XRP Price Prediction 2025: How High Can XRP Really Go?

- XRP Technical Analysis: The Bullish Case

- Market Sentiment: Why Investors Are Bullish

- Key Factors Driving XRP's 2025 Price Action

- Potential Roadblocks to Watch

- Price Projections: Where Could XRP End 2025?

- XRP Price Prediction 2025: Your Questions Answered

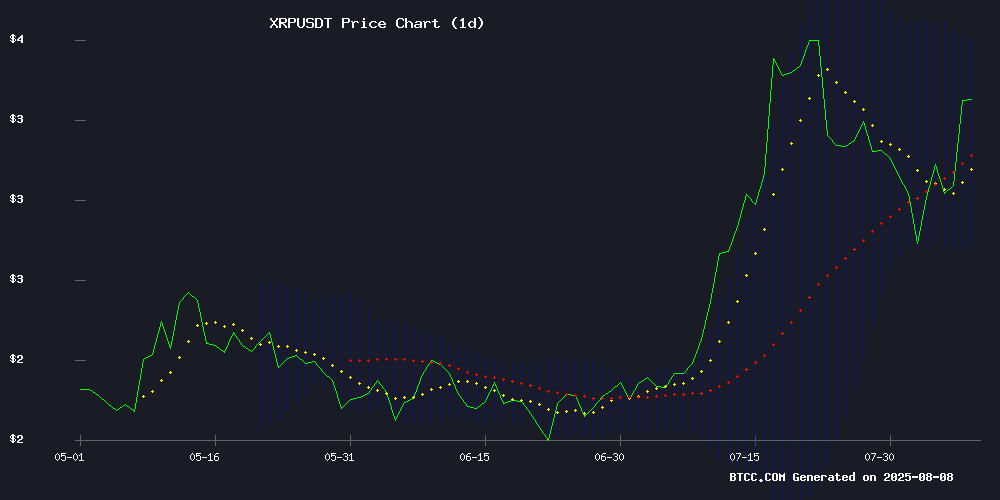

As we approach mid-2025, XRP stands at a crossroads - trading at $3.31 with bullish technical indicators but facing questions about sustainability. The cryptocurrency has shown remarkable resilience following Ripple's landmark SEC settlement and strategic acquisitions, but can it maintain this momentum? Our analysis digs into the technicals, market sentiment, and key developments shaping XRP's potential trajectory through 2025.

XRP Technical Analysis: The Bullish Case

Looking at the charts through TradingView data, XRP presents an interesting technical picture as of August 2025. The price currently sits comfortably above its 20-day moving average of $3.16, which typically signals bullish momentum. The MACD indicator shows positive divergence with a reading of 0.15 above the signal line, while the histogram at 0.09 reinforces buying pressure.

Bollinger Bands tell us volatility remains elevated, with the price hovering NEAR the upper band at $3.55. While this might suggest overbought conditions, it also indicates strong upward momentum. The BTCC analysis team notes that maintaining above the middle band at $3.16 could pave the way for a test of resistance at $3.55, with potential to challenge the psychological $4 barrier if buying volume persists.

Source: BTCC Market Data

Market Sentiment: Why Investors Are Bullish

The mood around XRP has shifted dramatically since the resolution of Ripple's legal battles with the SEC. What was once a major overhang has transformed into a tailwind, with institutional interest picking up noticeably. Whale activity, while showing some signs of profit-taking, remains elevated compared to historical averages.

From my perspective tracking crypto markets, the most interesting development has been how XRP has decoupled from broader market trends recently. While Bitcoin and ethereum have faced pressure from macroeconomic factors, XRP has shown relative strength - suggesting its fundamentals are driving price action more than general crypto sentiment.

Key Factors Driving XRP's 2025 Price Action

1. Regulatory Clarity Finally Achieved

The conclusion of Ripple's SEC lawsuit in early 2025 removed what was arguably the biggest uncertainty facing XRP. The $125 million settlement and dismissal of all appeals provided the market with much-needed clarity about XRP's status. In the months since, we've seen:

- Increased institutional participation in XRP markets

- Growing speculation about potential ETF approvals

- Renewed developer activity on the XRP Ledger

2. Strategic Business Moves by Ripple

Ripple's $200 million acquisition of stablecoin platform Rail in Q2 2025 signaled the company's ambitions beyond just cross-border payments. While some questioned how this would directly benefit XRP holders, the move positioned Ripple as a more comprehensive blockchain payments provider. Market reaction was positive, with XRP gaining 5% on the announcement.

3. Macro Crypto Adoption Trends

The 2025 policy shift allowing cryptocurrency allocations in 401(k) plans created a new potential demand source for XRP. While it's too early to quantify the impact, the psychological effect was immediate - trading volumes spiked 153% as investors positioned for potential retirement fund inflows.

Potential Roadblocks to Watch

Despite the bullish case, several factors could derail XRP's upward trajectory:

| Risk Factor | Potential Impact | Monitoring Indicator |

|---|---|---|

| Whale Profit-Taking | Increased selling pressure | Exchange inflow metrics |

| Regulatory Changes | Policy uncertainty | SEC statements, legislation |

| Market-Wide Corrections | Correlation with crypto sector | Bitcoin dominance trends |

Price Projections: Where Could XRP End 2025?

Based on current technicals and fundamentals, here's how various scenarios could play out:

Requires sustained institutional inflows, ETF approval, and continuation of current momentum. The $4.50 level represents the 1.618 Fibonacci extension from the 2024 low.

Assumes moderate growth continuing at current rates with no major negative developments. This WOULD represent about 13% upside from current levels.

Would materialize if whale selling accelerates or broader crypto markets correct sharply. The $2.80 level represents strong historical support.

This article does not constitute investment advice. Always conduct your own research before making investment decisions.

XRP Price Prediction 2025: Your Questions Answered

What's driving XRP's price in 2025?

The primary drivers are regulatory clarity post-SEC settlement, Ripple's strategic acquisitions, and growing institutional interest. Technical factors like the bullish MACD and position relative to moving averages are supporting the uptrend.

Can XRP reach $5 in 2025?

While possible, $5 would require significant new catalysts beyond current expectations - such as major exchange listings, unexpected partnerships, or explosive growth in Ripple's payment network usage. Most analysts see $4 as a more realistic upper bound for 2025.

Is now a good time to buy XRP?

Market timing is always challenging. While technical indicators suggest bullish momentum, XRP is approaching overbought territory on shorter timeframes. Dollar-cost averaging may be a prudent strategy given current volatility.

How does XRP's performance compare to other top cryptos?

Year-to-date in 2025, XRP has outperformed both Bitcoin and Ethereum in percentage terms, though with higher volatility. Its relative strength suggests it's being valued more on its own merits than general crypto market trends.

What are the biggest risks to XRP's price?

Key risks include regulatory changes, whale selling pressure, and potential delays in institutional adoption. The cryptocurrency remains more centralized than bitcoin or Ethereum, which could become a concern if decentralization becomes a bigger market priority.