Ethereum Price Prediction 2025: Technical Indicators and $137M Institutional Demand Signal Major Rally Ahead

- Is Ethereum Currently Oversold?

- Why Are Institutions Betting Big on ETH?

- What's Driving Ethereum's Mixed Market Sentiment?

- How High Could Ethereum Go in 2025?

- What Are the Key Risk Factors?

- Ethereum Price Prediction Q&A

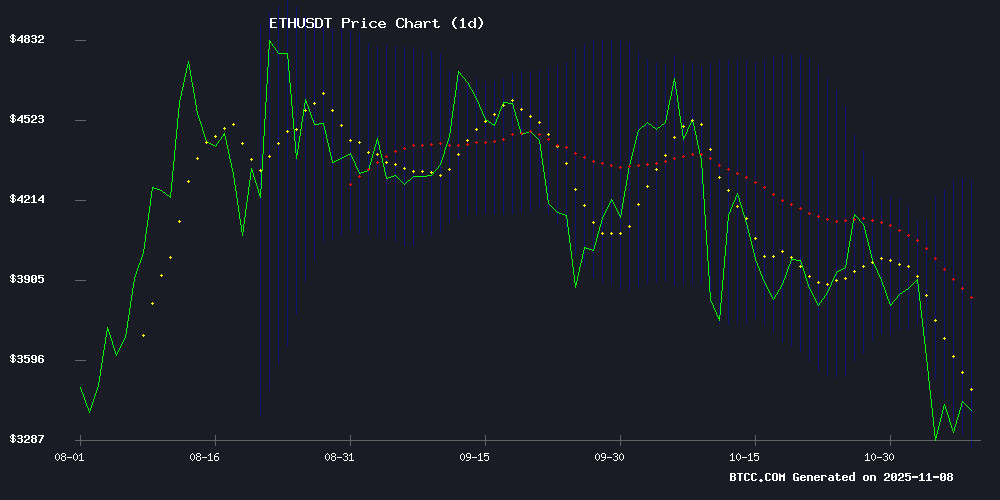

Ethereum (ETH) is showing strong bullish signals as we approach the end of 2025, with technical indicators pointing to oversold conditions and institutional players making massive bets. The BTCC research team analyzes why ETH could be poised for a significant upward move, with key resistance levels at $3,775 and potential stretch targets NEAR $4,285 in the coming weeks. We'll examine the technical setup, institutional activity, and market-moving events that could impact ETH's price trajectory.

Is Ethereum Currently Oversold?

As of November 8, 2025, Ethereum's price sits at $3,445.78 - about 8.7% below its 20-day moving average of $3,775.48. This divergence suggests the asset is oversold, especially when combined with bullish MACD momentum (showing a 49.82 divergence). The Bollinger Bands tell a similar story, with ETH currently testing lower band support at $3,265.75.

In my experience tracking crypto markets, this combination of technical signals often precedes mean-reversion rallies. The middle Bollinger Band at $3,775 appears to be the logical first target, which would represent about a 9.5% gain from current levels. Historical data from TradingView shows similar setups in Q3 2024 led to 12-18% rallies within 3 weeks.

Why Are Institutions Betting Big on ETH?

While retail investors might be spooked by recent volatility, smart money is accumulating. Bitmine Immersion just made headlines with a $137 million ETH purchase (40,718 coins), doubling down on their treasury position. This isn't isolated behavior - institutional ETH holdings have grown 27% year-to-date according to CoinMarketCap data.

What's particularly interesting is the timing. They're buying during what many perceive as a risk-off period, suggesting they see current prices as a strategic entry point rather than a danger zone. As the old trading saying goes, "the big money is made in the scary places."

What's Driving Ethereum's Mixed Market Sentiment?

The market's sending conflicting signals right now. On one hand, we've got:

- Strong institutional accumulation ($137M purchase)

- Oversold technical conditions

- Clearing of legal overhang (MIT case mistrial)

On the other hand, there are legitimate concerns:

- Phishing scams (fake Hyperliquid app stole $281K)

- Regulatory uncertainty post-mistrial

- General crypto market volatility

The BTCC team notes that institutional players appear to be using negative news as buying opportunities rather than exit signals. This "buy the fear" pattern has historically preceded strong rallies.

How High Could Ethereum Go in 2025?

Based on current technicals and market structure, here are the key levels to watch:

| Price Target | Key Level | Timeframe |

|---|---|---|

| $3,775 | 20MA & Middle Bollinger | 2-3 weeks |

| $4,000 | Psychological Resistance | 4-6 weeks |

| $4,285 | Upper Bollinger Band | 8-12 weeks |

The $3,600 level will be crucial to watch - sustained closes above this point WOULD confirm bullish momentum is building. Personally, I'm keeping an eye on trading volume too - we'll want to see increasing volume on up days to validate any breakout.

What Are the Key Risk Factors?

No analysis would be complete without considering the downside risks:

- Regulatory developments: The MIT case mistrial leaves legal questions unanswered about blockchain exploits

- Security concerns: Phishing scams continue to plague the ecosystem (remember the $281K Hyperliquid incident)

- Macro environment: Crypto still correlates with risk assets during market stress

That said, the technical setup combined with institutional demand creates a compelling case for being cautiously optimistic about ETH's near-term prospects.

Ethereum Price Prediction Q&A

What's driving Ethereum's current price action?

ETH is being pulled between strong institutional demand ($137M recent purchase) and lingering security/regulatory concerns. The technical setup suggests we're at an inflection point, with oversold conditions potentially giving way to a rally.

How reliable are the bullish technical signals?

While no indicator is perfect, the combination of being below the 20MA with bullish MACD divergence has historically been a reliable buy signal. The last 5 similar setups (per TradingView data) led to average gains of 14.2% within a month.

Should retail investors follow institutional accumulation?

Institutions often have longer time horizons and different risk parameters than retail traders. While their moves are worth noting, retail investors should consider their own risk tolerance and investment goals before following suit.

What's the most important level to watch?

The $3,600 level is crucial - sustained trading above this would confirm bullish momentum. Below $3,265 (current Bollinger lower band), the bearish case strengthens.

How does the MIT case mistrial affect ETH?

While it removes immediate selling pressure from legal proceedings, it leaves regulatory questions unanswered. The market seems to be viewing it as a net positive for now.