Ethereum Price Prediction 2025: Can ETH Hit $5,000 This September?

- What's Driving Ethereum's Current Price Momentum?

- How Are Institutional Players Impacting ETH's Valuation?

- What Are the Key Resistance and Support Levels?

- Could Real-World Asset Tokenization Be Ethereum's Trillion-Dollar Opportunity?

- What Are the Short-Term Risks to Watch?

- How Are Developers Impacting Ethereum's Future?

- What's the Price Outlook for Ethereum?

- Ethereum Price Prediction: Frequently Asked Questions

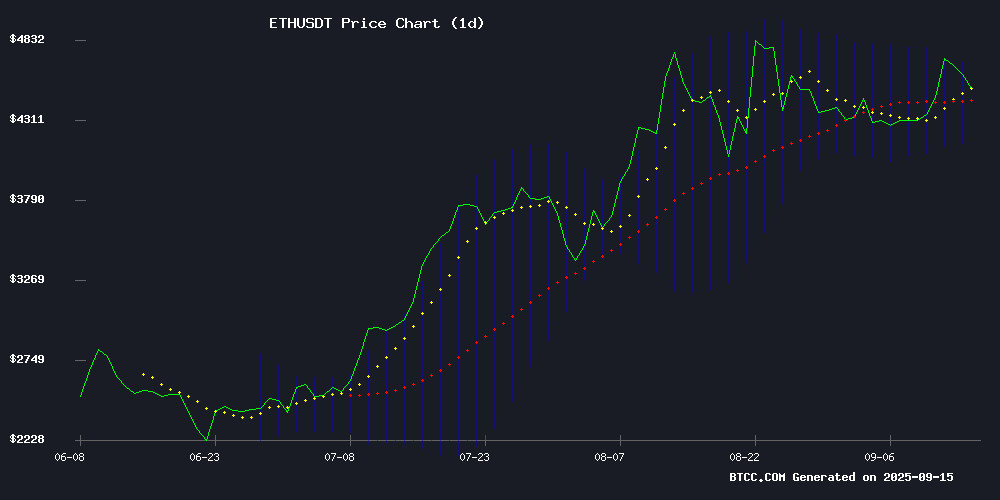

As Ethereum hovers around $4,531 in mid-September 2025, crypto markets are buzzing with anticipation. The second-largest cryptocurrency shows strong technical indicators, institutional adoption through ETFs, and massive potential from real-world asset tokenization. Our analysis reveals why $5,000 might be just around the corner, while also examining the profit-taking pressures and historical September weaknesses that could create short-term headwinds. With data from TradingView charts and CoinMarketCap metrics, we break down the complex factors driving ETH's price action.

What's Driving Ethereum's Current Price Momentum?

Ethereum's technical setup paints a bullish picture as of September 15, 2025. The price sits comfortably above its 20-day moving average ($4,417), while Bollinger Bands ($4,161-$4,674) suggest room for upward movement. The MACD shows some near-term consolidation potential at 20.31 versus 75.59, but overall market structure remains strong.

Source: BTCC TradingView Chart

How Are Institutional Players Impacting ETH's Valuation?

The institutional landscape has transformed dramatically in 2025. US-listed ethereum ETFs now hold 6.7 million ETH - nearly double April's levels - after attracting $10 billion in July-August inflows. Whale wallets (10,000-100,000 ETH holders) accumulated 6 million coins during this period, pushing combined reserves to an all-time high of 20.6 million ETH.

SharpLink Gaming's transformation into an Ethereum treasury company exemplifies this trend. The firm holds approximately 837K ETH (worth $3.6 billion), mostly staked for yield, representing $976 million in unrealized profits. This makes them the second-largest institutional ETH holder after the Ethereum Foundation itself.

What Are the Key Resistance and Support Levels?

| Level | Price | Significance |

|---|---|---|

| Immediate Resistance | $4,685 | Previous local high |

| Key Support | $4,550 | 100-hour MA |

| Psychological Barrier | $5,000 | Round number target |

Could Real-World Asset Tokenization Be Ethereum's Trillion-Dollar Opportunity?

Ryan Sean Adams of Bankless predicts Ethereum will become the foundational ledger for $100 trillion in American capital markets. The 2025 regulatory changes have accelerated real-world asset (RWA) tokenization, with stocks, bonds, and exchange-traded products potentially migrating on-chain in what Adams calls a "multi-decade transformation."

Ethereum's current TVL stands at $94 billion, showing growth patterns reminiscent of early 2021's bull market. The network appears poised to evolve into the de facto settlement LAYER for institutional finance, especially with U.S. Treasuries and dollar dominance in global markets.

What Are the Short-Term Risks to Watch?

September historically brings challenges for Ethereum. Current on-chain metrics show 98.14% of ETH supply in profit territory - approaching the 99.68% September 12 peak that typically precedes corrections. The taker buy-sell ratio slumped to 0.91 on September 13, marking the second-weakest bullish sentiment reading in thirty days.

The MVRV ratio hitting 1.97 also warrants caution, as it approaches the historically significant 2.4 level where profit-taking typically accelerates. Analyst Burak Kesmeci notes this zone has consistently acted as a bearish inflection point in previous cycles.

How Are Developers Impacting Ethereum's Future?

A Protocol Guild report reveals concerning compensation gaps for Ethereum's Core developers. With median salaries of $140,000 (50-60% less than industry peers), talent flight risks emerge as 40% of developers field external offers averaging $359,000. This compensation challenge comes as the rebranded Privacy Stewards for Ethereum (PSE) team unveils an ambitious end-to-end privacy roadmap, responding to Vitalik Buterin's April warning about privacy being existential for Ethereum's infrastructure role.

What's the Price Outlook for Ethereum?

Based on current technicals and fundamentals, here's our probability assessment:

| Target | Probability | Timeframe |

|---|---|---|

| $4,800 | High | 2-4 weeks |

| $5,000 | Medium-High | 4-8 weeks |

| $5,500+ | Medium | Q4 2025 |

This article does not constitute investment advice. Always conduct your own research before trading.

Ethereum Price Prediction: Frequently Asked Questions

What is Ethereum's current price as of September 2025?

As of September 15, 2025, Ethereum trades at $4,531.35, according to CoinMarketCap data. The price has shown strong momentum, recently testing the $4,700 level before pulling back slightly.

Can Ethereum really reach $5,000 in 2025?

The path to $5,000 appears plausible given current technicals and fundamentals. Key factors include institutional ETF inflows, whale accumulation patterns, and the growing RWA tokenization narrative. However, September's historical weakness and profit-taking pressures create near-term uncertainty.

What are the biggest risks to Ethereum's price growth?

Major risks include: 1) Profit-taking NEAR all-time highs (98.14% of supply in profit), 2) September seasonal weakness patterns, 3) Potential whale distribution, and 4) Regulatory developments around tokenized assets.

How does Ethereum's technical setup look in September 2025?

Technically, ETH shows strength trading above its 20-day MA ($4,417) within an ascending channel. The Bollinger Band range ($4,161-$4,674) suggests room for movement, though the MACD hints at possible near-term consolidation.

What makes Ethereum different from other altcoins in 2025?

Ethereum's institutional adoption through ETFs, its dominant position in decentralized finance (DeFi), and its emerging role in real-world asset tokenization set it apart. The network's staking yield and Layer 2 ecosystem continue to attract both retail and institutional capital.