ETH Price Prediction 2025: Will Ethereum Break $5,000 or Crash Below $3,500?

- Ethereum's Technical Battle: Bulls vs Bears at $4,000

- Institutional Whiplash: Adoption vs. Selling Pressure

- The Whale Awakens: $800M ETH Staking Move

- Fusaka Upgrade: Ethereum's Next Evolution

- Vitalik Buterin vs EU Chat Control

- ETH Price Scenarios: Where Next?

- Ethereum Price Prediction Q&A

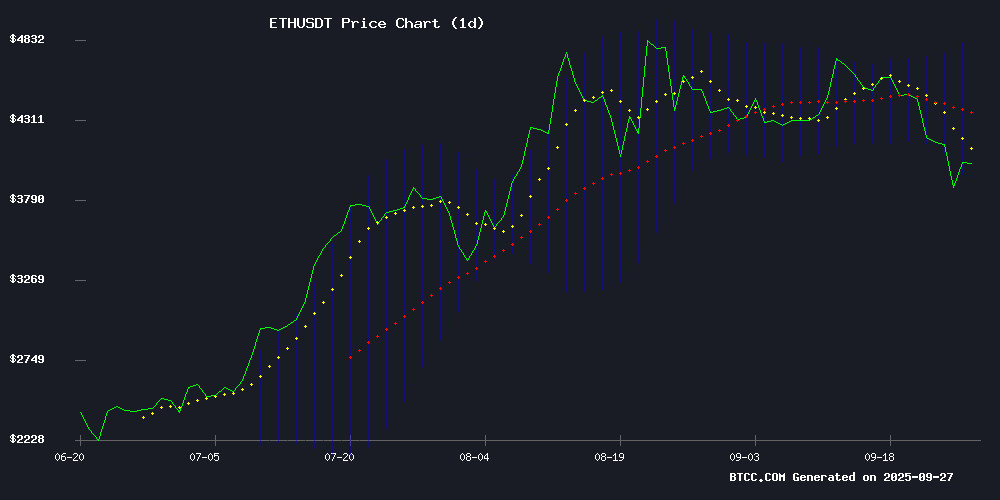

Ethereum's price action has become the crypto market's most gripping drama as we approach October 2025. Currently battling at the $4,000 frontline, ETH presents a complex technical picture with its 20-day MA resistance at $4,371 and critical support at $3,911. Institutional players are sending mixed signals - while SWIFT adopts Ethereum's Layer 2 for payments, BlackRock and Fidelity dump $274M worth of ETH. Meanwhile, an ethereum whale just woke from an 8-year slumber to stake $800M, and the network's on-exchange holdings hit multi-year lows. This article breaks down all the factors influencing ETH's next major move.

Ethereum's Technical Battle: Bulls vs Bears at $4,000

As of September 28, 2025, ETH trades at $3,999.08, caught in a tug-of-war between technical indicators. The 20-day moving average at $4,371.34 looms as formidable resistance, while the Bollinger Band's lower boundary at $3,911.70 offers make-or-break support. The MACD's 126.30 spread confirms bearish momentum, but oversold conditions suggest potential for reversal.

Source: BTCC

Source: BTCC

"This $4,000 battlefield reminds me of ETH's 2021 consolidation before its big breakout," notes crypto trader Mark Johnson. "The difference now is institutional participation - they're both the problem and potential solution."

Institutional Whiplash: Adoption vs. Selling Pressure

The institutional picture couldn't be more contradictory. SWIFT's pilot program using Ethereum's LAYER 2 for stablecoin payments with banks like BNP Paribas signals mainstream acceptance. Yet spot ETH ETFs saw $796M in outflows this week alone, with BlackRock and Fidelity's $274M sell-off raising eyebrows.

"Institutions giveth and taketh away," quips BTCC analyst Ava. "The SWIFT news is monumental for long-term adoption, but short-term, we're seeing profit-taking after ETH's 150% year-to-date rally."

The Whale Awakens: $800M ETH Staking Move

Blockchain sleuths detected a seismic shift as a dormant Ethereum address from 2017 activated to stake 200,000 ETH ($800M). The whale controls 736,316 ETH ($2.89B) across eight wallets, making this one of the largest staking deployments ever observed.

"This isn't some moonboy trader," explains on-chain analyst Emmett Gallic. "When early adopters stake instead of sell during volatility, it's a strong confidence vote in Ethereum's future."

Fusaka Upgrade: Ethereum's Next Evolution

Ethereum developers have launched the Nimbus testnet ahead of November's Fusaka hard fork. This upgrade focuses on validator efficiency across testnets like Holesky and Sepolia. Historically, successful upgrades catalyze ETH price rallies - the 2022 Merge preceded a 42% surge.

Tech analyst Sarah Zhang observes: "Fusaka won't be as flashy as the Merge, but its validator improvements could reduce staking risks, potentially attracting more institutional capital."

Vitalik Buterin vs EU Chat Control

Ethereum's co-founder made headlines criticizing the EU's proposed Chat Control legislation. "You can't make society secure by making people insecure," Buterin argued, warning against mass surveillance backdoors in encrypted messaging.

This stance reinforces crypto's privacy ethos while potentially drawing regulatory scrutiny. As one Brussels insider joked: "Vitalik just gave EU bureaucrats another reason to lose sleep over crypto."

ETH Price Scenarios: Where Next?

| Scenario | Price Target | Probability | Key Levels |

|---|---|---|---|

| Bullish | $4,800-$5,000 | 25% | Break above $4,371 |

| Neutral | $3,900-$4,300 | 40% | Hold $3,911 support |

| Bearish | $3,500-$3,800 | 35% | Break below $3,911 |

This article does not constitute investment advice. Crypto markets are highly volatile - always do your own research.

Ethereum Price Prediction Q&A

What's the most important technical level for ETH right now?

The $3,911 support is critical - a daily close below could trigger cascading liquidations toward $3,500. Conversely, reclaiming the 20-day MA at $4,371 WOULD signal bullish momentum returning.

Why are institutions sending mixed signals about Ethereum?

Different players have different time horizons. SWIFT's adoption reflects long-term blockchain infrastructure bets, while ETF outflows show short-term profit-taking after ETH's strong 2025 performance.

How significant is the $800M whale staking move?

Extremely significant. When early investors stake instead of sell during volatility, it suggests strong conviction in Ethereum's long-term value proposition and staking rewards.

Could the Fusaka upgrade impact ETH's price?

Historically, successful Ethereum upgrades precede price rallies. While Fusaka isn't as monumental as the Merge, validator improvements could make staking more attractive to institutional players.

What's the most surprising Ethereum development right now?

The record accumulation of ETH (1.2M in weeks) coinciding with derivatives market reset ($5B open interest wiped) creates a fascinating setup - it suggests smart money is buying while leverage gets flushed out.