Bitcoin Plunges Below $106K as Meme Coin Panic Selling Intensifies - Here’s Why Crypto Is Bleeding Today

Crypto markets tumble as Bitcoin loses critical $106K support level amid widespread panic selling.

The Meme Coin Massacre

Speculative assets lead the downturn with meme coins taking the hardest hits. Retail investors flee positions as fear spreads through altcoin markets.

Market Mechanics Unpacked

Leverage liquidations cascade through derivatives markets while spot selling pressure mounts. The perfect storm of over-leveraged positions and profit-taking creates downward momentum that even institutional buyers struggle to contain.

Broader Context Matters

Traditional finance veterans watching from the sidelines mutter 'told you so' while secretly checking their own crypto portfolios. Sometimes the market needs to remind everyone that digital gold still bleeds red like everything else.

Fed Rate Cut Uncertainty Triggers Risk-Off Sentiment

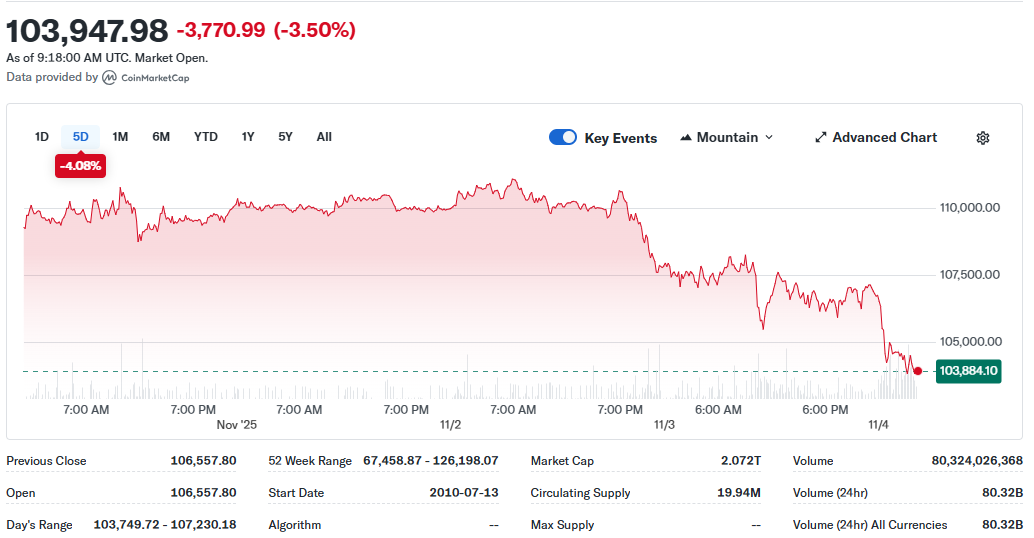

Monetary policy quickly became the driver of this latest market breakdown. On October 29, Fed Chair Jerome Powell stated that another rate cut in December is “far” from guaranteed, despite the 25 basis-point cut implemented in October. The Fed’s tone was interpreted as hawkish, fueling risk aversion.

The CME FedWatch Tool now shows a 69.3% chance of a cut, down from nearly 78% earlier. Treasury Secretary Scott Bessent warned that continued tightening could push sectors like housing into recession – further pressuring speculative assets.

