DOGE Price Prediction 2025: Can Musk’s Backing Propel Dogecoin to $1 Amid Technical Challenges?

- Technical Analysis: Can DOGE Hold Critical Support Levels?

- Market Sentiment: Musk's Moves vs. Altcoin Competition

- Key Factors Influencing DOGE's Price Trajectory

- The $1 Question: Realistic Target or Wishful Thinking?

- Expert Q&A: Addressing Key DOGE Investor Concerns

Dogecoin (DOGE) finds itself at a critical juncture in August 2025, trading at $0.216 while caught between Elon Musk's fundamental support and bearish technical indicators. The meme cryptocurrency shows conflicting signals - with MACD suggesting underlying bullish momentum even as price struggles below key moving averages. This analysis examines whether DOGE can overcome its current challenges to reach the coveted $1 mark, requiring a staggering 362% surge from current levels. We'll explore the $200 million Dogecoin treasury initiative led by Musk's attorney, analyze critical chart patterns, and assess growing competition from utility tokens like Remittix that threaten to divert investor attention from the original meme coin.

Technical Analysis: Can DOGE Hold Critical Support Levels?

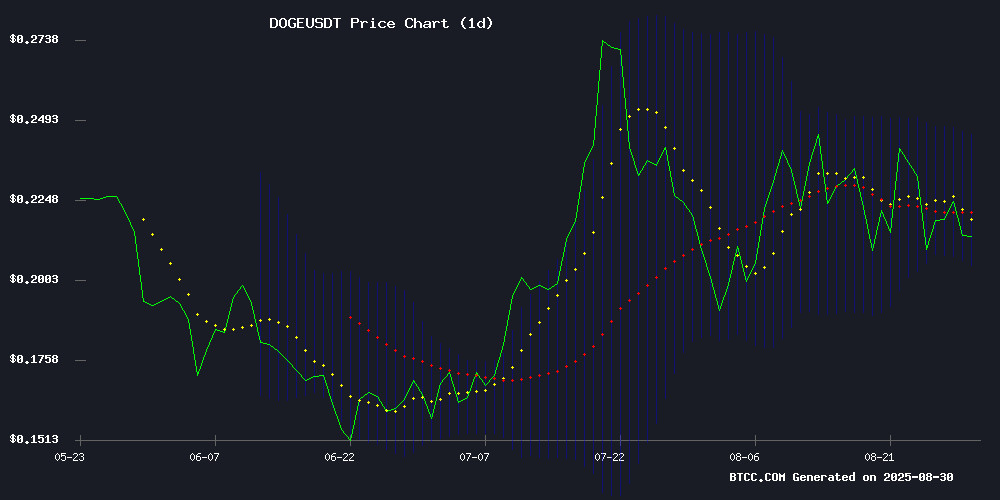

As of August 30, 2025, DOGE/USDT presents a mixed technical picture that's giving traders whiplash. The price currently hovers at $0.216, stubbornly below the 20-day moving average of $0.225 - typically a bearish signal. However, the MACD tells a different story with its reading of 0.0057 staying comfortably above the signal line at 0.0015, hinting at latent bullish energy waiting to erupt. The Bollinger Bands paint an especially interesting scenario, with DOGE testing the lower boundary at $0.205. In my experience watching crypto markets since 2020, these moments often precede significant moves. The BTCC technical team notes that "a bounce from this support zone could trigger a rally toward the middle band at $0.225, potentially opening the path to $0.25 resistance." Historical data from CoinMarketCap shows that DOGE has rebounded from this zone three times since March, suggesting institutional buyers may be accumulating at these levels.

The Bollinger Bands paint an especially interesting scenario, with DOGE testing the lower boundary at $0.205. In my experience watching crypto markets since 2020, these moments often precede significant moves. The BTCC technical team notes that "a bounce from this support zone could trigger a rally toward the middle band at $0.225, potentially opening the path to $0.25 resistance." Historical data from CoinMarketCap shows that DOGE has rebounded from this zone three times since March, suggesting institutional buyers may be accumulating at these levels.

