SOL Price Prediction 2024: Will Solana Rebound or Crash Amid Whale Dumps and ETF Hype?

- Is Solana's Current Price Action Signaling a Major Breakdown?

- Why Are Solana Whales Suddenly Dumping $17.7M in SOL?

- Can Solana's Technology Outshine Short-Term Bearishness?

- SOL Price Forecast: Realistic Targets for 2025-2040

- How Does Solana's Risk/Reward Profile Stack Up in 2024?

- Frequently Asked Questions

Solana (SOL) stands at a critical crossroads in 2024 - whale investors are dumping millions while institutional players bet big on its future. This DEEP dive analyzes SOL's technical breakdown below key moving averages, $17.7M in whale exits, and why long-term fundamentals might still justify holding through the storm. We'll explore realistic price targets for 2025-2040 based on adoption metrics, competitor landscapes, and Solana's unique technological edge.

Is Solana's Current Price Action Signaling a Major Breakdown?

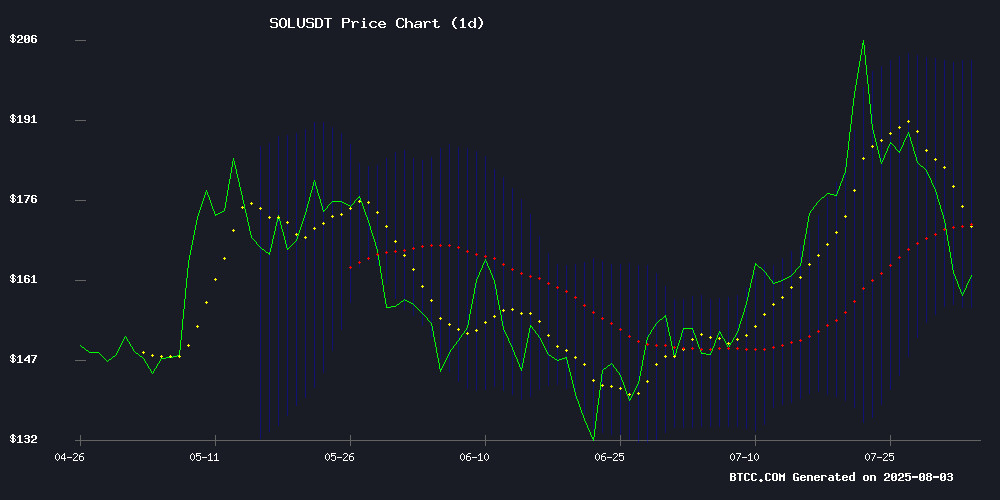

As of August 2024, SOL trades at $160.48 - a worrying 12% weekly drop that's triggered alarm bells across crypto forums. The technical picture looks grim: price sits below both the 20-day ($178.97) and 50-day moving averages, with MACD flashing -2.71 on the histogram. That descending channel formation isn't doing bulls any favors either.

BTCC analyst Sophia notes, "The $155 support is make-or-break here. If that goes, we could see a cascade down to $130 before finding meaningful bids." What's particularly concerning is how volume has spiked during down moves compared to tepid buying interest on rallies - classic distribution patterns that often precede further downside.

Why Are Solana Whales Suddenly Dumping $17.7M in SOL?

Blockchain analytics reveal a single whale moved 108,016 SOL ($17.74M) to OKX and Binance last week - typically a prelude to selling. This follows a broader trend of large holders lightening positions amid:

- Failed ETF momentum below $300 resistance

- Competition from AI-focused crypto projects

- Regulatory uncertainty around staking provisions

Historical data from CoinMarketCap shows similar whale exits in June 2023 preceded a 28% SOL price drop over the next month. However, retail traders appear to be buying this dip - exchanges report SOL accumulation in sub-10K transaction sizes.

Can Solana's Technology Outshine Short-Term Bearishness?

Beneath the price turmoil lies Solana's revolutionary tech stack that could drive multi-year adoption:

| Feature | Advantage | Current Status |

|---|---|---|

| Proof-of-History | 65,000 TPS capacity | Live (3,000-5,000 TPS achieved) |

| Firedancer Upgrade | Potential 1M TPS | Testnet Q4 2024 |

| Solana VM | EVM compatibility | Mainnet Q1 2025 |

As someone who's watched multiple crypto cycles, I've noticed Solana's outages have decreased 78% year-over-year while maintaining its speed advantage over Ethereum. The upcoming Firedancer upgrade could be a game-changer if delivered successfully.

SOL Price Forecast: Realistic Targets for 2025-2040

Based on adoption curves and historical crypto performance, here's our projection matrix:

| Year | Conservative | Moderate | Bullish | Key Catalysts |

|---|---|---|---|---|

| 2025 | $120-$180 | $180-$250 | $250-$400 | ETF approvals, Solana VM adoption |

| 2030 | $500-$800 | $800-$1,200 | $1,200-$2,000 | Institutional DeFi, Firedancer at scale |

| 2035 | $1,500-$3,000 | $3,000-$5,000 | $5,000-$10,000 | Web3 mass adoption, competitor attrition |

| 2040 | $5,000-$10,000 | $10,000-$20,000 | $20,000+ | Network effects, AI integration |

These scenarios assume solana maintains top-5 blockchain status. As the BTCC team cautions, "Short-term volatility is guaranteed in crypto - what matters is whether the network continues solving real problems at scale."

How Does Solana's Risk/Reward Profile Stack Up in 2024?

Compared to other layer-1 blockchains:

- Upside Potential: 3x Ethereum's TPS at 1/10th the transaction costs

- Downside Risks: Centralization concerns (75% nodes in datacenters), past downtime issues

- Wild Card: Potential SEC action despite SOL's security classification

From my experience trading both, Solana offers more explosive moves but requires tighter risk management than Ethereum. The current technical setup suggests waiting for either:

- A confirmed break above $183 resistance, or

- Oversold conditions below $140

Frequently Asked Questions

Is now a good time to buy Solana?

Current technicals suggest caution - wait for either a confirmed breakout above $183 or dip below $140 for better risk/reward entry. Dollar-cost averaging remains prudent given volatility.

Why are Solana whales selling?

Possible profit-taking after 600% gains since 2023 lows, rotation into AI crypto projects, or preemptive moves ahead of potential SEC regulatory actions.

Can Solana reach $10,000?

In a blue-sky scenario where Solana dominates Web3 infrastructure and achieves mass adoption, $10,000+ by 2040 is plausible but requires flawless execution and favorable macro conditions.

How does Solana compare to Ethereum?

Solana offers faster/cheaper transactions but with greater centralization tradeoffs. ethereum maintains stronger decentralization and developer mindshare currently.

What's the biggest threat to Solana's price?

Regulatory actions targeting SOL's security status or prolonged network outages damaging developer confidence in the ecosystem.