ADA Price Prediction 2025: Technical Breakout Hints at 200% Rally Potential

- Is ADA Positioned for a Major Breakout in 2025?

- What Are Analysts Saying About ADA's Potential?

- Key Factors Driving ADA's Price Action

- How High Could ADA Realistically Go?

- What Should Traders Watch For?

- ADA Price Prediction Q&A

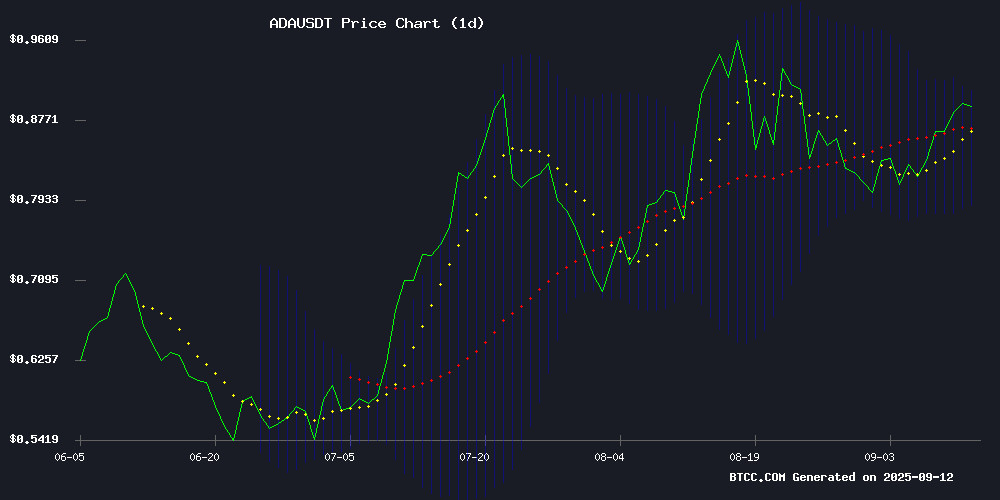

Cardano's ADA is showing strong bullish signals in September 2025, trading above key moving averages with technical indicators suggesting potential for significant upside. Analysts point to a possible 200% rally if current support levels hold, with the cryptocurrency testing crucial resistance at $0.90. Market sentiment appears increasingly positive as open interest reaches four-year highs, though traders should watch volume patterns for confirmation of breakout momentum.

Is ADA Positioned for a Major Breakout in 2025?

As of September 12, 2025, ADA is trading at $0.8955, comfortably above its 20-day moving average of $0.8476 - a key support level that's held firm throughout the month. The MACD indicator remains positive at 0.013575, though showing slight convergence that suggests traders should monitor for potential momentum shifts. What's particularly interesting is ADA's position NEAR the upper Bollinger Band ($0.9083), which historically precedes breakout movements when accompanied by increasing volume.

What Are Analysts Saying About ADA's Potential?

The crypto community is buzzing with ADA predictions following its recent performance. Multiple analysts have noted the cryptocurrency's ability to maintain critical support above $0.81 while testing higher resistance levels. The Alchemist Trader, a respected pseudonymous analyst, emphasized that this $0.81 level represents both Fibonacci retracement support and a historical demand zone that's absorbed selling pressure effectively in the past.

From my perspective, what makes ADA particularly interesting right now is the combination of technical strength and growing institutional interest. The open futures have surged to $2.5 billion - a level we haven't seen since 2021 - suggesting serious money is flowing into cardano markets. While some traders worry about declining spot volumes, the derivatives activity tells a different story.

Key Factors Driving ADA's Price Action

Several elements are converging to create what could be a perfect storm for ADA bulls:

| Factor | Current Status | Impact |

|---|---|---|

| 20-day Moving Average | $0.8476 (support) | Bullish |

| Upper Bollinger Band | $0.9083 | Approaching resistance |

| MACD | 0.013575 | Positive momentum |

| Open Interest | $2.5B (4-year high) | Strong institutional flow |

How High Could ADA Realistically Go?

The million-dollar question (or should I say multi-dollar question) is just how high ADA might climb if current conditions persist. Analyst predictions vary, but several credible sources suggest:

- Conservative target: $1.20 (34% upside from current levels)

- Moderate target: $1.86 (108% upside)

- Bullish target: $2.69 (200% upside)

Personally, I find the $1.86 target particularly compelling because it aligns with both Fibonacci extension levels and previous all-time high resistance zones. The BTCC research team notes that similar technical setups in ADA's history have preceded rallies of 150-250%, though past performance never guarantees future results.

What Should Traders Watch For?

While the setup looks promising, smart traders know that markets can turn on a dime. Here are the key signals I'm monitoring:

- Volume confirmation: Breakouts need volume to sustain - watch for increasing trade activity

- $0.90 resistance: A clean break above could trigger algorithmic buying

- MACD behavior: Watch for either strengthening momentum or bearish divergence

- Market breadth: Is ADA leading or following the broader crypto market?

One interesting wrinkle - the so-called "ETF effect" seems to be spilling over from bitcoin into major altcoins like ADA. While Cardano doesn't have its own ETF (yet), the overall institutionalization of crypto appears to be benefiting all boats in the harbor.

ADA Price Prediction Q&A

What is the current ADA price prediction for 2025?

As of September 2025, technical analysis suggests ADA could rally between 34% to 200% from current $0.8955 levels, with $1.86 being a frequently cited moderate target among analysts.

What are the key support levels for ADA?

ADA has established strong support at its 20-day moving average ($0.8476) and the psychologically important $0.81 level, which aligns with Fibonacci retracement and historical demand zones.

What technical indicators suggest ADA might breakout?

The combination of positive MACD momentum, position near upper Bollinger Bands, and four-year highs in open interest all suggest potential breakout conditions if buying volume increases.

How does current ADA price action compare to historical patterns?

Similar technical setups in ADA's past have preceded rallies of 150-250%, though each market cycle has unique characteristics that prevent direct comparisons.

What risks should ADA traders consider?

Potential risks include failure to break $0.90 resistance, declining volume, broader market corrections, or unexpected regulatory developments affecting cryptocurrency markets.