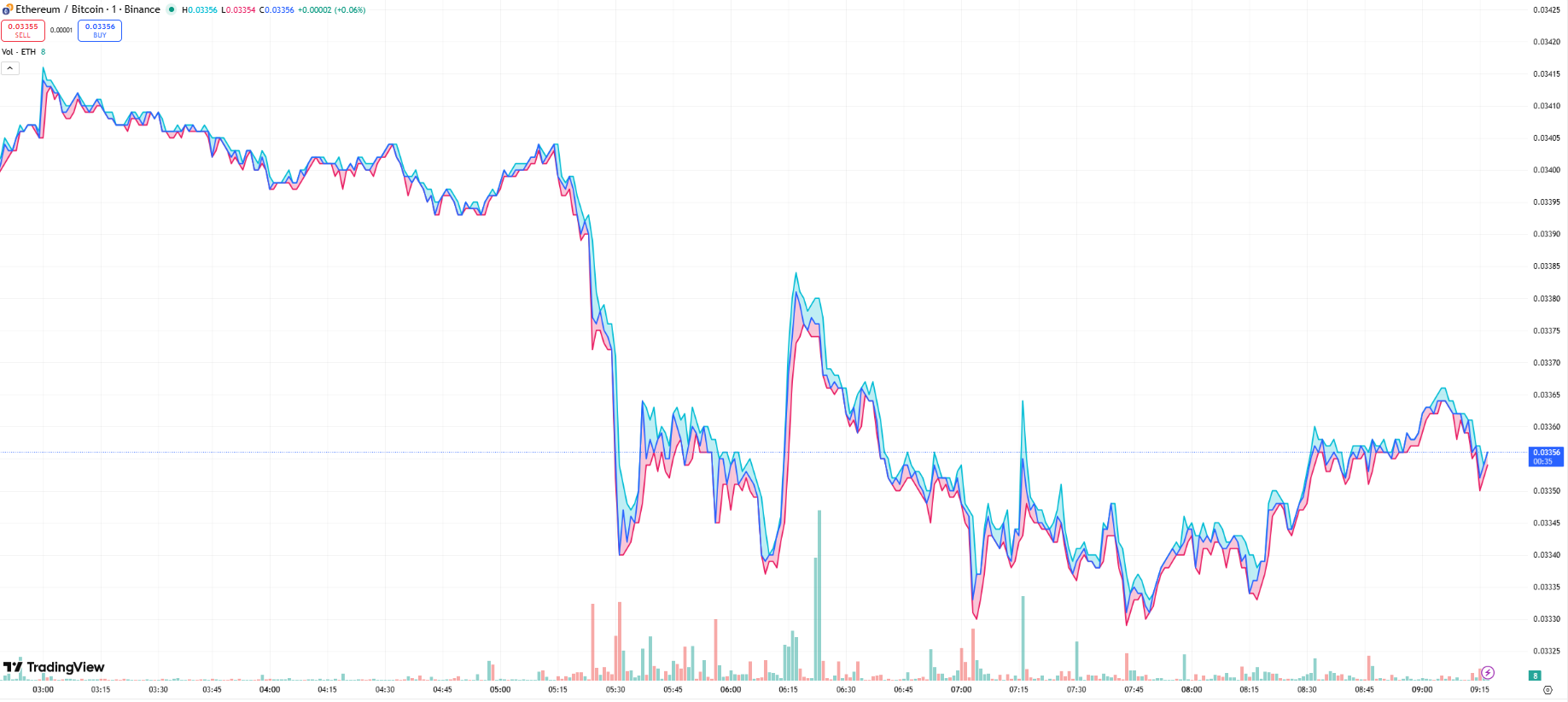

As the U.S. dollar strengthened, crypto assets sold off hard. Bitcoin first broke $110,000 support, then quickly collapsed through $106,000, wiping out traders who had bet on a relief rally.

Liquidations Surpass $1.29B as Altcoins and Meme Tokens Get Crushed

This wasn’t just a correction – it was a crazy liquidation event. According to CoinGlass, more than 334,000 traders were liquidated in a single day, with over $1.29 billion in positions wiped out:

- Ethereum: $85.6M liquidated

- Bitcoin: $74.6M

- Solana: $35M

- Dogecoin: down 6.9%

- Uniswap: down 9%

Total crypto market cap dropped to $3.52 trillion, down from an intraday peak of $3.81 trillion. The Crypto Fear & Greed Index plummeted to 21, firmly in “Extreme Fear” territory.

Traders are clearly in risk-off mode, rotating away from meme coins and altcoins toward more stable assets – or exiting completely.

Institutional Profit-Taking Sparks ETF Outflows Over $1.15B

Adding fuel to the sell-off were institutional outflows from spot bitcoin ETFs. Data from Fairsides confirmed that U.S. spot Bitcoin ETFs saw $1.15 billion in withdrawals over the past week, led by BlackRock, ARK Invest, and Fidelity.

These ETFs had previously helped drive Bitcoin’s rally past $110,000, but once momentum broke, the exits accelerated.

The shift in institutional flows suggests strategic profit-taking at technical resistance, paired with concerns over macro uncertainty.

Bitcoin’s dominance ROSE to 60.15%, signaling a market-wide retreat toward perceived safety. But with meme coins and altcoins facing outsized losses, many retail investors were left holding bags during the downturn.

Next Support Zones: $101K and $100K in Focus

Analysts are now watching $101,000–$100,000 as Bitcoin’s last line of defense. A breakdown here could trigger another $6 billion in liquidations, potentially pushing the price toward $95,000 or lower.

If Bitcoin stabilizes and climbs back above $108,000, it could reclaim $110,000, restoring confidence in the short term. But sentiment remains fragile, especially with upcoming catalysts like the U.S. jobs report and inflation data.

Any upside recovery may be capped at $112,500, while a broader market rebound could push total market cap back above $3.67 trillion. For now, traders remain cautious – and retail buyers are advised to stay informed and choose wallets and platforms built for these turbulent cycles.

Best Wallet Sees Uptick in Demand as Traders Seek Safer Tools

While markets panicked, tools like Best Wallet gained traction among crypto users looking for stable infrastructure and smart entry tools. The app has already raised $16.7 million in presale funding and supports:

- Over 330 decentralized exchanges

- 30 cross-chain bridges via Rubic

- Native support for ETH, SOL, BNB, and USDT

- Seamless swaps and upcoming gas-free token transfers

Best Wallet’s Upcoming Tokens feature has drawn attention by helping early users spot pre-exchange gems like WEPE and PEPU, which posted returns of up to 7,000%.

Its security model also appeals to cautious users. With 2FA, MPC-CMP private key splitting, and anti-fraud protocols, Best Wallet prioritizes user control during volatile conditions.

Visit Best Wallet Here

The post Why Is Crypto Down Today? Bitcoin Drops Below $106K as Panic Selling Hits Meme Coins Hard appeared first on icobench.com.