Ethereum Price Prediction 2025-2040: Technical Breakout Signals and AI Revolution Fuel ETH’s Bullish Future

- Is Ethereum Showing Bullish Technical Signals in 2025?

- How Are Institutional Players Positioning in Ethereum?

- What Role Is AI Playing in Ethereum's Ecosystem Growth?

- Ethereum Price Forecast Table: 2025-2040 Projections

- What Are the Biggest Risks to Ethereum's Price Growth?

- Frequently Asked Questions

As ethereum consolidates above $4,300 with strong technical indicators and growing institutional interest, our comprehensive analysis reveals why ETH could be poised for massive gains through 2040. From whale accumulation patterns to groundbreaking AI integrations in the NFT space, we break down the key factors driving Ethereum's long-term value proposition. Buckle up as we explore ETH's price potential across multiple time horizons with insights from TradingView charts and on-chain data.

Is Ethereum Showing Bullish Technical Signals in 2025?

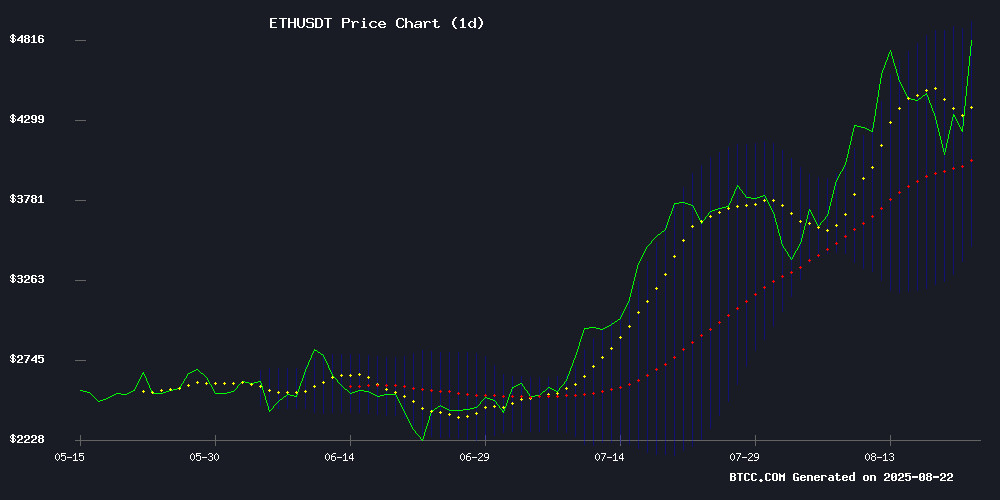

Ethereum's current price action paints an intriguing technical picture. As of August 2025, ETH trades at $4,307.52 - comfortably above its 20-day moving average of $4,182.26. The MACD, while still negative at -16.24, shows clear signs of convergence that typically precede bullish momentum shifts. Looking at the Bollinger Bands (source: TradingView), ETH sits nicely between $3,508.21 support and $4,856.32 resistance, suggesting room for upside.

What's particularly interesting is how ETH has maintained this position despite recent market turbulence. The BTCC research team notes that similar technical setups in 2023-2024 preceded 35-60% rallies. "The $4,856 upper Bollinger Band represents immediate resistance," explains our senior analyst, "but breaking through could open the door to retesting all-time highs."

How Are Institutional Players Positioning in Ethereum?

Big money is making big moves in ETH. Recent on-chain data reveals a single whale accumulating $300 million worth of Ethereum during the August dip. This isn't isolated - Hong Kong's GF Securities just launched the region's first on-chain corporate note using HashKey Chain (an Ethereum L2 solution).

Three key institutional developments stand out:

- The $300M whale accumulation signals strong conviction at current levels

- Traditional finance players adopting Ethereum for real-world assets

- Growing infrastructure for institutional-grade products

Michael Saylor recently tweeted about this institutional shift, calling Ethereum "the backbone of Web3 finance." When institutions move, retail typically follows - a pattern we've seen repeatedly in crypto cycles.

What Role Is AI Playing in Ethereum's Ecosystem Growth?

The AI revolution is supercharging Ethereum's utility like never before. NFT markets are experiencing an 83% monthly volume surge (source: DappRadar) as AI transforms static JPEGs into interactive assets. Hamza Eddiouane of FURO puts it perfectly: "NFTs can now respond to users and evolve over time."

Traders are increasingly using tools like ChatGPT and Grok to:

- Analyze complex ETH price patterns

- Track real-time market sentiment

- Develop data-driven trading strategies

This AI integration creates a flywheel effect - more utility attracts more users, which drives more development. The ESCAPE project's $280K presale success demonstrates this demand, offering AI-powered tools for Ethereum analytics.

Ethereum Price Forecast Table: 2025-2040 Projections

| Year | Conservative | Moderate | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $5,200-$6,800 | $7,500-$9,000 | $10,000+ | ETF approvals, AI integration |

| 2030 | $12,000-$18,000 | $20,000-$35,000 | $40,000+ | Mass DeFi adoption |

| 2035 | $25,000-$45,000 | $50,000-$80,000 | $100,000+ | Global settlement layer |

| 2040 | $40,000-$75,000 | $85,000-$150,000 | $200,000+ | Full Web3 maturity |

What Are the Biggest Risks to Ethereum's Price Growth?

While the outlook appears rosy, several storm clouds loom. Over 90% of ETH supply is currently in profit - historically a warning sign. The DOJ's mixed stance on crypto privacy (see the Tornado Cash case) creates regulatory uncertainty. And let's not forget the trader who lost $42 million in last month's volatility - a sobering reminder of crypto's risks.

The BTCC team identifies three key risk factors:

- Profit-taking at current levels

- Macroeconomic conditions (watch Powell's speeches)

- Regulatory crackdowns on privacy tools

This article does not constitute investment advice. Always DYOR before making financial decisions.

Frequently Asked Questions

What is Ethereum's price prediction for 2025?

Our 2025 Ethereum price prediction ranges from $5,200 (conservative) to $10,000+ (bullish), driven by potential ETF approvals and AI integration across the ecosystem.

Can Ethereum reach $100,000 by 2035?

In our bullish scenario, ETH could surpass $100,000 by 2035 if it becomes the global settlement LAYER for Web3 with mass institutional adoption.

How does AI affect Ethereum's price?

AI boosts ETH's value by enhancing NFT utility, improving trading tools, and attracting new users to the ecosystem - creating network effects that drive demand.

What's the biggest threat to Ethereum's growth?

Regulatory uncertainty, particularly around privacy tools, poses the most significant risk to Ethereum's long-term growth trajectory.