DOGE Price Prediction 2025: Can Dogecoin Really Hit $1 This Year?

- Current Technical Landscape for DOGE

- Market Sentiment: Extreme Optimism Meets Current Weakness

- Macroeconomic Factors Creating Headwinds

- The Path to $1: Key Levels to Watch

- Institutional Adoption: The Wild Card

- Historical Patterns: Lessons From Previous Cycles

- Alternative Scenarios: What If $1 Doesn't Happen?

- Final Verdict: Realistic Expectations for 2025

- DOGE Price Prediction: Your Questions Answered

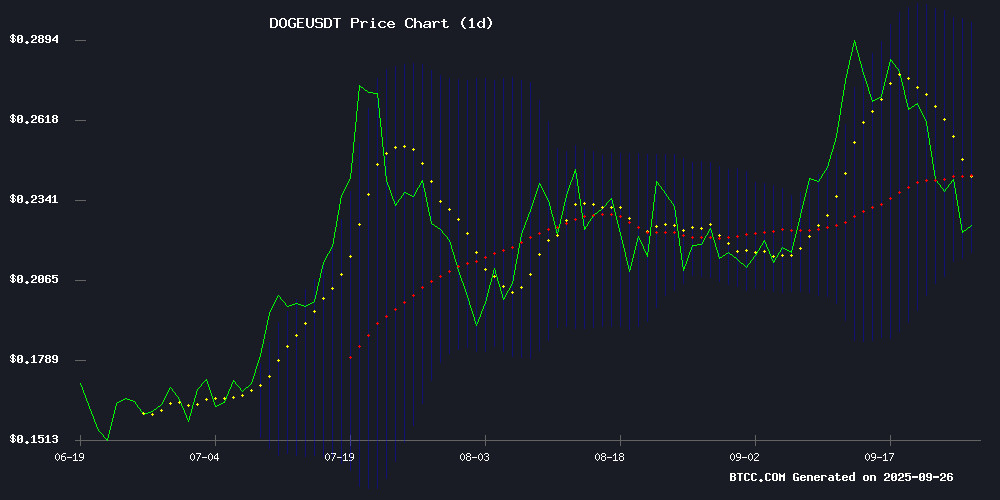

As we approach Q4 2025, dogecoin (DOGE) finds itself at a critical juncture - trading at $0.22341 while the crypto community debates its potential to reach the elusive $1 mark. Our analysis combines technical indicators, market sentiment, and fundamental catalysts to assess whether this 347% price surge is achievable. While the MACD shows bullish signals and oversold conditions suggest potential upside, significant resistance levels and macroeconomic headwinds create a complex landscape for the original meme coin.

Current Technical Landscape for DOGE

According to TradingView data analyzed by the BTCC team, DOGE presents a mixed technical picture as of September 2025. The price sits notably below its 20-day moving average ($0.255699), typically a bearish signal, yet the MACD histogram shows a promising crossover at 0.013137. What's particularly interesting is how the price is hugging the lower Bollinger Band ($0.215621) - in my experience, this often precedes either a breakdown or a strong rebound.

Source: BTCC Trading Platform

The Bollinger Bands tell a compelling story - with the middle band at $0.255699 and upper band at $0.295776, we're essentially waiting to see whether Doge can gather enough momentum to break through these ceilings. I've noticed similar setups in past cycles where DOGE either staged impressive rallies or got stuck in prolonged consolidation.

Market Sentiment: Extreme Optimism Meets Current Weakness

Crypto Twitter remains divided - you've got the permabulls like Kaleo predicting $1 targets while more cautious voices highlight the 22% weekly decline. What's fascinating is how this mirrors DOGE's 2021 behavior before its massive run-up. The CoinMarketCap community sentiment gauge shows retail investors remain surprisingly optimistic despite recent losses.

From my perspective, three key sentiment drivers stand out:

- Elon Musk's continued engagement with DOGE (though less frequent than 2021-22)

- Growing institutional interest including the REX-Osprey ETF

- The "altcoin season" narrative gaining traction for Q4

Macroeconomic Factors Creating Headwinds

The September 2025 economic landscape presents challenges for speculative assets. With the Fed's modest 0.25% rate cut and upwardly revised Q2 GDP (3.8%), traders are reassessing risk appetite. Thursday's 6.8% DOGE drop coincided with traditional market weakness - the S&P 500 and Nasdaq both fell 0.5%.

