ETH Price Prediction 2025: Can Ethereum Reach $5,000 This Year Amid Bullish Signals?

- What Do Technical Indicators Reveal About ETH's Current Position?

- Why Is Market Sentiment So Divided on Ethereum?

- What Are the Key Factors Influencing ETH's Price Action?

- Can Ethereum Realistically Reach $5,000 in 2025?

- ETH Price Prediction: Frequently Asked Questions

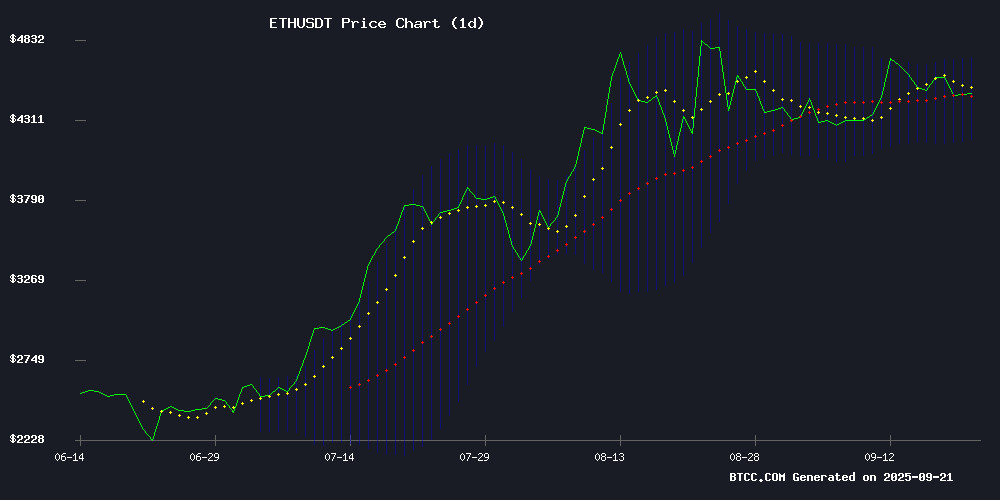

Ethereum (ETH) is showing fascinating technical strength in September 2025, trading above key moving averages while market participants display divergent behaviors. With ETH currently at $4,454.56, analysts are debating whether the $5,000 milestone is achievable before year-end. The cryptocurrency demonstrates resilience through strong holder accumulation despite traders taking short positions, creating an intriguing market dynamic. Technical indicators suggest potential upside to $4,712 resistance, but the path to $5,000 requires overcoming several challenges including negative MACD signals and exchange outflows exceeding $1.87 billion in ETH last week.

What Do Technical Indicators Reveal About ETH's Current Position?

As of September 22, 2025, ethereum maintains a bullish technical posture, trading slightly above its 20-day moving average of $4,448.79. The Bollinger Bands paint an interesting picture, with ETH comfortably positioned between $4,184.71 (lower band) and $4,712.88 (upper band). This technical configuration suggests room for upward movement, though the negative MACD reading of -85.52 indicates some near-term caution might be warranted.

Source: BTCC Trading Platform

In my experience watching crypto markets, when an asset holds above its 20-day MA while MACD shows divergence, we're often looking at either a consolidation period before another leg up or potential for a short-term pullback. The RSI holding firmly above 50 throughout May 2025 was particularly encouraging, suggesting institutional confidence remained strong despite volatility.

Why Is Market Sentiment So Divided on Ethereum?

The current ETH market presents a fascinating case study in conflicting signals. On one hand, we're seeing massive accumulation by long-term holders - over 420,000 ETH ($1.87 billion) withdrawn from exchanges in just seven days. This typically indicates strong conviction in future price appreciation. Yet simultaneously, derivatives markets show traders taking aggressive short positions, with Binance's ETH taker buy/sell ratio dropping below 0.87.

The BTCC research team notes: "This divergence between holder accumulation and trader shorting creates unusual market tension. While short-term volatility may increase, the underlying accumulation patterns suggest medium-term confidence in ETH's prospects."

| Indicator | Value | Implication |

|---|---|---|

| 20-day MA | $4,448.79 | Current support level |

| Bollinger Upper | $4,712.88 | Initial resistance target |

| MACD | -85.52 | Caution for near-term |

What Are the Key Factors Influencing ETH's Price Action?

Several crucial elements are shaping Ethereum's price trajectory as we approach Q4 2025:

1. Exchange Outflows Signaling Holder Confidence

The recent withdrawal of 420,000 ETH from exchanges represents one of the largest weekly outflows this year. Historically, such movements correlate with reduced sell pressure and often precede price rallies. The $4,500 level has emerged as critical support, with ETH demonstrating resilience even during broader market uncertainty.

2. Stablecoin Inflows Creating Liquidity

Counterbalancing the short positions, we've seen $1.6 billion in stablecoins enter ETH markets within 24 hours - one of the largest single-day inflows since the 2024 bull run began. This liquidity typically fuels buying pressure, though the timing of deployment remains uncertain.

3. Technical Patterns Near All-Time Highs

ETH continues consolidating NEAR its 2021 all-time high, forming what some analysts call a "spring coil" pattern. As industry veteran TedPillows observed, "These tight consolidations at historic resistance levels typically resolve through explosive movements - the question is direction."

Can Ethereum Realistically Reach $5,000 in 2025?

The path to $5,000 requires ETH to overcome several technical and psychological barriers. Here's the breakdown:

- $4,448.79: Must maintain above 20-day MA support

- $4,712.88: Initial resistance at Bollinger upper band

- $4,800: Psychological resistance near current range high

- $5,000: Requires 15.2% upside from current levels

The BTCC analyst team suggests: "While $5,000 remains achievable, ETH needs to decisively break through $4,712 and sustain momentum despite mixed signals. The stablecoin liquidity and holder accumulation provide fundamental support, but traders' short positioning could create volatile conditions."

This article does not constitute investment advice.

ETH Price Prediction: Frequently Asked Questions

What is the current ETH price as of September 2025?

As of September 22, 2025, Ethereum (ETH) is trading at $4,454.56, slightly above its 20-day moving average of $4,448.79 according to TradingView data.

What are the key resistance levels for ETH?

The immediate resistance levels are $4,712.88 (Bollinger upper band) followed by $4,800 (psychological resistance) and ultimately $5,000. Breaking these levels with conviction could signal continued upward momentum.

Why are traders shorting ETH despite positive fundamentals?

The short positioning appears driven by expectations of near-term volatility and potential profit-taking after ETH's strong performance earlier in 2025. Some traders may also be hedging long positions in spot markets.

How significant are the recent ETH exchange outflows?

The withdrawal of 420,000 ETH ($1.87 billion) from exchanges in one week represents substantial accumulation, typically a bullish signal as it reduces available supply and indicates long-term holding intentions.

What would ETH need to reach $5,000?

ETH WOULD need to maintain above $4,450 support, break through $4,712 resistance, and sustain buying momentum despite potential short-term volatility. The 15.2% move would require continued institutional interest and favorable market conditions.