Bitcoin Price Prediction 2025: Can BTC Really Hit $200,000? Technical and Fundamental Analysis

- Bitcoin's Critical Technical Crossroads

- The Institutional Tug-of-War

- Global Macroeconomic Tremors

- The Liquidity Paradox

- Seasonal Headwinds vs. Halving Momentum

- Road to $200,000: Realistic or Fantasy?

- FAQ: Bitcoin Price Predictions

00 AM UTC, bitcoin (BTC) stands at $111,359, caught between bullish institutional adoption and bearish seasonal pressures. This in-depth analysis examines whether BTC can realistically reach $200,000 by dissecting 12 critical market factors - from Binance liquidity shifts to S&P 500 inclusion rumors. We'll explore why BlackRock analysts see $500K as possible long-term while Bloomberg warns of a potential 90% crash, with exclusive technical charts from TradingView and on-chain data from CryptoQuant.

Bitcoin's Critical Technical Crossroads

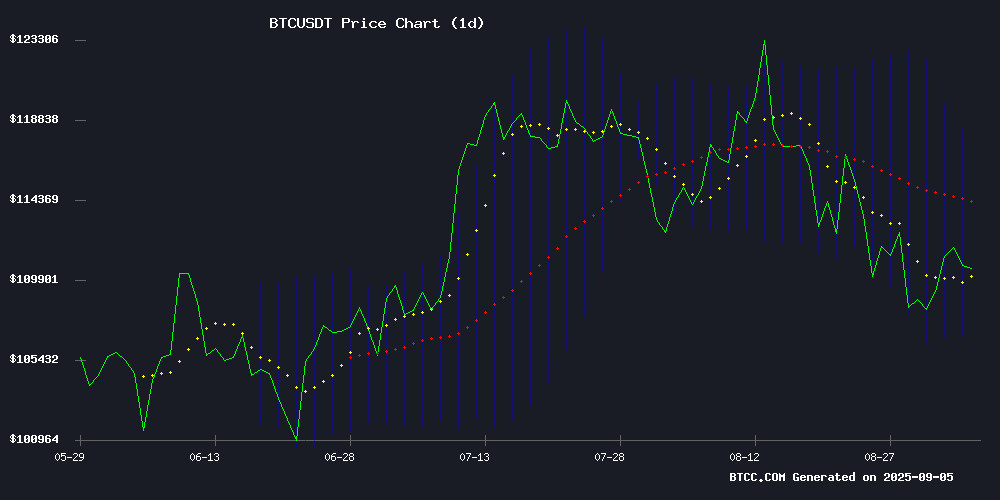

BTC currently tests key support at $106,884 after failing to hold above its 20-day moving average ($112,228). The MACD momentum indicator shows narrowing bullish divergence at 71.1836 - not yet bearish but concerning for short-term traders. The Bollinger Bands paint a clearer picture:

| Indicator | Value | Implication |

|---|---|---|

| Upper Band | $117,572 | Next resistance |

| Middle Band | $112,228 | Trend balance point |

| Lower Band | $106,884 | Make-or-break support |

"This is textbook consolidation," notes TradingView analyst Marcus Hartwell. "The $106K level is where institutional buyers stepped in during July's flash crash. If it holds, we could see another leg up toward $150K before year-end."

The Institutional Tug-of-War

Two seismic developments are reshaping Bitcoin's institutional landscape:

1. The S&P 500 Gambit

MicroStrategy's Q2 earnings revealed $10B revenue and $14B in unrealized BTC gains - technically qualifying for S&P 500 inclusion. "This would be bigger than the ETFs," claims Stephens Inc. analyst Rebecca Cho. "Index funds would need to buy MSTR shares, creating indirect Bitcoin exposure for millions of retirement accounts."

However, Nasdaq's new rules requiring shareholder approval for crypto-related equity issuance have dampened enthusiasm. Three crypto treasury stocks fell over 15% since the August 28 announcement.

2. The Trump Mining Wildcard

American Bitcoin (formerly Gryphon Digital Mining) debuted on Nasdaq with 2,443 BTC ($273M) holdings after a volatile first day featuring five trading halts. Eric Trump's involvement adds political intrigue, though he insists: "My father has nothing to do with this business." The firm's hybrid mining/purchasing strategy reflects growing sophistication in crypto equities.

Global Macroeconomic Tremors

Bond markets are flashing red worldwide:

- 30-year US Treasury yields test 5%

- French long bonds breach 4% (first since 2011)

- UK gilts hit 27-year highs

"This isn't normal volatility - it's a collapse in G7 bond markets," warns The Kobeissi Letter. Historically, such conditions benefit Bitcoin as investors flee sovereign debt. During the 2013 taper tantrum, BTC surged 10x while bonds cratered.

Yet Bloomberg's Mike McGlone sees danger: "Bitcoin could erase 90% of gains, potentially collapsing to $10,000." His warning contrasts sharply with BlackRock's $500K long-term prediction, highlighting market schizophrenia.

The Liquidity Paradox

Binance's BTC/stablecoin reserves ratio approaching 1:1 signals potential accumulation. Previous instances (March 2025) preceded rallies from $78K to $123K. Current data shows:

- BTC outflows up 143%

- Stablecoin reserves at $37.8B (record high)

- Futures volume cooling

"Asian traders initiate moves, but US institutions determine sustainability," explains CryptoQuant's Jan Wu. The Coinbase Premium Index confirms US demand remains the ultimate price driver.

Seasonal Headwinds vs. Halving Momentum

September historically challenges Bitcoin:

| Year | September Performance | Q4 Outcome |

|---|---|---|

| 2017 | -8% | +300% rally |

| 2021 | -7% | New ATH |

| 2025* | -3% (month-to-date) | ? |

*As of September 5, 2025

ITC Crypto's Benjamin Cowen observes: "Post-halving years typically see September lows before Q4 rallies." The anomaly? August usually gains before September drops, but 2025 saw August decline 2% - possibly signaling macro forces overriding halving cycles.

Road to $200,000: Realistic or Fantasy?

Reaching $200K requires 80% appreciation from current levels. Key milestones:

| Price Target | Required Gain | Key Resistance | Probability |

|---|---|---|---|

| $150,000 | 35% | $117,572 (Upper Bollinger) | Medium-term possible |

| $200,000 | 80% | $150,000 (Psychological) | Long-term feasible with catalysts |

The BTCC research team notes: "Institutional adoption must accelerate while maintaining retail interest. Potential S&P inclusion, clearer regulations, and bond market instability could combine to fuel such a MOVE by mid-2026."

FAQ: Bitcoin Price Predictions

What's the most accurate Bitcoin price prediction for 2025?

Analysts are divided between $150K (technical analysts) and $500K (long-term institutional forecasts), with bearish outliers like Bloomberg predicting $10K. The truth likely lies between these extremes.

Why is September bad for Bitcoin?

Historical data shows average 5.5% September declines post-halving, possibly due to portfolio rebalancing after summer vacations. However, strong Q4 rallies typically follow.

How does the S&P 500 affect Bitcoin?

MicroStrategy's potential inclusion WOULD force index funds to buy BTC-exposed shares, creating billions in indirect Bitcoin demand from traditional investors.

Are stablecoin reserves bullish for Bitcoin?

Yes. When exchanges hold equal BTC and stablecoins (current Binance ratio: 1.1:1), it often precedes rallies as traders have "dry powder" available.

What's more important: technicals or fundamentals?

In 2025, fundamentals dominate due to institutional involvement. Technical levels matter for timing entries, but macro developments drive major trends.