridge to Bitcoin’s Future

One project set to benefit from Bitcoin’s expanding ecosystem is Bitcoin Hyper ($HYPER) – a Layer 2 solution designed to merge Bitcoin’s security with Solana’s transaction speed.

By bridging the Bitcoin base layer with Solana’s architecture, Bitcoin Hyper enables wrapped BTC to power dApps with high throughput and low fees.

The project’s development is ahead of schedule, with SVM (Solana VIRTUAL Machine) programs now running natively on its network.

This means developers can deploy Solana-compatible contracts on a Bitcoin-anchored rollup without compatibility issues – a unique position in the Layer 2 space.

Bitcoin Hyper’s presale has already raised $8.6 million, with tokens priced at $0.01265 and a price increase due in just over a day.

Given the macro setup for Bitcoin, HYPER stands to ride the momentum, offering infrastructure critical for scaling BTC’s real-world applications.

Why Timing Matters for BTC and Bitcoin Hyper

The convergence of technical signals like the CME gap and macro drivers such as ETF inflows, corporate adoption, and potential 401(k) exposure make the current environment pivotal for Bitcoin.

Historically, periods of sustained institutional accumulation have coincided with outsized gains for projects in the Bitcoin ecosystem.

If BTC breaks above $123,000 and enters price discovery, demand for faster, cheaper Bitcoin transactions could spike – precisely where Bitcoin Hyper fits in.

For investors watching both the Core asset and its ecosystem plays, this could be a rare dual opportunity.

Buy Bitcoin Hyper Here

The post Bitcoin News: CME Gap, Market Moves, and Why Bitcoin Hyper Is in the Spotlight appeared first on icobench.com.