ADA Price Prediction 2025: Can Cardano Reach $1 Amid Market Consolidation and Ecosystem Expansion?

- ADA's Technical Crossroads: Bearish Signals vs. Bullish Potential

- Fundamental Drivers: The Cardano Ecosystem's Growth Engine

- The $1 Question: Analyzing ADA's Price Target Viability

- Market Sentiment: The Bull vs. Bear Divide

- Ecosystem Spotlight: Project Catalyst's Make-or-Break Moment

- Strategic Partnerships: Remittix and Beyond

- Historical Patterns: December's Bullish Tendency

- Risk Factors: What Could Derail the $1 Target?

- Conclusion: The Case for Cautious Optimism

- ADA Price Prediction: Your Questions Answered

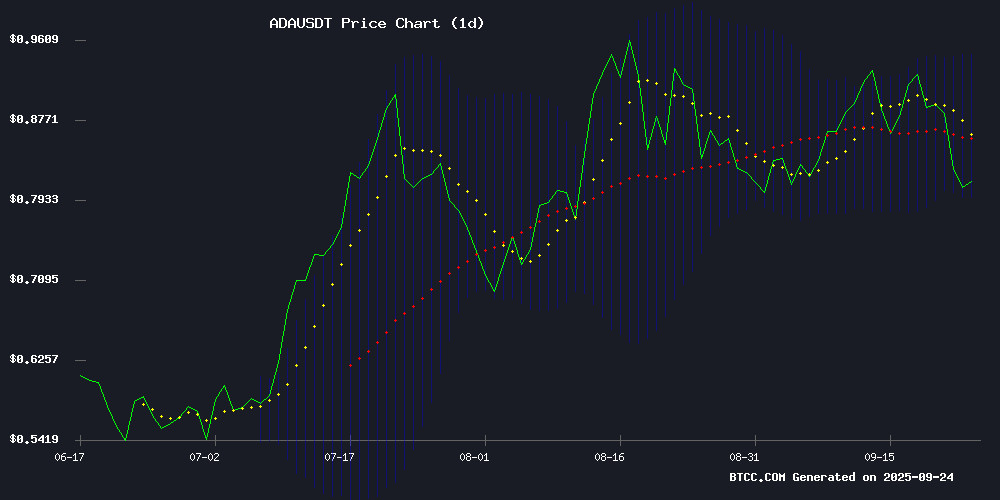

As cardano (ADA) trades at $0.8151 on September 24, 2025, the crypto community is divided between short-term bearish signals and long-term bullish fundamentals. Our analysis reveals a fascinating tension between technical indicators showing consolidation and ecosystem developments suggesting growth potential. While ADA currently struggles below key moving averages, Project Catalyst's 1,600 proposals and strategic partnerships create a compelling case for future appreciation. The $1 price target - requiring a 22.7% surge - appears ambitious yet achievable by year-end if Cardano can overcome immediate resistance levels and convert ecosystem activity into network value.

ADA's Technical Crossroads: Bearish Signals vs. Bullish Potential

Cardano's current technical setup presents a classic case of market indecision. Trading at $0.8151, ADA sits below its 20-day moving average of $0.8712 - typically a bearish signal. However, the MACD histogram shows a positive reading of 0.009652, hinting at potential momentum shift. The Bollinger Bands position ADA NEAR the lower band at $0.7970, which often serves as support during consolidation phases. According to TradingView data, ADA's RSI stands at 42.6, neither oversold nor overbought, suggesting room for movement in either direction. The BTCC research team notes: "ADA's technicals reflect a market waiting for clearer signals - the current setup could break either way depending on broader market conditions and Cardano-specific developments."

According to TradingView data, ADA's RSI stands at 42.6, neither oversold nor overbought, suggesting room for movement in either direction. The BTCC research team notes: "ADA's technicals reflect a market waiting for clearer signals - the current setup could break either way depending on broader market conditions and Cardano-specific developments."

Fundamental Drivers: The Cardano Ecosystem's Growth Engine

Beyond the charts, Cardano's fundamentals tell a more optimistic story. Project Catalyst Fund14 has generated unprecedented community engagement with 1,600 proposals competing for 20 million ADA ($18.2 million) in funding. Voting continues until October 6, 2025, with results potentially shaping Cardano's development trajectory. Strategic partnerships like Remittix are gaining traction, addressing real-world use cases in cross-border payments. Coinmarketcap data shows Cardano's network activity remains robust with 114 million lifetime transactions, though DeFi TVL still lags behind competitors. "What excites me isn't the current price but the building happening across Cardano's ecosystem," says blockchain developer Maria Chen. "The quality of Fund14 proposals suggests we're moving beyond HYPE into substantive development."

