SHIB Price Prediction 2025-2040: Expert Forecasts and Critical Market Drivers

- What Does SHIB's Technical Analysis Reveal About Its Price Trajectory?

- How Is Market Sentiment Impacting SHIB's Price Action?

- What Are the Key Factors That Could Influence SHIB's Future Price?

- SHIB Price Predictions: 2025 Through 2040 Scenarios

- Frequently Asked Questions About SHIB's Future

As the crypto market continues its rollercoaster ride, Shiba Inu (SHIB) remains one of the most talked-about meme coins. Our comprehensive analysis dives deep into SHIB's technical indicators, market sentiment, and long-term price projections through 2040. While the token shows neutral-bullish signals in the near term with potential for consolidation, its long-term trajectory remains highly speculative - with scenarios ranging from 10x gains to stagnation. We'll examine key factors including whale activity, exchange supply dynamics, and emerging competitors like XYZVerse that could shape SHIB's future.

What Does SHIB's Technical Analysis Reveal About Its Price Trajectory?

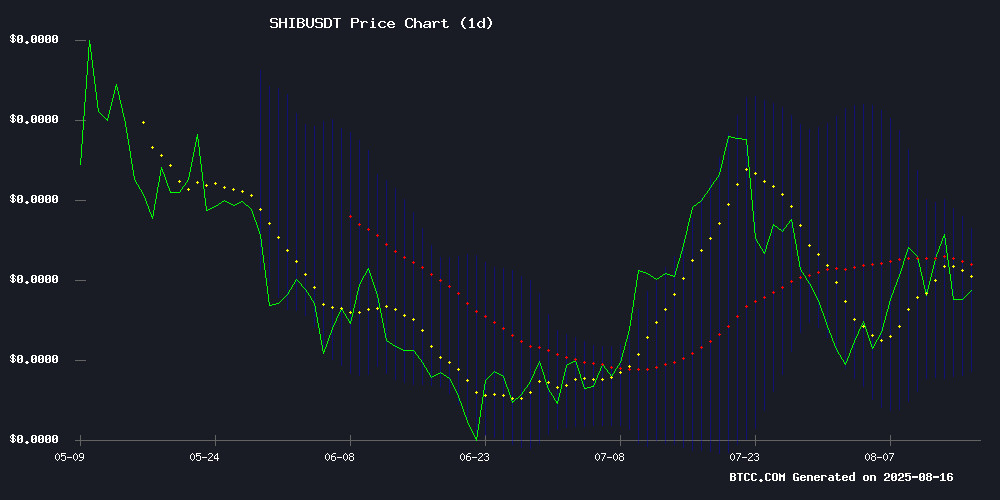

Currently trading at 0.00001297 USDT (as of August 2024), SHIB presents a mixed technical picture that warrants careful consideration. The price sits slightly above its 20-day moving average of 0.00001287 USDT, suggesting modest bullish momentum. However, the MACD indicator tells a different story - showing a bearish crossover with the MACD line at -0.00000004, signal line at 0.00000048, and histogram at -0.00000052.

Bollinger Bands paint a more neutral picture, with the price hovering NEAR the middle band (0.00001287 USDT). The upper band stands at 0.00001402 USDT while the lower band sits at 0.00001171 USDT. This configuration typically indicates a period of consolidation before the next significant move.

From my experience tracking meme coins, these conflicting signals suggest we might see sideways movement in the near term. A decisive break above the upper Bollinger Band could trigger bullish momentum, potentially testing resistance at 0.000015 USDT. Conversely, a drop below the lower band might confirm bearish trends, possibly leading to a retest of support around 0.000011 USDT.

How Is Market Sentiment Impacting SHIB's Price Action?

The current market sentiment surrounding SHIB is decidedly mixed, creating what I like to call a "tug-of-war" scenario. On one hand, we're seeing reduced exchange supply - SHIB reserves on centralized platforms dropped from 122.54 trillion to 121.31 trillion tokens in early August 2024. This 1% reduction typically signals accumulation by long-term holders, which historically supports price stability.

However, there's a concerning counter-narrative emerging. Data from IntoTheBlock reveals whale addresses (holding ≥1% of circulating supply) have reduced their positions by 150% in netflow terms. When the big players exit, it often foreshadows price stagnation or decline. This divergence explains why SHIB has underperformed compared to other meme coins during recent market rallies.