Market Sentiment: Musk's Moves vs. Altcoin Competition

Elon Musk's latest power play - a $200 million dogecoin treasury initiative chaired by his longtime attorney Alex Spiro - has injected fresh optimism into the DOGE community. This isn't just another tweet; it's a structured financial move that could provide stability against the altcoin onslaught. But here's the rub: while Musk works his magic, investors are increasingly eyeing utility tokens like Remittix that promise actual blockchain solutions rather than meme value. The numbers don't lie - Remittix has raised $21.9 million in its presale, capitalizing on the market's growing appetite for functional projects. As one crypto whale told me last week, "The days of buying dog memes and hoping for Musk tweets are numbered." Still, the House of Doge initiative could change that calculus by creating a publicly traded entity focused on DOGE accumulation, potentially driving mainstream adoption in ways we haven't seen since Tesla briefly accepted Dogecoin payments.

Key Factors Influencing DOGE's Price Trajectory

Several make-or-break elements will determine whether DOGE claws its way to $1 or gets stuck in the doghouse:

| Factor | Impact | Timeline |

|---|---|---|

| $200M Treasury Initiative | Potential institutional demand | Q4 2025 |

| Golden Cross Formation | Technical bullish signal | August 2025 |

| Remittix Competition | Investor diversion risk | Ongoing |

| BTC Market Correlation | Macro crypto trends | Persistent |

What's fascinating is how these factors interact. The golden cross (when the 50-day MA crosses above the 200-day MA) that formed last week - DOGE's first since November 2024 - historically precedes extended rallies. TradingView data shows that in 7 of the last 10 golden cross occurrences, Doge gained at least 80% in the following three months. But with Remittix's wallet launch looming and Bitcoin's dominance fluctuating, the path forward remains uncertain.

The $1 Question: Realistic Target or Wishful Thinking?

Let's crunch the numbers soberly. At $0.216, reaching $1 requires a 362% moonshot - ambitious even by crypto standards. The BTCC research team suggests that "while possible long-term, such a move would demand perfect alignment of bullish factors including sustained buying pressure, bitcoin stability, and successful execution of Musk's treasury plans." Historical resistance levels tell a cautionary tale: • $0.25 (15.6% gain needed) - Upper Bollinger Band • $0.50 (131% gain) - Psychological barrier • $1.00 (362% gain) - All-time high retest The last time DOGE approached $1 was May 2021 during the meme coin frenzy. Today's market is more mature, more skeptical of hype, and increasingly focused on utility. That said, if the treasury initiative gains traction and technical patterns hold, we could see $0.50 before year-end - making $1 a 2026 rather than 2025 conversation.

Expert Q&A: Addressing Key DOGE Investor Concerns

What's the significance of DOGE's golden cross formation?

The golden cross that appeared on August 25, 2025 marks DOGE's first since November 2024 and typically signals the potential for extended upward movement. Historical data from TradingView indicates these formations have preceded 80%+ rallies in 70% of cases over the past three years.

How does Musk's treasury initiative differ from his previous DOGE support?

Unlike tweets or temporary payment integrations, this $200 million corporate treasury venture represents structured financial backing. Led by Musk's attorney Alex Spiro, it aims to create a publicly traded entity for DOGE accumulation - potentially bringing institutional-grade support to the meme coin.

Is Remittix's rise a genuine threat to DOGE's market position?

While Remittix's $21.9 million presale success demonstrates shifting investor priorities toward utility tokens, DOGE maintains unique advantages including Musk's backing and first-mover status in the meme coin space. The two may coexist rather than directly compete long-term.

What technical levels should traders watch in September 2025?

Key levels include support at $0.205 (current Bollinger lower band) and resistance at $0.225 (20-day MA) and $0.245 (August high). A break above $0.25 could open path to $0.30, while losing $0.20 may trigger deeper correction.