Ethereum Price Prediction 2025: Bullish Signals Point to $5,000+ as ETH Flips Mastercard

- Why Is Ethereum Surging in August 2025?

- Institutional Adoption Reaches New Highs

- Technical Analysis: Where Next for ETH Price?

- Contrarian Signals: The Whale Short Position

- Ethereum in Local Markets: Japan and Korea Lead

- FAQ: Ethereum Price Prediction 2025

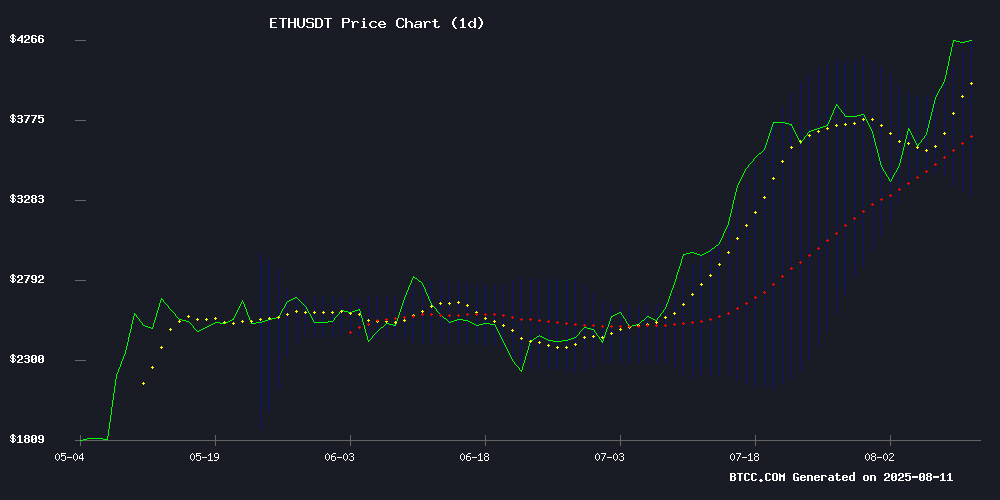

Ethereum is making waves in August 2025, with ETH/USD breaking through $4,200 and surpassing Mastercard's market capitalization. Our analysis reveals strong technical indicators, institutional validation, and growing adoption that suggest this rally has room to run. While whale short positions warrant caution, the overall picture paints a bullish case for ethereum reaching $5,000+ in the coming months.

Why Is Ethereum Surging in August 2025?

Ethereum's current price of $4,267.61 represents a 25% weekly gain, with the cryptocurrency testing key resistance levels. The technical setup looks particularly strong - ETH is trading comfortably above its 20-day moving average ($3,793.42) and the MACD indicator shows a bullish crossover with the histogram turning positive at 40.77. As the BTCC technical team noted, "A sustained break above the $4,275 level would confirm the bullish momentum, potentially targeting the $4,800 psychological resistance in the short term."

Institutional Adoption Reaches New Highs

Ethereum's market cap surpassing Mastercard (now ranking as the 22nd most valuable asset globally) demonstrates its growing financial significance. Institutional players are accumulating ETH at an unprecedented rate - Bitmine alone holds over $3.33 billion worth of Ethereum, while Galaxy Digital's desk received $160 million worth of ETH from major exchanges in a single hour recently.

The OTC market is showing signs of tightening too. As one trader commented, "The only way to buy ETH now is through public markets." This scarcity dynamic could potentially accelerate ETH's price trajectory in coming weeks.

Technical Analysis: Where Next for ETH Price?

Looking at the charts, several key levels stand out:

| Level | Price | Significance |

|---|---|---|

| Current Price | $4,267.61 | Testing upper Bollinger Band |

| Immediate Resistance | $4,275.33 | Upper Bollinger Band |

| Next Target | $4,800 | Psychological round number |

| All-Time High | $4,891 | Previous record |

Contrarian Signals: The Whale Short Position

Not everyone is bullish though. Mysterious whale AguilaTrades has placed an $84 million short position on Ethereum using 25x leverage. This contrarian bet comes as ETH's daily RSI approaches overbought territory. While some see this as a hedge against correction, others view it as a risky gamble given ETH's momentum.

As one BTCC analyst noted, "While AI models predict cycle tops at $15,000 and Vitalik's holdings crossing $1 billion generate positive sentiment, traders should monitor the $84 million short position as a potential contrarian indicator."

Ethereum in Local Markets: Japan and Korea Lead

Interestingly, Ethereum has already hit all-time highs in Japanese yen (¥639,455) and South Korean won (₩5,971,000) despite trading 12% below its USD ATH. This divergence highlights how local liquidity and adoption dynamics can drive cryptocurrency valuations independently of global benchmarks.

FAQ: Ethereum Price Prediction 2025

Is Ethereum a good investment in August 2025?

Based on current technicals and fundamentals, Ethereum presents a compelling case. The cryptocurrency shows strong institutional adoption, developer activity, and clear technical targets at $4,800 then $5,000. However, investors should always conduct their own research and consider risk tolerance.

What's the Ethereum price prediction for 2025?

Analysts see several potential targets: short-term $4,800, mid-term $5,000, with some AI models suggesting a cycle top of $15,000. The $5,000 target appears increasingly plausible given current momentum.

Why did Ethereum surpass Mastercard's market cap?

Ethereum's growing adoption in decentralized finance, NFTs, and institutional portfolios has driven its valuation higher. The cryptocurrency now ranks as the 22nd most valuable asset globally.

What are the risks to Ethereum's price?

Potential risks include regulatory challenges (like the developer detention in Turkey), whale profit-taking, and macroeconomic factors that could impact crypto markets broadly.