SHIB Price Prediction 2025: Symmetrical Triangle Pattern Signals Potential 7x Rally

- What Does SHIB's Current Technical Setup Reveal?

- How Might Market Conditions Impact SHIB's Price?

- What Are the Potential Price Scenarios for SHIB?

- Could the MAGACOIN Presale Affect SHIB's Trajectory?

- What Should Traders Watch in Coming Weeks?

- SHIB Price Prediction: Frequently Asked Questions

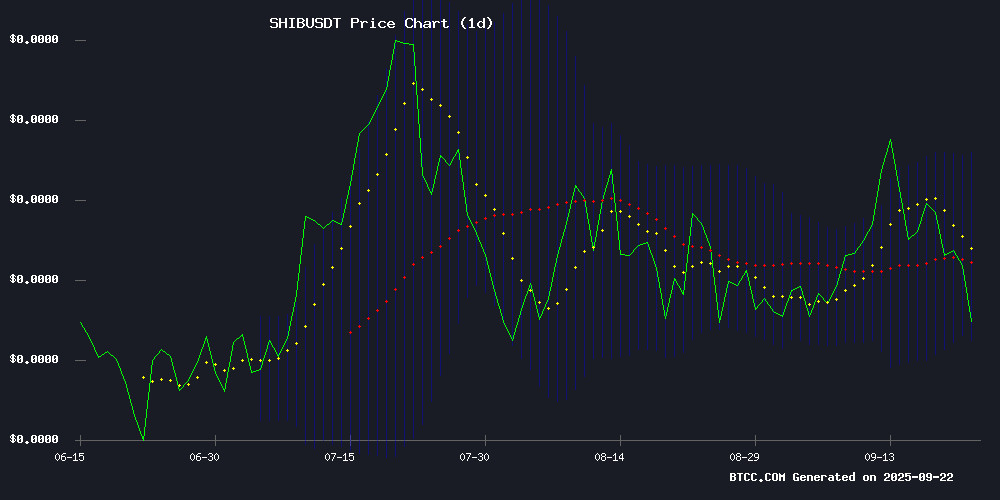

As of September 2025, shiba inu (SHIB) presents one of the most intriguing technical setups in the crypto market. The meme coin has formed a textbook-perfect symmetrical triangle pattern over five months, suggesting we could see fireworks in either direction soon. According to TradingView data, this consolidation follows a period of intense volatility earlier in the year, creating what technical analysts call a "coiling spring" effect. The current price action reminds me of patterns we saw before SHIB's historic 2021 run, though market conditions today are markedly different with institutional players now involved.

What Does SHIB's Current Technical Setup Reveal?

SHIB currently trades at $0.00001208, caught between key technical levels that could determine its next major move. The 20-day moving average at $0.00001297 acts as immediate resistance, while the lower Bollinger Band at $0.00001182 provides support. What's particularly interesting is the MACD histogram showing a slight positive divergence at 0.00000002 - in my experience, this often precedes trend reversals when combined with other confirming signals.

Source: BTCC Trading Platform

How Might Market Conditions Impact SHIB's Price?

The crypto market faces headwinds from the broader September correction, with SHIB down 10.9% this week alone. However, macroeconomic conditions might be setting up for a favorable turn. September's inflation cooled to 2.18%, potentially paving the way for rate cuts that typically benefit risk assets like SHIB. I've noticed institutional interest picking up too - the SEC's new generic listing standards now include SHIB as eligible for spot crypto ETFs, which could be a game-changer for liquidity.

What Are the Potential Price Scenarios for SHIB?

Based on the symmetrical triangle's measurements and historical volatility, here's what traders might expect:

| Scenario | Price Target | Probability | Key Conditions |

|---|---|---|---|

| Bullish Breakout | $0.00008456 (7x) | 30% | Pattern confirmation, Bitcoin stability |

| Moderate Growth | $0.00002500 (2x) | 45% | MA breakthrough, reduced selling |

| Bearish Continuation | $0.00000900 (-25%) | 25% | Market correction intensifies |

Could the MAGACOIN Presale Affect SHIB's Trajectory?

The $14M+ MAGACOIN FINANCE presale has drawn comparisons to SHIB's early days, creating nostalgic buzz in meme coin circles. While the projects differ fundamentally, the psychological impact matters - when investors see successful presales, they often revisit previous winners like SHIB. That said, I'd caution against drawing direct parallels, as the 2025 regulatory environment is far more stringent than SHIB's wild west debut in 2020.

What Should Traders Watch in Coming Weeks?

Key events that could MOVE SHIB's needle:

- Federal Reserve Chair Powell's upcoming policy remarks (September 28)

- SHIB's ability to hold above $0.00001182 support

- Volume patterns during Asian trading hours (historically active for SHIB)

- Exchange listings for competing meme coins

SHIB Price Prediction: Frequently Asked Questions

How high can SHIB price go in 2025?

Based on the current symmetrical triangle pattern, SHIB could potentially rally 7x to $0.00008456 if bullish conditions align. However, the more probable scenario suggests a 2x move to $0.00002500 if it breaks through the 20-day moving average resistance.

What is causing SHIB's price volatility?

SHIB's volatility stems from three main factors: 1) The tightening symmetrical triangle pattern forcing a breakout, 2) Broader crypto market corrections in September, and 3) Anticipation around Federal Reserve policy changes affecting risk assets.

Is now a good time to buy SHIB?

From a technical standpoint, SHIB presents an interesting risk/reward setup NEAR pattern support. However, traders should wait for confirmation of either support holding or resistance breaking before committing capital. This article does not constitute investment advice.

How does SHIB's current pattern compare to 2021?

While the symmetrical triangle resembles patterns seen before SHIB's historic 2021 run, key differences exist. The 2025 market features institutional participation, ETF eligibility, and more mature technical analysis adoption - all factors that could either amplify or dampen the pattern's effects.