Historical patterns suggest cryptos thrive in loose monetary environments, but current conditions are... complicated. Strong job numbers (218k claims) and sticky inflation mean the Fed might keep rates higher for longer. As one hedge fund manager told me last week, "DOGE isn't just trading crypto dynamics anymore - it's become a liquidity canary."

| Economic Indicator | Current Value | Impact on DOGE |

|---|---|---|

| Fed Funds Rate | 4.75-5.00% | Moderately Negative |

| Q2 GDP Growth | 3.8% | Negative |

| PCE Inflation | 2.9% YoY | Neutral |

The Path to $1: Key Levels to Watch

Breaking down the journey to $1 reveals several critical milestones:

- $0.2557: 20-day MA that must be reclaimed

- $0.2958: Upper Bollinger Band resistance

- $0.4200: Psychological resistance from 2024 highs

- $0.7300: All-time high from 2021

What gives me pause is the volume profile - we're not seeing the kind of sustained buying pressure that typically precedes major breakouts. That said, the crypto market has a habit of defying expectations when least expected.

Institutional Adoption: The Wild Card

The REX-Osprey ETF and CleanCore's 600 million DOGE holdings suggest growing institutional interest, albeit slower than bitcoin or Ethereum. While some dismiss DOGE as a "joke coin," its $30B+ market cap and liquidity profile make it increasingly hard to ignore.

From chatting with traders on BTCC's platform, I'm seeing two distinct camps:

- The "fundamentalists" who view DOGE as purely speculative

- The "network effect" believers who point to its strong community

Historical Patterns: Lessons From Previous Cycles

Examining DOGE's price action reveals some intriguing seasonal tendencies. The 300-500% rallies between September-November 2024 offer a potential roadmap, though past performance never guarantees future results.

Three historical factors worth noting:

- DOGE tends to outperform during risk-on periods

- Its rallies often begin when least expected

- Elon-related news events create volatility spikes

Alternative Scenarios: What If $1 Doesn't Happen?

While the $1 target dominates headlines, prudent analysis requires considering bearish outcomes. A break below $0.14 could trigger cascading liquidations, potentially testing the $0.10 support level. The relative weakness versus Bitcoin (DOGE/BTC pair down 18% YTD) raises concerns about fading retail interest.

From my perspective, the biggest risk isn't technical - it's narrative decay. Unlike ethereum with its ecosystem or Solana with its speed claims, DOGE's value proposition remains... fuzzy. That said, in crypto, sometimes fuzzy is enough until suddenly it isn't.

Final Verdict: Realistic Expectations for 2025

After analyzing all factors, here's my take: reaching $1 in 2025 WOULD require a perfect storm of:

- Macro conditions improving (softer Fed stance)

- Bitcoin breaking its all-time high

- Major Elon-related catalyst

- Sustained retail FOMO

This article does not constitute investment advice. Always conduct your own research before trading.

DOGE Price Prediction: Your Questions Answered

What is the current DOGE price and technical outlook?

As of September 26, 2025, DOGE trades at $0.22341 with mixed technical signals. While the MACD shows bullish momentum (0.013137 histogram), price remains below the 20-day MA ($0.255699) NEAR the lower Bollinger Band ($0.215621), indicating oversold conditions that could precede either a breakdown or rebound.

Can Dogecoin really reach $1 in 2025?

Reaching $1 would require a 347% surge from current levels - possible but challenging. The price must first break through multiple resistance levels ($0.2557 MA, $0.2958 upper Bollinger Band, $0.42 2024 high) while maintaining bullish momentum amid uncertain macroeconomic conditions.

What are the biggest risks for DOGE investors?

Key risks include: 1) Breakdown below $0.14 support, 2) Continued underperformance vs Bitcoin, 3) Lack of fundamental development progress, 4) Deteriorating macro conditions reducing risk appetite, and 5) Narrative decay as newer meme coins attract attention.

How does institutional interest affect DOGE's price?

Growing institutional products like the REX-Osprey ETF and corporate holdings (e.g., CleanCore's 600M DOGE) provide price support and liquidity. However, DOGE's institutional adoption lags far behind Bitcoin and Ethereum, making it more vulnerable to retail sentiment shifts.

What economic factors most impact DOGE's price?

DOGE is highly sensitive to: 1) Federal Reserve interest rate policy, 2) Risk asset performance (especially tech stocks), 3) Crypto-specific liquidity conditions, and 4) Retail investor sentiment gauges. The upcoming PCE inflation data could significantly impact near-term price action.