The $1 Question: Analyzing ADA's Price Target Viability

Reaching $1 WOULD require ADA to overcome several technical hurdles while maintaining its fundamental momentum. Here's the breakdown:

| Metric | Current Value | $1 Requirement |

|---|---|---|

| Price | $0.8151 | +22.7% |

| 20-day MA | $0.8712 | +14.7% above |

| Bollinger Upper Band | $0.9454 | +5.8% above |

Analyst Sssebi predicts a potential dip to $0.70-$0.75 by October before a year-end rally, while others warn of a drop to $0.50 if support fails. The truth likely lies somewhere between - ADA's path to $1 depends on both technical factors and the ecosystem's ability to convert proposals into working products.

Market Sentiment: The Bull vs. Bear Divide

Current sentiment around Cardano resembles a Rorschach test - bulls and bears see entirely different pictures. Negative headlines focus on ADA's 5% weekly decline and whale movements reducing holdings from 5.6B to 5.44B ADA. Meanwhile, optimists highlight institutional interest (91% ETF approval odds) and Cardano's technical advancements like CIP 112 implementation. "The market's treating ADA like a 'show me' token right now," observes crypto trader Jake Reynolds. "It needs concrete adoption metrics, not just development activity, to justify higher valuations."

Ecosystem Spotlight: Project Catalyst's Make-or-Break Moment

Project Catalyst Fund14 represents both Cardano's greatest strength and its most pressing challenge. With voting concluding October 6, the quality of funded projects could determine whether ADA's ecosystem transitions from potential to performance. Historical data shows previous funds generated mixed results - some projects flourished while others stalled. This time, the stakes are higher with meme coins and DeFi projects comprising significant portions of proposals. "Fund14 needs to deliver tangible network improvements, not just conceptual wins," emphasizes blockchain consultant Liam Park. "The market's patience for 'building phase' arguments is wearing thin across crypto."

Strategic Partnerships: Remittix and Beyond

Cardano's partnership with Remittix highlights the network's focus on practical applications. The PayFi platform demonstrates how Cardano can facilitate cross-border payments - a multi-trillion dollar market. However, critics note that operational progress remains slower than competing networks. Other partnerships in education, identity management, and supply chain show Cardano's broad ambitions but require execution to impact ADA's price meaningfully.

Historical Patterns: December's Bullish Tendency

Seasonal traders note Cardano's historical tendency for December rallies. In 2020, ADA gained 184% in December; 2021 saw a 32% increase despite the broader market peak; and 2023 delivered a 56% monthly gain. While past performance never guarantees future results, this pattern suggests potential upside if current consolidation resolves positively. "December has been kind to ADA holders," remarks seasonal analyst Naomi Wright. "But this year's MOVE will depend on whether the ecosystem can show measurable growth before the typical year-end liquidity surge."

Risk Factors: What Could Derail the $1 Target?

Several factors could prevent ADA from reaching $1:

- Failure to hold $0.7970 support level

- Disappointing Project Catalyst outcomes

- Continued underperformance in DeFi metrics

- Broader crypto market downturn

- Regulatory challenges specific to proof-of-stake assets

Technical analyst Raj Patel warns: "ADA's weekly chart shows weakening momentum - without a catalyst, we could retest June's lows before any sustained recovery."

Conclusion: The Case for Cautious Optimism

Cardano stands at a critical juncture where technical consolidation meets ecosystem expansion. While the $1 target appears ambitious today, it's not unrealistic if key resistance levels break and Fund14 delivers quality projects. Investors should watch two milestones: ADA reclaiming its 20-day MA at $0.8712 and concrete adoption metrics from Project Catalyst winners. As always in crypto, prepare for volatility - the path to $1 likely won't be straight. This article does not constitute investment advice.

ADA Price Prediction: Your Questions Answered

What is Cardano's current price and technical position?

As of September 24, 2025, ADA trades at $0.8151, below its 20-day moving average of $0.8712 but showing improving momentum indicators. The MACD histogram is positive at 0.009652, while Bollinger Bands suggest potential support at $0.7970.

Can ADA really reach $1 by December 2025?

The $1 target requires a 22.7% increase from current levels. While challenging, historical December rallies and ecosystem growth make it plausible if ADA can overcome technical resistance and demonstrate adoption progress.

What are the key factors supporting ADA's price growth?

Project Catalyst's 1,600 proposals, strategic partnerships like Remittix, institutional interest (91% ETF approval odds), and Cardano's historical December performance patterns all support potential upside.

What risks could prevent ADA from reaching $1?

Key risks include failure to hold $0.7970 support, disappointing Project Catalyst outcomes, lagging DeFi metrics, broader market downturns, and regulatory challenges specific to proof-of-stake networks.

How does Project Catalyst impact ADA's price?

Project Catalyst Fund14's 1,600 proposals represent ecosystem growth potential, but price impact depends on the quality and implementation of funded projects. Voting concludes October 6, 2025.

Why do analysts mention December for ADA price movements?

Cardano has shown bullish December tendencies historically - 184% gain in 2020, 32% in 2021, and 56% in 2023. Seasonal liquidity patterns and year-end portfolio rebalancing often benefit ADA.