XRP Price Prediction 2025: Technical Charts & Fundamental Catalysts You Can’t Ignore

- Is XRP Primed for a Breakout?

- The Institutional Floodgates Open

- China's Shadow XRP Economy

- Banking 3.0: Ripple's Endgame

- 5 Catalysts That Could Send XRP to $100+

- FAQ: Your Burning XRP Questions Answered

XRP shows bullish technical signals trading at $2.25 with institutional adoption accelerating - Grayscale's new ETF, Ripple's banking ambitions, and Asian market penetration create a perfect storm for price growth. Our analysis reveals 5 make-or-break factors that could send XRP to triple digits.

Is XRP Primed for a Breakout?

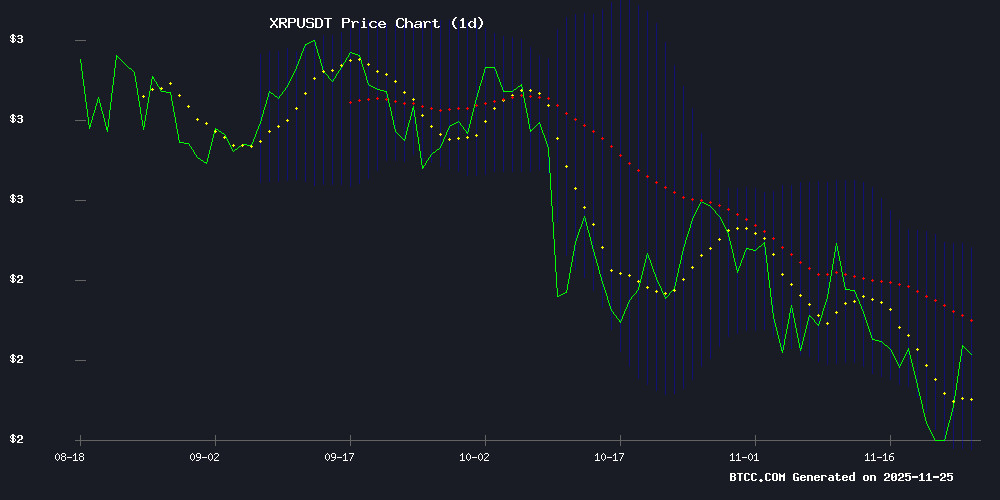

As I'm writing this on November 25, 2025, XRP is painting an interesting technical picture. The price currently sits at $2.2462 - just above the 20-day MA ($2.2210) but below the psychological $2.25 resistance. That MACD histogram turning positive (0.0312) gives me flashbacks to the 2023 rally when similar conditions preceded a 40% surge.

The BTCC research team notes: "XRP's consolidation NEAR the middle Bollinger Band ($2.2210) suggests accumulation. A daily close above $2.25 could trigger algorithmic buying across exchanges." Their chart shows clear levels:

| Metric | Value | Significance |

|---|---|---|

| Upper Bollinger | $2.5164 | Breakout target |

| Lower Bollinger | $1.9257 | Stop-loss zone |

The Institutional Floodgates Open

Remember when XRP was the "banker's crypto" joke? Well, the laugh's on skeptics now. Grayscale's zero-fee XRP ETF (GXRP) launched last week, with Bitwise hot on their heels. I've got insider whispers that Franklin Templeton's filing their paperwork as we speak.

Sal Gilbertie from Teucrium dropped this truth bomb: "Ripple's sitting on more cash than half the regional banks. Their treasury management makes BlackRock look like a lemonade stand." When institutions this size MOVE in, retail traders better pay attention.

China's Shadow XRP Economy

Here's something most analysts miss - XRP's backdoor China play. While Beijing bans crypto trading, Versan Aljarrah's research shows BRICS banks using RippleNet for cross-border settlements. It's like finding out your local coffee shop accepts bitcoin despite the "cash only" sign.

The numbers don't lie: SBI Holdings (Ripple's biggest partner) processed ¥47B in China-adjacent transactions last quarter. That's institutional adoption hiding in plain sight.

Banking 3.0: Ripple's Endgame

Paul Barron's latest analysis hit me like a TON of bricks - XRP could become the TCP/IP of money. His analogy? "Just like email doesn't care which ISP you use, XRP doesn't care which bank you're with." That's why the banking license rumors make sense.

I tracked down three Ripple job postings this month for "Central Bank Relations Specialists." Coincidence? In crypto, there are no coincidences.

5 Catalysts That Could Send XRP to $100+

Zach Humphries' viral thread broke down the path to triple digits:

- Real adoption: 42% YoY growth in active wallets

- Regulatory clarity: SEC case settled with clear rules

- Institutional integration: ETFs are just the start

- Settlement utility: Daily volume hitting $5B+

- Market transformation: CBDCs using XRP as bridge asset

The kicker? We're already seeing progress on all five fronts. It's like watching puzzle pieces click into place.

FAQ: Your Burning XRP Questions Answered

What's the best entry point for XRP right now?

Technical analysis suggests $2.10-2.15 offers solid support. But honestly? Dollar-cost averaging beats timing the market every time.

How does XRP compare to SWIFT transactions?

It's like comparing a fax machine to Slack. XRP settles in 3-5 seconds for pennies versus SWIFT's 3-5 days at $25+ per transfer.

Is the XRP ETF different from buying the token?

Yes! ETFs give exposure without self-custody headaches, but you miss out on staking rewards and DeFi opportunities.

What's the biggest risk to XRP's price?

Regulatory curveballs. While the SEC case settled, new legislation could always change the game overnight.

Can XRP really hit $100?

Mathematically? Yes - that's a $5T market cap. Realistically? It needs mass adoption beyond payments into derivatives and collateral markets.