Cardano Price Prediction: On-Chain Data Reveals Surging Token Distribution - What’s Next for ADA?

On-chain metrics flash a distribution signal for Cardano. Large holders are moving tokens—is this smart profit-taking or a worrying exodus?

The Data Doesn't Lie

Network activity shows a clear uptick in ADA moving from long-term wallets to exchanges. This isn't just noise; it's a measurable shift in holder behavior that often precedes price volatility. When whales start swimming toward the exits, retail investors should at least check the lifeboats.

Price at a Crossroads

This distribution phase throws a wrench into straightforward bullish predictions. The market must now absorb these coins without significant new demand to keep prices elevated. It's the classic crypto tug-of-war: fundamental development progress versus the cold, hard calculus of supply and demand.

Smart Money's Game

Seasoned traders watch these flows like hawks. Distribution can signal a local top, or simply a healthy reshuffling before the next leg up. The key differentiator? Whether selling gets absorbed by new, stronger hands or just floods the market. One fund manager's 'strategic reallocation' is another's panic dump—the blockchain shows the moves but not the motives.

Looking Beyond the Noise

Cardano's fate won't be decided by a single on-chain metric. Ecosystem growth, developer activity, and broader market tides will ultimately dictate ADA's trajectory. This distribution wave is a test of resilience, not a death knell. After all, in crypto, sometimes you need a good shakeout to build a stronger foundation—or so the hopium dealers tell themselves before checking their portfolios again.

Large Holders Reduce Exposure

On-chain data from Santiment indicates that Cardano’s largest wallet cohorts have reduced their holdings over recent days. Supply distribution metrics show that addresses holding between 100,000 and 1 million ADA, 1 million to 10 million ADA, and 10 million to 100 million ADA collectively shed around 90 million tokens between Saturday and Tuesday.

This decline in large-wallet balances suggests distribution rather than accumulation, increasing available supply in the market. Historically, similar trends have coincided with periods of heightened downside pressure, particularly when retail demand remains subdued.

Derivatives Positioning Reflects Bearish Sentiment

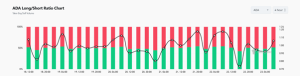

Data from derivatives analytics platform Coinglass adds to the picture of weakening sentiment. ADA’s long-to-short ratio stood at approximately 0.89 on Tuesday, indicating that short positions outweighed long positions across tracked derivatives markets.

Image Courtesy: Coinglass

A ratio below one typically reflects expectations of further downside among Leveraged traders. While derivatives positioning can shift quickly, sustained imbalances often amplify spot market trends during periods of low liquidity or weak momentum.

Technical Structure Remains Fragile

From a technical perspective, ADA has struggled to regain footing after being rejected from the upper boundary of a falling wedge pattern earlier this month. Following that rejection on December 9, the token declined sharply over the next nine days, eventually touching a two-month low near $0.34.

Momentum indicators continue to reflect caution. The daily Relative Strength Index (RSI) remains below the neutral midpoint, while the Moving Average Convergence Divergence (MACD) has maintained a bearish crossover, signaling persistent downside momentum.

Image Courtesy: TradingView

Broader Context for Cardano

Cardano has faced increasing competition from other layer-1 and layer-2 networks, particularly as developers and users prioritize throughput, fees, and ecosystem incentives. While the network continues to evolve through protocol upgrades, market participants have remained sensitive to broader risk-off conditions across crypto assets.

Similar patterns of whale distribution and derivatives-driven pressure have appeared in other major altcoins during periods of market consolidation.

Implications for the Crypto Market

The current combination of on-chain distribution, bearish derivatives positioning, and weak technical momentum underscores the challenges facing ADA in the near term. For investors and builders, the data highlights how shifts in holder behavior can quickly influence market structure, especially in an environment where capital remains selective across the digital asset space.

Bitcoin Hyper: Positioning For Wider Adoption

While on-chain metrics from networks like cardano point to a widening distribution of tokens among holders, a separate thread of market interest has been forming around Bitcoin-focused infrastructure aimed at extending its functionality within DeFi.

Bitcoin Hyper (HYPER) falls into this category, describing itself as a Solana-based Layer-2 that introduces smart contract capabilities and higher transaction throughput, with final settlement anchored to the Bitcoin blockchain.

The approach reflects the growing BTCFi narrative, which explores ways to broaden Bitcoin’s use cases without modifying its core protocol. Based on disclosed data, the bitcoin Hyper presale has accumulated roughlyso far.

Buy Bitcoin Hyper Here

The post Cardano price Prediction: On-Chain Data Shows Increased Token Distribution appeared first on icobench.com.