Ethereum Price Prediction 2025: Can ETH Shatter $5,000 Amid BlackRock’s Buying Spree?

- Why Is Ethereum Surging in August 2025?

- Technical Analysis: The $4,958 Resistance Battle

- Institutional Moves Shaking the ETH Market

- Fed Policy: The Hidden Catalyst

- Will ETH Hit $5,000 in 2025?

- FAQs: Ethereum's $5,000 Question

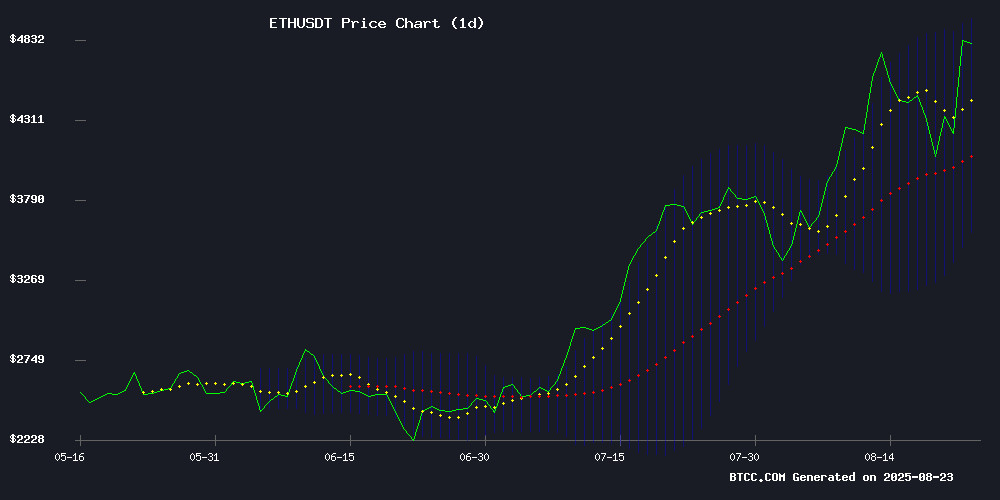

Ethereum stands at a pivotal moment in August 2025, trading at $4,742.89 and flirting with its all-time high. With BlackRock's massive accumulation, $1.5 billion in ETH-backed buybacks, and dovish Fed signals creating perfect market conditions, analysts see a clear path to $5,000. However, technical indicators suggest traders should watch the $4,260 support level closely. This DEEP dive examines whether ETH can finally break through the psychological $5,000 barrier or if we're due for a correction.

Why Is Ethereum Surging in August 2025?

The second-largest cryptocurrency has been on a tear since June, rallying over 100% as institutional players pile in. What's particularly fascinating is how this rally differs from 2021's retail-driven mania. This time, it's corporations and Wall Street giants leading the charge. SharpLink Gaming alone holds 740,760 ETH (worth ~$3 billion), while spot Ether ETFs now hold nearly 6% of circulating supply. The Fed's potential September rate cuts have added rocket fuel to this institutional frenzy.

Source: BTCC trading platform

Technical Analysis: The $4,958 Resistance Battle

Looking at the charts, ETH is currently testing the upper Bollinger Band at $4,958.68 - a critical resistance level. The MACD, while still negative at -8.34, shows convergence that typically precedes momentum shifts. The BTCC technical analysis team notes that sustained volume above $4,958 could trigger the final push to $5,000. However, failure to break through might see a retest of the $4,260 support zone where 690,000 ETH sits waiting in buy orders.

| Key Level | Price | Significance |

|---|---|---|

| Current Price | $4,742.89 | Testing upper Bollinger Band |

| Resistance | $4,958.68 | Upper Bollinger Band |

| Target | $5,000.00 | Psychological milestone |

| Support | $4,260.00 | Critical support zone |

Institutional Moves Shaking the ETH Market

SharpLink Gaming's $1.5 billion buyback program has turned heads across Wall Street. Their CEO Joseph Chalom made waves by stating, "When our stock trades below the NAV of our ETH holdings, issuing equity becomes dilutive. Buying back shares is the mathematically obvious move." This isn't just corporate maneuvering - it represents a fundamental shift in how institutions view ethereum as a treasury asset.

Meanwhile, spot Ether ETFs recorded $287.6 million inflows on August 22nd alone, snapping a four-day outflow streak. BlackRock's ETHA captured 81% of these inflows, suggesting big money isn't just dipping toes but diving headfirst into ETH.

Fed Policy: The Hidden Catalyst

Powell's Jackson Hole comments lit the fuse for ETH's latest surge. His suggestion of September rate cuts sent shockwaves through risk assets, with Ethereum's 4.7 beta coefficient amplifying the move. What's fascinating is how crypto has evolved from its "anti-establishment" roots to become a macro play. Traders now parse Fed statements with the same intensity they once reserved for Satoshi's whitepaper.

Will ETH Hit $5,000 in 2025?

The math seems simple - at $4,742, ETH needs just a 5.4% push to reach $5,000. But markets are never that straightforward. The BTCC research team identifies three potential scenarios:

- Bull Case (60% probability): Break above $4,958 with volume triggers algorithmic buying, pushing ETH to $5,200 by September

- Base Case (30%): Consolidation between $4,260-$4,958 through Q3 before eventual breakout

- Bear Case (10%): Macro shock triggers flight to safety, testing $3,700 support

Personally, I've noticed retail traders are more cautious this time around - perhaps burned by 2021's volatility. The options market shows heavy call buying at $5,000 strikes, but with protective puts layered underneath. It's a more sophisticated approach than the "YOLO" mentality of previous cycles.

FAQs: Ethereum's $5,000 Question

What's driving Ethereum's price surge in 2025?

The current rally combines institutional adoption (ETFs, corporate treasuries), favorable Fed policy, and technical breakout patterns. Unlike 2021's retail-driven mania, this MOVE has fundamental support from major financial players.

How significant is the $4,958 resistance level?

Extremely significant - it represents the upper Bollinger Band where previous rallies have stalled. A clean break with volume could trigger algorithmic buying programs and short covering.

What happens if ETH breaks $5,000?

Psychologically important levels often become self-fulfilling prophecies in crypto. A confirmed break could bring in sidelined capital and potentially target $5,500-$6,000 based on Fibonacci extensions.

Are there risks to this bullish outlook?

Absolutely. Regulatory developments, unexpected Fed policy shifts, or technical failure at resistance could spark profit-taking. The $4,260 support level remains critical for maintaining bullish structure.