TRX Price Surge: 3 Bullish Signals That Could Push TRX to $0.35 in July 2025

- What's Driving TRX's Current Price Action?

- How Significant Is TRON's Stablecoin Dominance?

- What Impact Will the Nasdaq Listing Have?

- Technical Analysis: Where Could TRX Go Next?

- How Does Ruvi AI Compare to TRON's Growth?

- Is TRX a Good Investment Right Now?

- TRX Price Prediction: Your Questions Answered

TRON's TRX token is showing remarkable strength as we approach the end of July 2025, combining technical breakout patterns with fundamental milestones that could redefine its market position. Currently trading at $0.3148, TRX has outperformed Cardano in market capitalization while demonstrating real-world utility through its dominance in stablecoin transactions. This analysis examines the key factors driving TRX's price action, including its Nasdaq listing through a backdoor strategy, technical indicators suggesting further upside, and network metrics that reveal growing adoption. With the cryptocurrency testing critical resistance levels, traders are watching closely for either a breakout or consolidation phase in the coming days.

What's Driving TRX's Current Price Action?

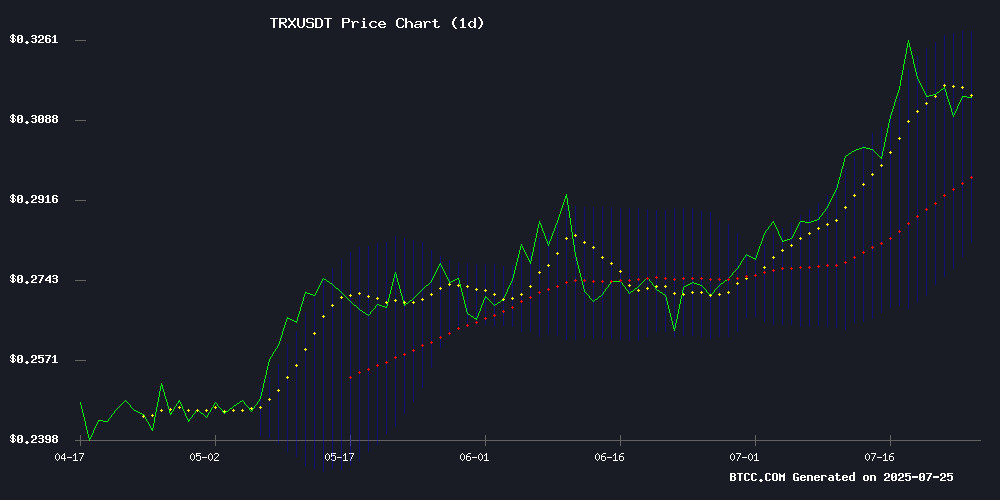

TRX has been one of the standout performers in the crypto market this week, currently trading at $0.3148 with clear bullish signals across multiple timeframes. The token recently surpassed its 20-day moving average ($0.3053) and is now testing the upper Bollinger Band at $0.3281. What makes this move particularly interesting is that it's happening alongside significant fundamental developments that validate TRON's growing ecosystem.

Source: BTCC price charts

The MACD histogram turning positive (0.000381) suggests weakening downward momentum, while the ADX reading of 46 confirms a strong trend. "We're seeing textbook technical signals," notes a BTCC market analyst. "The $0.328 level is crucial - a clean break could open the path to $0.35, while rejection here might mean consolidation before the next move."

How Significant Is TRON's Stablecoin Dominance?

TRON's network fundamentals tell an equally compelling story. The blockchain now processes 54% of all stablecoin transactions on Uquid, with daily USDT transfers averaging 2.4 million according to CryptoQuant data. This isn't just impressive - it's practically dominating the stablecoin payment space.

What does this mean for TRX? Essentially, it demonstrates real-world utility beyond speculation. Merchants are choosing tron for its combination of speed (2,000 TPS capacity) and low fees, making it ideal for everything from digital gift cards to online purchases. This growing commercial adoption creates organic demand for TRX that supports its price appreciation.

What Impact Will the Nasdaq Listing Have?

In a strategic MOVE that caught many by surprise, TRON Inc. made its Nasdaq debut through an unconventional backdoor listing. By acquiring toy manufacturer SRM Entertainment (a Disney and Universal supplier), TRON gained public market access while retaining the legacy business. The market responded enthusiastically, sending shares up 53.27% to $10.30.