Adding to the complexity, futures traders appear skeptical too - SHIB's open interest recently hit a 30-day low. In my view, this creates a precarious situation where short-term traders might want to exercise caution despite the tempting price levels.

What Are the Key Factors That Could Influence SHIB's Future Price?

XYZVerse: The New SHIB Competitor?

A fascinating development in the meme coin space is the rise of XYZVerse, which some analysts are comparing to SHIB's early days. The project's $XYZ token has surged to a $15 million market cap, offering a unique blend of sports engagement and Web3 innovation. Unlike traditional meme coins, XYZVerse provides tangible utility through gamified products and strategic partnerships, including one with bookmaker.XYZ that offers token holders exclusive betting perks.

Having watched countless "SHIB killers" come and go, I'm cautiously intrigued by XYZVerse's approach. Their token presale has shown steady growth from $0.0001 to $0.005, with plans to list on major exchanges after hitting a $0.02 target. While it's too early to tell if XYZVerse can replicate SHIB's explosive growth, its differentiated model certainly warrants attention from SHIB investors.

Exchange Supply Dynamics: A Double-Edged Sword

The recent drop in SHIB's exchange reserves could be interpreted as both bullish and bearish. On the positive side, fewer tokens on exchanges typically means reduced selling pressure, which can support price appreciation. The 1% reduction in August 2024 suggests some investors are moving SHIB to cold storage for long-term holding.

However, this comes with a caveat. Reduced liquidity can also amplify price volatility, making SHIB more susceptible to sharp moves in either direction. From my perspective, this supply dynamic creates potential for both explosive upside and painful corrections, depending on broader market conditions.

Whale Activity: Reading Between the Lines

The whale exodus we're seeing raises important questions about SHIB's near-term prospects. Large holders often have better market insight than retail investors, so their departure shouldn't be ignored. That said, whale activity can sometimes be misleading - what appears as distribution might actually be movement between wallets or preparation for new strategies.

One thing's certain: when whales reduce exposure during a broader meme coin rally, as we've seen recently, it's typically not a positive sign for short-term price action.

SHIB Price Predictions: 2025 Through 2040 Scenarios

Long-term predictions for highly volatile assets like SHIB should always be taken with a grain of salt. That said, based on current data and historical patterns, we can outline potential scenarios:

| Year | Bullish Case (USDT) | Base Case (USDT) | Bearish Case (USDT) |

|---|---|---|---|

| 2025 | 0.000025 | 0.000015 | 0.000008 |

| 2030 | 0.0001 | 0.00005 | 0.00002 |

| 2035 | 0.0005 | 0.0002 | 0.0001 |

| 2040 | 0.001 | 0.0005 | 0.0003 |

These projections assume various adoption scenarios, regulatory developments, and macroeconomic conditions. The bullish case presumes significant ecosystem growth and mainstream adoption, while the bearish scenario accounts for potential regulatory crackdowns or loss of community interest.

As someone who's followed crypto cycles since 2017, I'd caution against putting too much weight on any long-term meme coin prediction. The space evolves too rapidly, and today's darling can become tomorrow's afterthought. Diversification remains crucial.

Frequently Asked Questions About SHIB's Future

Is SHIB a good investment in 2024?

SHIB presents high-risk, high-reward potential. The technicals show mixed signals, with both bullish and bearish indicators. While the reduced exchange supply is positive, whale exits raise concerns. Only allocate what you can afford to lose.

Can SHIB reach $0.01 by 2030?

Reaching $0.01 WOULD require massive adoption and token burns. Our base case suggests $0.00005 by 2030, making $0.01 unlikely without extraordinary circumstances. The bullish case shows $0.0001 as more plausible.

How does XYZVerse compare to SHIB?

XYZVerse differentiates itself with actual utility through sports engagement features, while SHIB remains primarily community-driven. XYZVerse is much smaller ($15M vs. SHIB's multi-billion market cap) but shows interesting early growth patterns.

Why are whales reducing SHIB positions?

Possible reasons include profit-taking after recent gains, portfolio rebalancing, or concerns about meme coin volatility. Whale exits often precede price stagnation, so this trend warrants monitoring.

What's the most realistic SHIB price prediction for 2025?

Our base case suggests 0.000015 USDT, factoring in current trends. The bullish case (0.000025) would require sustained buying pressure, while the bearish scenario (0.000008) might materialize if market conditions deteriorate.