The listing comes with several bullish implications for TRX:

| Factor | Impact |

|---|---|

| $310 million capital infusion | Strengthens TRX reserves and development |

| 365 million TRX in treasury | $115 million war chest for ecosystem growth |

| Institutional validation | Attracts traditional investors to TRX |

This Nasdaq milestone coincides with TRX surpassing Cardano's ADA in market cap ($29 billion vs ADA's $28.5 billion), marking a significant shift in the crypto rankings. While ADA slipped 8% amid broader volatility, TRX held its ground - a testament to its growing strength.

Technical Analysis: Where Could TRX Go Next?

The charts reveal several interesting developments for TRX traders:

1.: This level aligns with the 1.618 Fibonacci extension, making it a critical barrier. The token's ability to hold above $0.31 suggests underlying strength.

2.: The $0.3067-$0.31 area has become important support. A breakdown here could shift sentiment, while holding above maintains the bullish case.

3.: Daily transactions average 2.35 million, showing healthy network activity, though transfer volume volatility (4.90 trillion tokens) indicates whale movements could cause sudden price swings.

"The technicals paint a cautiously optimistic picture," says our analyst. "We'd like to see confirmation above $0.328 with strong volume to confirm the breakout. Until then, traders might want to watch these key levels closely."

How Does Ruvi AI Compare to TRON's Growth?

An interesting side note in the crypto space is the emergence of Ruvi AI (RUVI), which recently gained CoinMarketCap listing. While still early in its development, the project's focus on AI and blockchain infrastructure draws inevitable comparisons to TRON's early days.

However, TRX currently enjoys significant advantages in:

- Established network effects (54% stablecoin market share)

- Public market validation (Nasdaq listing)

- $1 billion in on-chain revenue milestone

This isn't to dismiss Ruvi AI's potential, but rather to highlight how far TRON has come in establishing itself as a blockchain powerhouse.

Is TRX a Good Investment Right Now?

Based on current metrics, TRX presents a compelling case for consideration:

| Metric | Value | Implication |

|---|---|---|

| Price | $0.3148 | 13% above 20-day MA |

| MACD | Positive crossover | Early bullish signal |

| Market Cap | $29 billion | Surpassed Cardano |

That said, crypto investments always carry volatility risks. The current technical setup appears favorable, but traders should watch key levels and manage risk accordingly. The combination of technical strength and fundamental milestones makes TRX one of the more interesting assets to watch as we move through Q3 2025.

This article does not constitute investment advice. Cryptocurrency investments are volatile and risky. Always conduct your own research before making investment decisions.

TRX Price Prediction: Your Questions Answered

What is the current TRX price prediction for July 2025?

As of July 26, 2025, technical analysis suggests TRX could test $0.35 if it breaks through the $0.328 resistance level. The token is currently trading at $0.3148 with bullish MACD crossover and strong network fundamentals supporting further upside potential.

Why did TRX surpass Cardano in market cap?

TRX's market cap growth to $29 billion (surpassing ADA's $28.5 billion) stems from multiple factors including its Nasdaq listing, dominance in stablecoin transactions (54% market share), and $1 billion in on-chain revenue. Meanwhile, ADA faced an 8% price drop amid broader market volatility.

How significant is TRON's stablecoin transaction volume?

Extremely significant. Processing 54% of Uquid's stablecoin transactions (averaging 2.4 million daily USDT transfers) demonstrates real-world utility beyond speculation. This commercial adoption creates organic demand for TRX that supports its price appreciation.

What does TRON's Nasdaq listing mean for TRX?

The Nasdaq listing through SRM Entertainment acquisition provides institutional validation, $310 million in new capital, and public market visibility. TRON Inc. now holds 365 million TRX ($115 million) in treasury, creating potential price support through strategic ecosystem investments.

What are the key technical levels to watch for TRX?

Traders should monitor: 1) Resistance at $0.3177 (Fibonacci level) and $0.328 (upper Bollinger Band), 2) Support between $0.3067-$0.31, and 3) Daily transaction volume (currently 2.35 million) for breakout confirmation or rejection signals.